Balanced funds are those funds that invest the majority of their portfolio in stocks and the rest in fixed-income instruments. A balanced fund thus straddles two asset classes – equity and debt. What is the benefit in doing so? Who do these funds suit? Here are the answers.

What they are

Balanced funds invest about 65% to 75% of their portfolio in equities and the remaining in debt. Depending on the equity market conditions, funds either reduce equity holding or increase it. Such tweaking is within the 65-75% range. Funds almost never take equity above the 75% limit; the portfolio always holds a sizeable debt component. Balanced funds do not bring their debt component down to zero nor lift it beyond 35%.

Such tweaking is within the 65-75% range. Funds almost never take equity above the 75% limit; the portfolio always holds a sizeable debt component. Balanced funds do not bring their debt component down to zero nor lift it beyond 35%.

The more aggressive among balanced funds work with a 70-75% equity holding while the conservative ones move between 65-70% in equity. The aggressive funds are thus able to deliver higher returns than the conservative ones when markets rise but will also fall more when markets correct. Their volatility will consequently be higher.

The balanced benefit

Whether aggressive or otherwise, all balanced funds have one thing in common – they have far lower risk than pure equity funds while allowing reasonable participation in the stock markets. The equity and debt portions play different roles in a balanced fund’s portfolio and together make a well-crafted investment option.

The equity portion’s role is to deliver returns. The equity holding is significant enough to ensure a reasonable participation in the stock market and the inherent higher returns in this asset class. More, funds move across market capitalisations in their equity holdings, holding a good amount of mid-cap stocks when opportunities are ripe. In doing so, they try to extract as much as possible from their equity holdings. But the lower equity exposure of 65-75% compared to the 95% average for pure equity funds (the remaining 5% is held in cash to meet redemption requirements) brings down the risk level too. When markets correct, this reduced equity exposure results in losses being much lower than pure equity funds.

The debt portion serves to protect. Debt and equity, to begin with, rarely move in tandem so there is already a hedge to the equity through the debt. Further, the debt portion delivers its own returns that supplement equity returns or compensate for equity losses. Funds also do not manage the debt portion actively. They mostly investt in top-rated quality corporate debt, hold these instruments, and earn the interest accrued on them. But some of them go long on duration to make the best of an interest rate move.

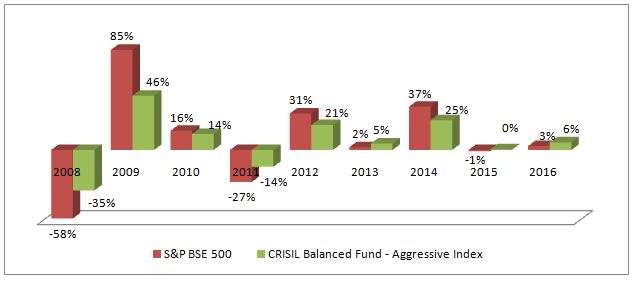

The graph shows the year-wise returns of the CRISIL Balanced Fund index (an index that is the benchmark for balanced funds and is comprised of the Nifty 50 and the CRISIL Composite Bond fund index in a 65:35 proportion) and the BSE 500 index (an index that is the broadest representation of the stock market). Balanced funds will not deliver as high returns as pure equity funds, but they will not fall as much either. Note that balanced funds cannot escape losses altogether losses when stock markets correct. The majority of their portfolio is still in stocks. It is just that these losses are contained.

Some balanced funds, especially the new ones on the block, put a portion of their equity into derivatives or arbitrage. Either way, equity still makes up 65% of their portfolio at the minimum. Balanced funds that do this derivative strategy are not to be confused with equity savings funds. That category seeks to protect equity exposure extensively through derivatives and debt. Balanced funds leave most of their equity portion open and counter risk primarily through debt. We’ll put up a separate post on equity savings funds.

Portfolio role

A balanced fund needs a holding period of at least 3-4 years and can be part of a long-term portfolio as well. A balanced fund is a good starting point for beginner investors wanting equity exposure. Since these funds have lower volatility than equity funds, investors new to equity will not be as alarmed by market swings. Balanced funds are also useful for conservative equity investors for the same reason. High-risk investors with a shorter horizon of three years can also invest in balanced funds, instead of taking an excessive amount of risk through pure equity funds.

Balanced funds are taxed like equity funds – holding over 1 year qualify as long-term and capital gains are tax-exempt. Capital gain on holding for less than 1 year is 15% plus cess.

A balanced mutual fund comes with many advantages of investment. This type of investment caters to most of the requirement of an amateur investor.

A balanced mutual fund comes with many advantages of investment. This type of investment caters to most of the requirement of an amateur investor.