This week too, we revisit a fund that we reviewed in 2013 (without recommending it then). Franklin Build India is a fund that will invest in multi-themes that are meant to act as building blocks for the economy. If you believe that the economy has bottomed out and this could be a good time to take exposure to some of the beaten down sectors, then this fund could be a good choice to ride the recovery.

Franklin Build India may seem to have delivered just 6% in 2013; but if you had invested through SIPs, you would have generated a handsome IRR of 20% that year. While the fund’s longer term return of 3 years remains unimpressive, we believe this could be the time to accumulate the fund for riding better times perhaps 2-3 years from now.

The Fund

Franklin Build India may, on the face of it, seem like an infrastructure fund. But having seen the difficulties faced by other fund houses in keeping a narrow mandate, Franklin Templeton India wisely chose a much larger investment universe for this fund. The fund will invest in sectors that form the building blocks of the economy; that would mean infrastructure, natural resources, financial services, agriculture and themes that are proxy to social development.

This may not seem too different from what a diversified fund would invest in. That’s true to an extent. In fact, the fund has classified itself as a diversified fund and set itself a broad index – CNX 500 as its benchmark. Then why would we choose this fund? Simply because, at this point, we still find pure infrastructure themes and funds that invest in them to be risky. A fund such as Franklin Build India would provide adequate exposure to the theme without going overboard.

While it may not be wrong to say this fund’s universe is rather diversified, you are unlikely to see this fund take very high exposure to software, consumer themes or those that piggyback on the consumption story. Also, it is likely that this kind of fund would have more intense exposure to infrastructure, energy, engineering or cement sectors than pure diversified funds.

Suitability

Franklin Build India is suitable only for investors with a high risk appetite, and for those who are looking for the ‘next theme’ to invest in. However, note that this theme, or rather multi-theme, may not bear fruit the way the IT or pharma sector did in 2013. You should have a 2-3 year time frame and consider an SIP of at least 1-2 years and then hold after that.

So will this fund outperform infrastructure funds when there is an infrastructure recovery story? Likely not. But at this juncture, this fund appears less risky to play the themes we mentioned earlier and may be better than diversified themes to play such themes, in an upturn.

Performance

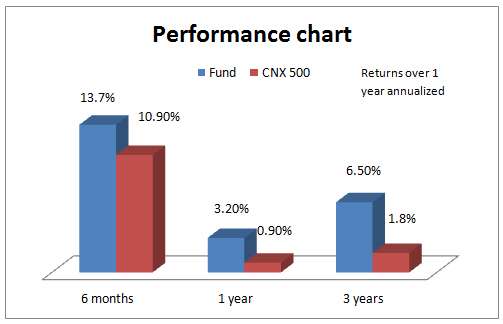

Franklin Build India comfortably managed to beat its benchmark over the last 1 and 3 years. Last year, while it outpaced infrastructure funds (that returns negatively), it just about matched diversified equity funds. Over 3 years, though, the fund beat diversified equity funds by 3 percentage points. We reckon this outperformance would be significant in a rallying market.

When we reviewed this fund in May 2013, the fund beat its benchmark CNX 500 67% of the times on a rolling 1-year return basis for 3 years. It has now improved this record to a good 76% and inspires confidence as 2013 was far from being an easy year. In fact in 2013 alone, its similar performance record was close to 100%.

The fund also deviates less from its mean returns (measured by standard deviation) suggesting that it’s performance is not too volatile.

Portfolio

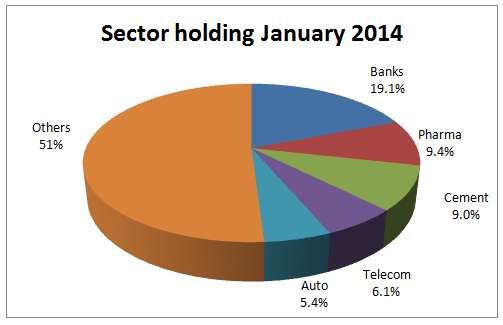

Franklin Build India held about 53% of its assets in large-cap stocks with a market cap of over Rs. 10,000 crore as of January 2014. Its average market cap holding at Rs. 16,350 crore means that it mostly holds stocks larger than what PineBridge Infrastructure. Still this market cap is lower when compared with ICICI Pru Infrastructure (average market cap of close to Rs. 30,000 crore).

While banks, cement, telecom services and auto are some of the ‘cyclical sectors’ in the portfolio, the fund still has other sectors such as pharma and software. Though some of the top holdings such as Maruti Suzuki India and Amara Raja Batteries remained lack lustre during the first half of 2013, they picked pace in the rally beginning September. Other interesting picks such as Cera Sanitaryware and Bajaj Electricals too did well.

The fund is managed by Anand Radhakrishnan, Roshi Jain and Neeraj Gaurh. The last-mentioned manager, being a recent addition to this fund, perhaps as a result of the impending promotion of Anand Radhakrishnan as CIO.

I have a corpus of Rs 20 lacs and would like to invest in liquid fund and debt fund and do swp of Rs 15000 pm , i have no other income . Should i file income tax return? as my yearly income is below the tax bracket. Also suggest me good 2 to 4 debt fund and liquid fund to invest.

hello sir,

One of our advisors will contact you on your portfolio query. it is better not to address over blog. As for capital gains: if you do SWP, you may have short-term (if done withing 1 year) or long-term capital gain. if such gains plus all your other income is less than 2 lakh then you need not pay tax nor file returns. However, if you have any capital loss and wish to set it off in future years, then you will be required to file a return. thanks, Vidya

I have a SIP going from Jan 2013 till now in Franklin Build India. This week CAGR is 10.78%. Though I was double mind couple of months back when it tanked but now after reading this review intent to remain invested for 2 years.

I have a SIP going from Jan 2013 till now in Franklin Build India. This week CAGR is 10.78%. Though I was double mind couple of months back when it tanked but now after reading this review intent to remain invested for 2 years.

I have a corpus of Rs 20 lacs and would like to invest in liquid fund and debt fund and do swp of Rs 15000 pm , i have no other income . Should i file income tax return? as my yearly income is below the tax bracket. Also suggest me good 2 to 4 debt fund and liquid fund to invest.

hello sir,

One of our advisors will contact you on your portfolio query. it is better not to address over blog. As for capital gains: if you do SWP, you may have short-term (if done withing 1 year) or long-term capital gain. if such gains plus all your other income is less than 2 lakh then you need not pay tax nor file returns. However, if you have any capital loss and wish to set it off in future years, then you will be required to file a return. thanks, Vidya