Would you prefer a diversified portfolio of stocks or like taking focused bets? If you like the latter, then that is what UTI Focussed Equity, the new fund offer from the UTI Mutual stable, will offer. The new fund will be a three-year closed-end diversified equity fund. The NFO will close on August 27.

The fund

UTI Focused Equity Fund will seek to take focused exposure in stocks and build a portfolio of upto 30 stocks. It will have no sector or stock bias and can go upto 8% in single stock and upto 30% in single sector.

As is the case with UTI’s stock selection strategy, this fund too will select stocks with positive operating cash flows and having profits after taxes of over Rs 50 crore. The fund will be managed by Anoop Bhaskar and Lalit Nambiar.

Why now

The AMC’s idea of going for a fixed-period focussed equity portfolio at this juncture stems from its favourable view on key macro factors. With both the CPI and WPI steadily coming off their highs, the scope for lower interest rates now seems possible over the next 12 months or so.

Such a fall could trigger the very low credit growth now. From over 30% credit growth seen during 2005-06, credit growth is now 14%. Any small dip in rates, leading to improved credit growth would mean significant headroom for corporate profit margins to improve.

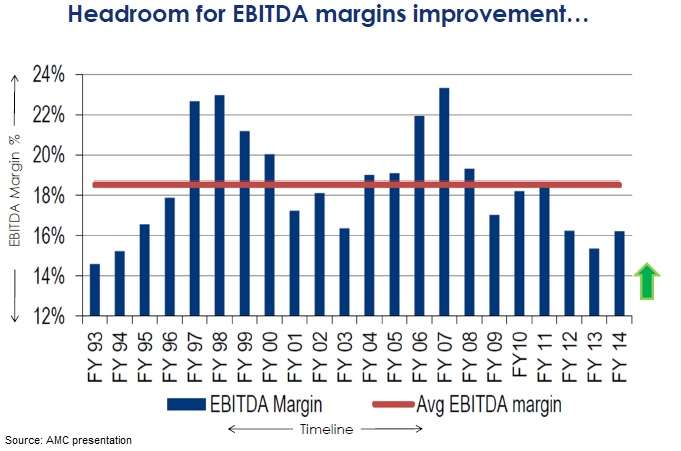

Data below shows that current EBITDA margins for companies are well below the average and have space to improve.

An increase in profit margins would lead to earnings expansion. Analysts expect Sensex earnings to grow by 17% CAGR between March 2013 and 2017.

Suitability

UTI Focussed Equity is suitable for those willing to lock their money for 3 years and wish to have focussed exposure with a compact portfolio. If you believe that a fund manager can perform the job better with a closed-end approach that provides leeway to buy and hold and also have no redemption pressure, then you might want to consider this as an option.

Also, for a fund that wishes to adopt an concentrated approach to stocks, constant inflows may be a challenge in terms of deploying the money effectively. This appears to be one more reason for the closed-end approach. While there would be no track record to fall back upon, the track record of the fund managers have been consistent.

Investing in NFO is made simple with FundsIndia. Open a free FundsIndia account in less than 20 minutes for NFO investing.

In a way, close end fund provides a forced discipline. But, most of the close end funds, referring to ELSS, has underperformed their own open end scheme for a 3 year period. http://www.ddramanathan.blogspot.in

Just a few difference Ramanathan – ELSS is not strictly close ended..it has inflows to manage and part outflows of money crossing 3 years. But your observation of ELSS funds is true. As for closed-end funds, while it is too eearly to say, funds such as IDFC Equity Opportunities or Sundaram Microcap have put up inspiring shows…for now 🙂 thanks, Vidya

Madam,

Pls. advice shall I purchase this UTI focussed equity fund?

Hello Sairajkumar, sorry for the delay in responding. you have to take a call on NFOs. We are usually neutral as there is no track record for us to rely upon. thanks, Vidya

As the duration is 1100 days ~ 3 years, can one claim benefit under 80 C for the amount invested in this fund?

Hello Jay, For claiming 80C benefit, fudns have to qualify separately as an ELSS fund. UTI Focussed Equity is not an ELSS fund. thanks, Vidya

Dear Vidya,

Since this is an equity fund, any returns after 3 years should be tax free, if I am not wrong?

Yes Aayush, Equity funds’ capital gains are exempt after 1 year. Since this is a 3-year fund, on maturity, gains will be exempt from tax. thanks, Vidya

what is your opinion about the UTI NFO UTI Focussed Equity Fund being a close ended fund ?

Hello Mahesh,

Sorry for the delayed reply. Clsoed-end effectively means that you time your entry. But for a fund, with less uncertainty of inflow and nor redemption pressure, it can be managed better, if there is a good fund manager. thanks, Vidya

Hi Vidya, It does not allow us to exit when the NAV is high, unlike open ended funds, right? That’s a con with fixed period locking for close-ended schemes. Am I right? Any other benefits that I am missing.

Sanjay

Hello Sanjay, Yes closed-end nature of a fund does not allow exits in between.

But even in open-ended funds, how do you know when an NAV is high? This is not like a stock right. Since stocks in a fund’s portfolio keep changing, you can always have the NAV scaling new highs all the time. Your exit in a fund should be based either on your nearing your goal or poor performance compared with peers and not merely NAV value. thanks, Vidya

Thanks Vidya for the inputs. I shall buy.

Regards,

Sanjay

As the duration is 1100 days ~ 3 years, can one claim benefit under 80 C for the amount invested in this fund?

Hello Jay, For claiming 80C benefit, fudns have to qualify separately as an ELSS fund. UTI Focussed Equity is not an ELSS fund. thanks, Vidya

Dear Vidya,

Since this is an equity fund, any returns after 3 years should be tax free, if I am not wrong?

Yes Aayush, Equity funds’ capital gains are exempt after 1 year. Since this is a 3-year fund, on maturity, gains will be exempt from tax. thanks, Vidya

In a way, close end fund provides a forced discipline. But, most of the close end funds, referring to ELSS, has underperformed their own open end scheme for a 3 year period. http://www.ddramanathan.blogspot.in

Just a few difference Ramanathan – ELSS is not strictly close ended..it has inflows to manage and part outflows of money crossing 3 years. But your observation of ELSS funds is true. As for closed-end funds, while it is too eearly to say, funds such as IDFC Equity Opportunities or Sundaram Microcap have put up inspiring shows…for now 🙂 thanks, Vidya

Madam,

Pls. advice shall I purchase this UTI focussed equity fund?

Hello Sairajkumar, sorry for the delay in responding. you have to take a call on NFOs. We are usually neutral as there is no track record for us to rely upon. thanks, Vidya

what is your opinion about the UTI NFO UTI Focussed Equity Fund being a close ended fund ?

Hello Mahesh,

Sorry for the delayed reply. Clsoed-end effectively means that you time your entry. But for a fund, with less uncertainty of inflow and nor redemption pressure, it can be managed better, if there is a good fund manager. thanks, Vidya

Hi Vidya, It does not allow us to exit when the NAV is high, unlike open ended funds, right? That’s a con with fixed period locking for close-ended schemes. Am I right? Any other benefits that I am missing.

Sanjay

Hello Sanjay, Yes closed-end nature of a fund does not allow exits in between.

But even in open-ended funds, how do you know when an NAV is high? This is not like a stock right. Since stocks in a fund’s portfolio keep changing, you can always have the NAV scaling new highs all the time. Your exit in a fund should be based either on your nearing your goal or poor performance compared with peers and not merely NAV value. thanks, Vidya

Thanks Vidya for the inputs. I shall buy.

Regards,

Sanjay