For the fifth policy in a row, the Reserve Bank of India (RBI) left policy rates unchanged, waiting for more consistent signals of the inflation sliding. Even as there is a status quo on rates, the signals coming from the RBI appear to favour a rate cut early next year, that is, if there are no negative surprises.

That the RBI is taking some comfort from lower inflation is evident from its downward revision of the Consumer Price Index (CPI) inflation to 6 per cent for March 2015. This does not come as a surprise as CPI inflation has moved positively for 3 months in a row, decelerating to 5.5 per cent in October 2014, compared with a year ago.

While much of the slowdown in prices can be attributed to a high base, moderation in rural wage growth, lower global commodity prices in rupee terms, reduction in fiscal deficit, as well as flattening trends in property prices have also been widely cited reasons behind the inflation’s slowing pace.

What to expect

If inflation continues in the current trajectory (although a bounce up can be expected in January 2015), and there are no new geo-political risks, it appears that we are at last headed for a rate cut next year.

The question that the RBI has left for the market to puzzle over is whether a rate cut would happen in the next policy meet in February, soon after the December inflation numbers are known, or whether it would wait for the Budget, or the policy post that to know the efforts taken by the Government to address structural issues, and their measures on the deficit front.

In our opinion, the timing of the rate cut should not matter much as there is now a clear direction for the market to move. This has already been the case with G-Sec yields, which fell 60-70 points in the last 6 months.

More importantly, the window for a rate cut, when it happens, may not be too high, at least not within a span of 6 months. This is because the possibility of inflation falling below the 6 per cent mark and remaining consistently below that mark is not too high for the following reasons:

• One, as stated by the RBI, protein foods have continued to see a pressure on prices.

• Two, there have not been any administered price revisions in fuel segments such as electricity. A hike could impact inflation.

• Three, a weaker than expected agricultural production (what with Rabi sowing not showing encouraging signs) could also impact prices.

• Four, a pick up in supply side, which is possible only with more investment, is crucial for sustained low inflation.

In other words, we think rate cuts, when they happen, would not be measured in large portions at a time. This is good news for retail investors because the current gentle slide in yields, together with a measured cut, would prevent speculative exits in the bond market, thus leaving more money on the table for long-term investors.

Debt strategy

We have been advocating investors with a 2-year plus view to go for income funds that have a mix of government securities and corporate bonds.

We have, in the past 2 quarters, during reviews for our Select Funds list, been consistently tweaking and actively managing income funds in our list to ensure that investors gain from the gradually sliding yields. We used a two-fold strategy that has been working and we continue to advocate it. One is returns through a duration call, and the second through higher spreads (credit calls).

The first one is a simple case of funds mostly increasing exposure to government securities with longer maturities. These could even be tax-free bonds traded in the market. This is typically done when interest rates have peaked. We had chosen such funds a couple of quarters ago as we had observed funds upping their stakes to make the best of slowly falling yields.

The second is a multi-pronged strategy of keeping the duration at reasonable levels, but choosing those corporate bonds that have a higher spread over government securities.

Returns through duration

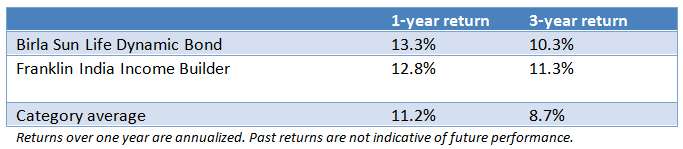

We would currently go with Birla Sun Life Dynamic Bond for those looking at low credit risk, but wanting to play the interest rate cycle. We prefer this fund over many other dynamic bond funds as it is known to also reduce its portfolio maturity when rate cycles are not in favour. Hence, for those looking at adding a debt fund for the long term, this fund, which does not require active management, can be a good addition to your portfolio.

For those looking at longer maturity profiles, we had added Tata Dynamic Bond and UTI Dynamic Bond to our list a couple of quarters ago. These funds have a longer average maturity (than the above Birla fund) of 11 years and 9 years respectively.

While pure gilt holdings could be risky for retail investors as they require an active profit booking strategy, income/dynamic bond funds, which have upped their portfolio maturity and also hold some good corporate bonds with profitable spreads, should deliver adequate returns without too much risk. They are also capable of adjusting their maturity profile based on varying interest rate cycles.

Returns from higher spread

Our Select Funds list also has funds such as Franklin India Income Builder that does not take longer duration calls, but manages its credit profile well. Currently laden with a good chunk (close to two-thirds) of AA-rated or lower instrument assets, this fund is well placed to benefit from a higher spread between AA corporate bonds and gilts. Its credit risk though is higher than the other funds in our Select Funds list such as HDFC Medium Term Opportunities.

It is noteworthy that we would prefer not less than a 2-year strategy on these funds. For those who are particular about being tax efficient, a not less than 3-year strategy would be required. We would recommend a lump sum approach at this juncture, unless the funds are part of an asset allocated portfolio with tenure of over 5 years.