Not to be outdone by the spate of NFOs in the equity fund space, debt fund managers too have come up with quite a few new offers this month. With interest rates showing signs of stability and the monetary policy closing in (January 28), fund houses appear to have picked opportunities to invest in the debt market.

But interestingly, most of them appear to be playing it safe. Here we discuss a few of the debt NFOs out in the market currently:

DWS Inflation Indexed Bond Fund

Among the earlier NFOs to open this month, this scheme, the first of its kind, will invest in inflation-indexed bonds (IIB) traded in the debt market. We have reviewed this fund a week ago. You may check the review here: DWS Inflation Indexed Bond Fund.

Offer closes: January 27, 2014.

Canara Robeco Medium Term Opportunities Fund

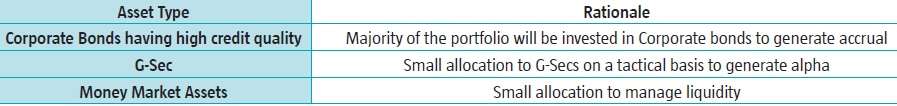

This open-ended debt fund will seek to invest its assets, predominantly in corporate bonds, with high credit quality. Given the rate uncertainty, the fund will only take short to medium duration calls and will have only a small allocation to government securities.

Among corporate bonds, the fund will mainly invest in AAA-rated securities. The fund will be managed by Avnish Jain and benchmarked against Crisil Composite Bond index.

Suitability: The fund will be suitable for those not wanting to take duration calls that turned out to volatile, the way it was last year, and also not willing to take credit risks. This fund’s investment may be viewed as a basket of bonds/deposits that you would otherwise hold in top-rated instruments.

A 3-year AAA-rated PSU bond or a AAA-rated NBFC bond has seen an increase in yields by about 20 basis points between October and now, providing good levels to lock into. Rates are anywhere between 9.35% and 9.7% currently. Any fall in yields will also provide some price appreciation.

The NFO closes on January 31, 2014.

UTI Banking and PSU Debt Fund

UTI Banking & PSU Debt Fund, an open-ended debt fund will seek to invest at least 80% of its assets in debt and money market instruments of banks and public sector undertakings.

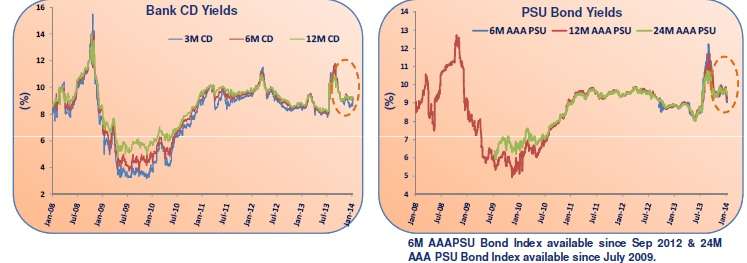

That means the fund may invest in certificates of deposits, and top-rated commercial papers, and PSU bonds. The fund will not take long duration calls and seeks to keep average portfolio maturity at about 12-18 months.

Suitability: Currently 1-year CD rates at close to 9.3% and 1-year commercial paper rates at 9.8% again provide scope to lock in to attractive rates without having to take much risk on the interest rate curve as well as on credit.

That said, there are quite a few Banking and PSU debt funds from DWS, Baroda Pioneer, JP Morgan and Kotak currently available. Also, many short-term debt funds do provide exposure to certificates of deposit and PSU credit instruments.

The fund is suitable only for low-risk investors looking to seek safety from public sector credit instruments. The NFO closes on January 30, 2014. The fund will be managed by Sudhir Agarwal.

Investing in NFO is made simple with FundsIndia. Open a free FundsIndia account in less than 20 minutes for NFO investing.