Short on time? Listen to a brief overview of this week’s recommendation.

[soundcloud url=”http://api.soundcloud.com/tracks/267960815?secret_token=s-dONuI” params=”color=ff5500&auto_play=false&hide_related=false&show_comments=true&show_user=true&show_reposts=false” width=”100%” height=”166″ iframe=”true” /]

If you are looking for options to help you earn higher than the dwindling bank deposit rates, and if you have a medium-term time horizon of about two years or more, you can consider investing in Invesco India Medium Term Bond Fund (earlier called Religare Invesco Medium Term Bond). With a return of 9.2 per cent over the last one year, and about the same annualised over the last two years, the fund has beaten its category average by well over 50 basis points.

The fund and its suitability

Invesco Medium Term Bond Fund is a short-term debt fund (its ‘medium term’ title notwithstanding), and is suitable for investors with a two-year or longer time-frame. The fund does not play on the interest rate cycle as it consistently keeps its portfolio maturity at less than a year. At a time when many short-term debt funds have been increasing their average maturity or taking slightly higher credit risks to deliver, this fund has managed to keep its maturity at the lower end consistently, while also keeping credit risks at bay.

This fund is suitable for investors who are looking for slightly superior returns in this space and are willing to take marginal risks that are somewhat hedged by the fact that the duration of the instruments in the portfolio is short.

The fund is a good fit for investors whose bank FDs have matured recently and who see much lower rates now, or for those who are disenchanted by the low rates prevailing in FDs, in general. It is important to stick to the minimum time-frame for this fund and not be shocked by any marginal negative returns on a day-to-day basis. It is noteworthy that the fund’s risk profile would be higher than some of the other funds in this category in FundsIndia’s Select Funds list – namely – HDFC Short Term Opportunities.

Performance

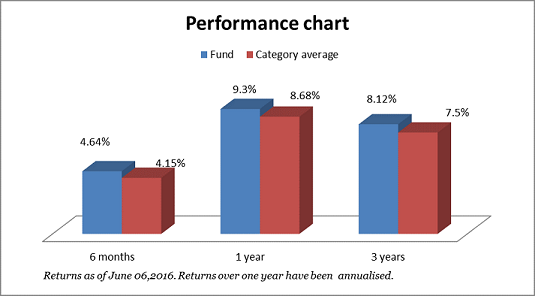

Invesco Medium Term Bond Fund has comfortably beaten its category average over 1- and 3-year time-frames. However, as is the case with many of its peers, it has not been consistent in beating the benchmark, Crisil Short Term Bond Index Fund, over a 3-year time-frame. Given the variance between the fund portfolios and the construction of the index, this is not a surprise. The fund may not also be strictly comparable with many of its peers who either sport a longer maturity or have a higher risk profile.

The fund has not delivered any negative returns over 1-year periods, but has periods, especially in mid-2013 (during the debt turmoil), with negative 1-month returns. However, this was a mark-to-market loss, and was made up once accruals accumulated.

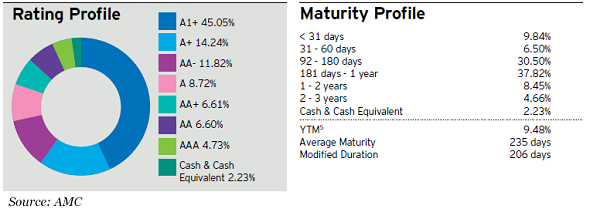

A yield-to-maturity of 9.48 per cent, higher than many funds in that category, provides some indication on the nature of accrual in the papers it holds.

Portfolio

Invesco Medium Term Bond Fund stands out for two qualities. One, as discussed earlier, it has a relatively low maturity portfolio and that acts as a natural hedge against any risk that it may take on with any instrument. Its present average maturity in about 235 days. Two, it mostly adopts a buy and hold approach, sailing on good coupon rates and earning accrual income from such instruments. As can be seen from the rating of the instruments that it holds, its risk profile is not low. However, much of what it holds is either commercial papers or very short-term debentures. The rest are A+ or AA rated papers.

This fund does not have high exposure to any single instrument. Invesco Mutual, as an AMC, is among the few fund houses that had (and continue to have) their own internal credit rating mechanism. Thus, it is not entirely dependent on external ratings of papers.

The AMC’s credit appraisal process, besides rating companies and their instruments internally, also determines the debt servicing ability (optimal borrowing limit) of companies. This helps decide the maximum exposure that Invesco, as a fund house, can take to a particular company. At a time when SEBI has come up with regulations on an AMCs’ exposure to instruments and groups, it is noteworthy that this process was already in place and running at Invesco Mutual.

The fund is managed by Nitish Sikand, and does not have an exit load. Capital gain indexation benefit is available for holdings of over 3 years; holdings shorter than that are taxed at slab rates.

FundsIndia’s Research team has, to the best of its ability, taken into account various factors – both quantitative measures and qualitative assessments, in an unbiased manner, while choosing the fund(s) mentioned above. However, they carry unknown risks and uncertainties linked to broad markets, as well as analysts’ expectations about future events. They should not, therefore, be the sole basis of investment decisions. To know how to read our weekly fund reviews, please click here.

If I invest what worse can happen with me in future ?? And why .

Hello Raj,

The worst case scenario is short-term mark to market losses. It will be recouped if held.

Whether any incometax payable on the investment interest received.If I put money in balanced fund which I think no tax on it’ return.Which is better from ‘real’income point view.

Satish, this is a debt fund. Balanced fund is equity fund (>65% equity) for taxation purposes.

If I invest what worse can happen with me in future ?? And why .

Hello Raj,

The worst case scenario is short-term mark to market losses. It will be recouped if held.

Whether any incometax payable on the investment interest received.If I put money in balanced fund which I think no tax on it’ return.Which is better from ‘real’income point view.

Satish, this is a debt fund. Balanced fund is equity fund (>65% equity) for taxation purposes.