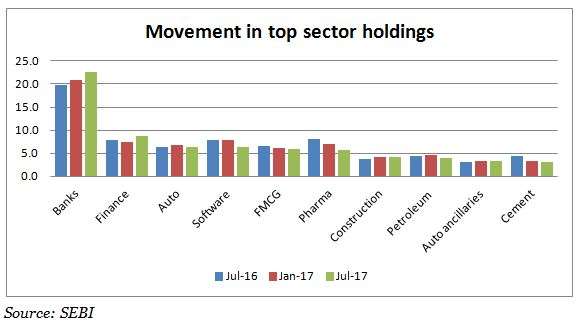

Banking and financial services are the most favoured sectors for equity mutual funds, with both sectors seeing their share in equity fund AUM inching steadily higher. Data from SEBI show that, from accounting for 27.8% of the AUM in July last year, the two sectors account now for 31.2% of the equity AUM.

Inching up

Banking is already the top sector holding for most mutual funds given the share the sector has in the market. Funds had begun turning wary of banks in the previous months, opting instead for NBFCs. But the past six months has seen a sharp surge in share of AUM, moving from 20.9% in January 2017 to 22.6% in July 2017 (latest available data). The value of fund holdings in banking is up a strong 42% in July 2017 compared to January, and even more by 57% against the year ago.

Funds have also continued to bet on financial companies. Value of holding in financial companies is up 55% and 70% in the same periods. Max India, IDFC, Oriental Bank, Capital First, Equitas Holdings, and Muthoot Finance are some stocks that saw a rise of more than 3 percentage points in mutual fund holdings between the December 2016 and June 2017 quarters.

What drives the increasing preference here is that financial services provide a play on both the investment cycle of economic growth and the consumption cycle. A consumption uptrend will lead to growth in retail loan book, which is already shoring up several banks and boosting most non-banking financial companies. A revival in overall corporate credit growth and moves to force a solution to the bad loan problem will help ride the broader economic growth.

Other traditional consumption sectors such as FMCG and durables are seeing lower opportunities given their higher valuations. Cement, a sector some funds consider a proxy consumer play due to housing demand, is steadily seeing preference coming down. Funds also appear to be maintaining status quo on automobiles, with the sector’s share in the equity AUM dipping marginally over the past six months.

On the cyclical side, funds already picked up sectors that showed promise such as energy. This bet continues. Funds have also added to another reviving sector – metals and steel. The two sectors account for 3.3% of the AUM in July 2017, up from the 2% just six months ago. In value terms, the sectors’ holdings have doubled. Tata Metaliks, for example, saw a sharp 4 percentage point increase in fund holding between December 2016 and June 2017.

Moving out

Software began to gather some interest in the early part of 2017, but that has given way over the past three months. From an 8% AUM share in February 2017, the share slid to 6.3% by July 2017. Pharmaceuticals, of course, continue to see dipping fund holding. The troubles dogging the sector seem to be keeping funds away, barring the truly contrarian.

(This article was first published in Economic Times)