For those of you who are new to our platform, FundsIndia’s ‘Select Funds’ is a list of investment worthy funds. Spread across various categories, this list helps you narrow down your investment choices from the hundreds of funds that you would otherwise have to sift through before investing.

This list is reviewed on a quarterly basis. There are additions to ensure that good choices are not left out. There are also deletions if we find certain funds’ strategies to be inappropriate for the prevailing market conditions.

Before we move on to the changes we have made this quarter, here’s an important message – none of the funds we’ve removed warrant an exit unless we explicitly state that.

We do not prefer that you sub-optimally churn your portfolio. Our endeavour, through the Select Funds list, is to choose funds that are good and appear to have an edge in the present environment. A fund that is removed may still be a good performer, and may help build long-term wealth. However, our call (for the purpose of this list) would have been based on whether a peer fund can do a better job when fresh exposure is taken today.

This quarter, our Select Funds list, more or less, remains the same, but with a handful of key changes, and also the introduction of a new category.

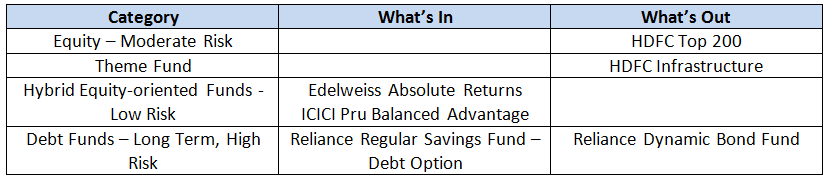

Equity Funds – Moderate Risk

After much contemplation for several quarters now, we decided to remove HDFC Top 200 from our Select Funds list. The fund has built wealth in many a portfolio, and we continue to revere its performance and its fund manager’s conviction. We even defended the fund in our earlier reviews saying that some calls taken by the fund were more long term, and some were erring on the side of prudence like moving to large caps now.

In fact, the fund moved to more large-cap stocks post the recent correction, and we think it is a good move. We stick to those views. However, the fund’s volatility disturbs us. Its deviation, especially on the downside, continues to be high, and we would prefer this metric to be lower unless it is a mid-cap fund. Given the range-bound market we are likely to be in, this metric gains importance. If you are holding this fund, continue it as a part of your portfolio. But we would prefer fresh exposures in our Select Funds list’s Equity Moderate Risk category.

We will continue to watch the fund for its performance, and we’ll keep you updated on our stance.

Theme Funds

One other fund that we would like to remove from our theme list (which is a dynamic list) is HDFC Infrastructure. While we brought this in sincerely hoping that capital spending in the economy would revive sooner, we have not seen sufficient signs of this; although stocks dependent on such spending have run up. For now, until we either see lower valuations or better prospects in the space, we are more comfortable with a diversified theme fund like Franklin Build India, which is also part of our New India Portfolio.

New Category: Hybrid Equity-oriented Funds – Low Risk

This new category is positioned a tad higher than Hybrid Debt-oriented Funds (mostly Monthly Income Plans), and a few notches lower than Hybrid Equity-oriented Funds – Moderate Risk (essentially Balanced Equity Funds) in terms of their risk-return profile.

We have added two funds within this category: ICICI Pru Balanced Advantage and Edelweiss Absolute Returns. We would like to make it clear that these two funds have different strategies, although we have classified them under the same bucket. However, they have a couple of things in common: both use derivative strategies and some amount of debt to contain downsides better than equity or balanced funds. That means they are relatively low volatile funds. Also, both funds seek to deliver higher than MIP-category returns (but lower than regular Equity Balanced Funds).

Why did we add these two funds in our list? We found that a good number of investors wanted to take part in equities, but prefer low volatility and more predictability in the direction of their funds, and more importantly, they wanted the tax advantage of equity as well, even over the medium term.

These funds serve such a purpose. Please note that these funds have enough exposure to unhedged equity to deliver negative returns in a down market. Do not mistake them for ‘no fall’ funds; it’s just that they may still contain a fall better than the market or indices. We will, in future weeks, discuss about these funds in our call (you can click here to read our review of the ICICI Pru Balanced Advantage Fund).

For now, note that these are for a 1-3 year holding period, and suit those looking for low volatility, or reasonably steady dividend, or want equity-like tax advantage. We would not recommend them as core holdings for long-term wealth building (five years and above). We prefer regular Equity Funds or Balanced Funds for that purpose.

Debt Funds

In our Debt Funds – Long Term – High Risk category, we’ve made a change from one aggressive fund to another. We’ve added Reliance Regular Savings Fund – Debt Plan, instead of the Reliance Dynamic Bond Fund. By taking this call, we move from an interest rate risk-return stance (Reliance Dynamic Bond) to an income accrual (marginal credit risk) stance with the Reliance Regular Savings Fund – Debt Plan.

The high average maturity in this Dynamic Bond Fund would provide capital appreciation on a rate fall, no doubt. To this extent, we continue to hold a positive view on the fund. However, we think a longer and more sustainable rally is possible in the credit space. While this is a bet that may take longer to deliver, it is likely to follow a corporate earnings growth recovery and can last longer.

We would allow funds such as Birla Sun Life Dynamic Bond to provide us the interest rate rally, and add Reliance Regular Savings – Debt Plan to play the spread.

Hello Madam,

I wanted to know if Equity Savings Fund (From Birla, Icici, Kotak, SBI and Reliance) are included in this new category “Hybrid Equity-riented Funds – Low Risk” or these Equity Savings Fund can be compared to MIP Funds or they are in another new different category

Hello vivek, Yes, they will, according to their strategy, fall under this category. Since they do not have a sufficient track record, we will not really know if their performance too will ensure that they fit in this bucket. thanks.

Hi Vidya,

I’m investing in HDFC TOP 200 Fund (G) and HDFC Mid-Cap Opportunities Fund (G) through SIP. After reading your blog and researching on web, I’ve following options-

1. To switch from HDFC TOP 200 Fund (G) to HDFC Mid-Cap Opportunities Fund (G) and combine its SIP amount with HDFC Mid-Cap Opportunities Fund (G)’s SIP amount.

2. To Stop SIP in HDFC TOP 200 Fund (G) and combine its SIP amount with HDFC Mid-Cap Opportunities Fund (G)’s SIP amount.

3. To Redeem HDFC TOP 200 Fund (G)’s units and re-invest in some ultra short term bond or debt fund, and combine its SIP amount with HDFC Mid-Cap Opportunities Fund (G)’s SIP amount.

What would you suggest?

Regards,

Samir Nigam.

Samir, thanks for writing on the blog. In future, I would request you to use the ‘advisor appointment’ feature if you have queries on your portfolio. You can request for a specific person to answer it, if you want. The blog is more of a pubic discussion forum.

First, HDFC Midcap is not a substitute for Top 200. The latter is large-cap focused and the other is midcap. Next, if you have a 5 year plus time frame, I would suggest you continue your SIPs as the fund’s volatility has typically come down in longer periods and returns beat category. In fact for a volatile fund such as this, averaging is important.

With select funds, since we do not know the time frame of an investor, we have to be conservative in taking performance of 3-5 years as well. However, we have not said the fund is an exit.

If you are still unhappy, then stop SIPs in Top 200 and increase SIP in funds like UTI Opportunities that you already have.

Hi Vidya,

I’m investing in HDFC TOP 200 Fund (G) and HDFC Mid-Cap Opportunities Fund (G) through SIP. After reading your blog and researching on web, I’ve following options-

1. To switch from HDFC TOP 200 Fund (G) to HDFC Mid-Cap Opportunities Fund (G) and combine its SIP amount with HDFC Mid-Cap Opportunities Fund (G)’s SIP amount.

2. To Stop SIP in HDFC TOP 200 Fund (G) and combine its SIP amount with HDFC Mid-Cap Opportunities Fund (G)’s SIP amount.

3. To Redeem HDFC TOP 200 Fund (G)’s units and re-invest in some ultra short term bond or debt fund, and combine its SIP amount with HDFC Mid-Cap Opportunities Fund (G)’s SIP amount.

What would you suggest?

Regards,

Samir Nigam.

Samir, thanks for writing on the blog. In future, I would request you to use the ‘advisor appointment’ feature if you have queries on your portfolio. You can request for a specific person to answer it, if you want. The blog is more of a pubic discussion forum.

First, HDFC Midcap is not a substitute for Top 200. The latter is large-cap focused and the other is midcap. Next, if you have a 5 year plus time frame, I would suggest you continue your SIPs as the fund’s volatility has typically come down in longer periods and returns beat category. In fact for a volatile fund such as this, averaging is important.

With select funds, since we do not know the time frame of an investor, we have to be conservative in taking performance of 3-5 years as well. However, we have not said the fund is an exit.

If you are still unhappy, then stop SIPs in Top 200 and increase SIP in funds like UTI Opportunities that you already have.

Hello Madam,

I wanted to know if Equity Savings Fund (From Birla, Icici, Kotak, SBI and Reliance) are included in this new category “Hybrid Equity-riented Funds – Low Risk” or these Equity Savings Fund can be compared to MIP Funds or they are in another new different category

Hello vivek, Yes, they will, according to their strategy, fall under this category. Since they do not have a sufficient track record, we will not really know if their performance too will ensure that they fit in this bucket. thanks.