For those of you who are beneficiaries of the 7th Pay Commission hike or any other pay hike, it’s important that you plan your spending and investing. You may not be able to do a repeat of what you did during the 6th Pay commission. Spending all that you get, stashing the money in a deposit or buying real estate assets – none of these are ideal options for you at this point in time; unlike the last time. Here’s a low down on why these are poor options today and also what you should do with the current hike – be it from the pay commission or otherwise.

Avoid EMIs, SIP to spend later

The Sixth Pay commission is often cited as one of the reasons for pulling back the economy from the 2008 downturn. This was because of almost 32 months of arrears that government employees received. That left a large lump sum in hand thus resulting in large-ticket spending, giving a boost to consumption. Lending rates in 2010-11 were also lower than what they are today (according to historical RBI data).

This time around, the arrears are just for about 6-7 months (as it is being implemented in a shorter span from the report date). This basically means you will not have a huge lump sum in your hand. While you are likely to be tempted to buy large white goods through EMI, do note that interest rates on loans are still not low and have not fallen the way your deposit rates have. Hence, refrain from EMI purchases just because you have received a hike. Unless it is indeed time for you to replace any large discretionary consumer good, going for an EMI-based purchase because of a hike is not a good idea at this juncture.

What to do: If you can postpone your spends a bit, the best you can do is invest your arrears and also start a SIP in ultra-short-term debt funds for 6-12 months (or until you need to purchase the goods). This will not only deliver superior returns than your savings bank and the current FD/RD rate but also provide high liquidity. You will also avoid running a high rate, tax inefficient EMI on your spends. Consider funds such as Birla Sun Life Floating Rate Fund Long Term Plan and ICICI Pru Flexible Income Plan. These funds have limited risk, invest in short-term instruments and also have SIP options of as low as Rs 1,000.

Substitute FDs with debt funds

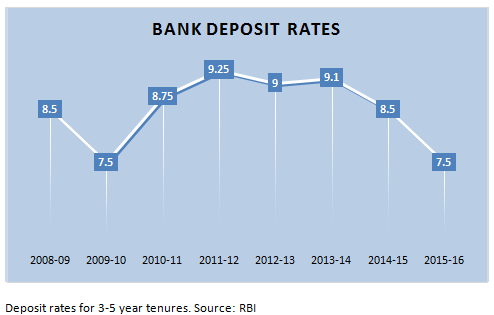

The current interest rate of 7-7.5 per cent you will get on deposits is far lower than the 8.75 – 9 per cent rates you earned on 3-5-year bank deposits or recurring deposits in 2010-12.

If you are stashing some arrears money in FD, please note that such arrears are already taxed; you do not want to invest it in deposits at a time when your post-tax FD rate is as low as 5 per cent! It would be even worse if you started a recurring deposit for the long term at the current low interest rates. You would not be able to save for your goals; whether it is education or retirement, without falling steeply short. This is not the time for fresh investments in deposits.

What to do: For those of you looking for substitutes for deposits – we would say invest in debt mutual funds. If you have a short-term (1-2-year need) then a fund such as Birla Sun Life Treasury Optimiser is a good option to go with. Otherwise, UTI Dynamic Bond and HDFC Medium Term Opportunities would provide you with FD-plus returns at this juncture. The former can gain from a rally in gilt (with fall in rates), while the latter will give less glamourous but steady accrual income (through buying and holding corporate bonds).

No more physical assets. Invest in funds

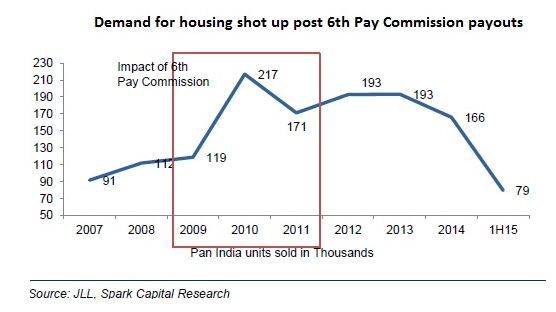

We currently widely read about a downturn in the real estate market and that prices are not moving. This combined with a lower rate scenario that may follow, may tempt you to invest in real estate. While affordability and convenience should be the primary factors to consider when it comes to buying a house for residing; you need to be careful about the market timing when it comes to real estate investing – be in land or property. There is data to substantiate that the 6th Pay Commission caused a spike in real estate units bought. As a result, prices climbed up too fast. Take a look at the data below that shows the spike in demand for housing. This demand was said to be triggered by the bulk amount received from arrears in the 6th pay commission besides a steep increase in pay.

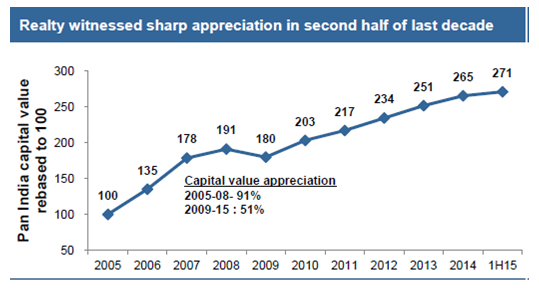

Now, look at the data below to see whether prices that shot up as a result of demand, have really corrected.

You will see that the prices have not moved down (although data is a bit dated; latest real estate research reports still show sluggish prices and not a correction as builders and land owners are reluctant to cut down prices). Now, the question can be why would we not have a similar rally now?

Two factors are needed to trigger such a rally:

One, there needs to be a lower supply than there is today. The supply of land (available for sale) and housing is far higher now than it was 7-8 years ago and real estate research data suggests that there have been a large number of unsold properties without commensurate demand; and yet there has been no reduction in prices. Hence, either a price correction or sudden spike in demand (as supply is already there) is needed to trigger a rally.

Two, the kind of demand seen post 2009 may not repeat itself. The spike you see in the earlier chart post 2009, came from the arrears largesse, that left a lot of money in the hands of the earning class. As the current arrears are estimated at just a fifth of the Sixth Pay Commission arrears, we do not think such a demand trigger is possible. Also, it is noteworthy that the average hike in the sixth pay commission was 60 per cent; which was large enough to support EMIs. This time around, the average hike is about 24 per cent; not good enough to take large EMIs.

Long story short, you could well have a timing risk, trying to ‘invest’ in real estate at this point.

Unlike a mutual fund or stock market where you can average your investments through buying continuously (SIPs) you cannot do so in real estate. Unless you believe prices have corrected, after the steep hike seen in the past years, you may catch it wrong.

What to do: If you are looking at long-term RDs or ‘investment’ in real estate, we would say, drop the idea and go for a combination of the above debt funds and equity funds. You may add gold only if you fancy it and want to diversify your asset allocation.

- For this, growth-style funds such as SBI Bluechip, Kotak Select Focus and Franklin India Prima Plus are well placed to deliver from any improvement in corporate earnings as they are well diversified across sectors and less volatile, given their large-cap bias. This, if you have a 5-year time frame at least and will run SIPs.

You will be surprised to know that equity mutual funds delivered an absolute return of 375 per cent (annualised return of 16 per cent) between 2005 and the first half of 2015; as opposed to the seemingly high return of 171 per cent (index moved from 100 to 271) given in the real estate chart above for the same period. The returns in equity funds would have been higher through SIP.

Please note that you do not have to necessarily invest in new funds. If you have existing equity or debt mutual funds, simply increase your SIP in those funds. - For those of you still fascinated with the idea of investing in gold, we think investment in gold bonds (issued by the government. If you miss this time, you will have more issues coming) would by far be the best option that you have today; given the 2.75 per cent interest you will get in addition to the final market value of gold on maturity. And the maturity proceeds are exempt from tax. But make sure this does not account for over 10-15 per cent of your asset allocation.

All of the above need not apply only to those who benefited from pay commission hikes. A pay hike of any kind, calls for smart investing.

FundsIndia’s Research team has, to the best of its ability, taken into account various factors – both quantitative measures and qualitative assessments, in an unbiased manner, while choosing the fund(s) mentioned above. However, they carry unknown risks and uncertainties linked to broad markets, as well as analysts’ expectations about future events. They should not, therefore, be the sole basis of investment decisions. To know how to read our weekly fund reviews, please click here.

Which one is better to invest Hdfc midcap opportunity fund(G) or Hdfc medium term opportunity fund as NAV differs. I want to make Sip investment. Kindly advise which one is good and whether Rs 1000 or 1500 pm shd be invested Therr are so many funds. Kindly advice other funds also OF HDFc or other funds in similar range of NAV with yr recommendations THNX.

Tejinder, you are talking about a equity midcap fund and a debt fund. They are not comparable. You may need to know more about the category of funds before getting to invest. Please talk to your advisor at FundsIndia, if you are a FI investor and they will help you choose. thanks, Vidya

Which one is better to invest Hdfc midcap opportunity fund(G) or Hdfc medium term opportunity fund as NAV differs. I want to make Sip investment. Kindly advise which one is good and whether Rs 1000 or 1500 pm shd be invested Therr are so many funds. Kindly advice other funds also OF HDFc or other funds in similar range of NAV with yr recommendations THNX.

Tejinder, you are talking about a equity midcap fund and a debt fund. They are not comparable. You may need to know more about the category of funds before getting to invest. Please talk to your advisor at FundsIndia, if you are a FI investor and they will help you choose. thanks, Vidya

Is it good time to invest? as Market doing good day by day or i should wait for drop? to get better unites

Hello Jyoti – to get units at lower prices, you need to average using SIP. sitting on the sidelines, trying to time the market, seldom works. thanks, Vidya

Is it good time to invest? as Market doing good day by day or i should wait for drop? to get better unites

Hello Jyoti – to get units at lower prices, you need to average using SIP. sitting on the sidelines, trying to time the market, seldom works. thanks, Vidya

Should I invest in NCD(9-10% PA) or debt fund considering 3-5 years span?

We will definitely say debt fund since you have capital gains indexation benefit. For NCD, if you simply hold and earn interest, the interest is taxable at your slab rate. Post tax returns will be more efficient in debt funds. thanks, Vidya

Hello Vidya,

As part of smart solutions, for long term investment in childern’s education,the robo-advisor is suggesting Reliance Equity Fund and HDFC TOP 200 as part of portfolio. However, currently, these two are not rated as one of the best options by various other rating agencies. What is your take? Are these funds good to go for long-term investment in education portfolio.

Hi Adarsh, you have asked a pertinent question. HDFC Top 200 is a high beta fund – a bull market fund. It underperforms in volatile markets. However, it adequately makes up for this in rallies. For instance if you take year to date, it is ahead of its peers. The fund manager also takes longer time frame calls that underperform in short term. Given, this and the fact that we do not wish to churn smart solutions portfolio too much, (since it is a long-term portfolio), we have been keeping watch over it. If you notice, we do not have it in our select funds but have retained in all smart solutions. if we think the fund will not deliver with its current portfolio, we will certainly take a call in our half yearly review and you will receive a mail about it. We will keep watch.

thanks

Vidya

Should I invest in NCD(9-10% PA) or debt fund considering 3-5 years span?

We will definitely say debt fund since you have capital gains indexation benefit. For NCD, if you simply hold and earn interest, the interest is taxable at your slab rate. Post tax returns will be more efficient in debt funds. thanks, Vidya

Hello Vidya,

As part of smart solutions, for long term investment in childern’s education,the robo-advisor is suggesting Reliance Equity Fund and HDFC TOP 200 as part of portfolio. However, currently, these two are not rated as one of the best options by various other rating agencies. What is your take? Are these funds good to go for long-term investment in education portfolio.

Hi Adarsh, you have asked a pertinent question. HDFC Top 200 is a high beta fund – a bull market fund. It underperforms in volatile markets. However, it adequately makes up for this in rallies. For instance if you take year to date, it is ahead of its peers. The fund manager also takes longer time frame calls that underperform in short term. Given, this and the fact that we do not wish to churn smart solutions portfolio too much, (since it is a long-term portfolio), we have been keeping watch over it. If you notice, we do not have it in our select funds but have retained in all smart solutions. if we think the fund will not deliver with its current portfolio, we will certainly take a call in our half yearly review and you will receive a mail about it. We will keep watch.

thanks

Vidya

My query has not yet been replied. Kindly reply

Tejinder, we replied to it. Here it is, re-produced:

Tejinder, you are talking about a equity midcap fund and a debt fund. They are not comparable. You may need to know more about the category of funds before getting to invest. Please talk to your advisor at FundsIndia, if you are a FI investor and they will help you choose. thanks, Vidya

My query has not yet been replied. Kindly reply

Tejinder, we replied to it. Here it is, re-produced:

Tejinder, you are talking about a equity midcap fund and a debt fund. They are not comparable. You may need to know more about the category of funds before getting to invest. Please talk to your advisor at FundsIndia, if you are a FI investor and they will help you choose. thanks, Vidya

Good points Vidya!!!

Pay hike and receipt of bonus is a good opportunity to review your balance sheet and make adjustments.

Though the post is about investments, in my opinion, repayment of expensive loans should be considered before starting to deploy bonus for investments.

From what I have seen, many investors are concerned about finding high return opportunities while simply ignoring high cost loans sitting in their balance sheet. Not the best approach.

Thanks!!!

Good points Vidya!!!

Pay hike and receipt of bonus is a good opportunity to review your balance sheet and make adjustments.

Though the post is about investments, in my opinion, repayment of expensive loans should be considered before starting to deploy bonus for investments.

From what I have seen, many investors are concerned about finding high return opportunities while simply ignoring high cost loans sitting in their balance sheet. Not the best approach.

Thanks!!!