Short on time? Listen to a brief overview of this week’s review.

[soundcloud url=”http://api.soundcloud.com/tracks/269180332″ params=”color=ff9900&auto_play=false&hide_related=false&show_comments=true&show_user=true&show_reposts=false” width=”100%” height=”166″ iframe=”true” /]

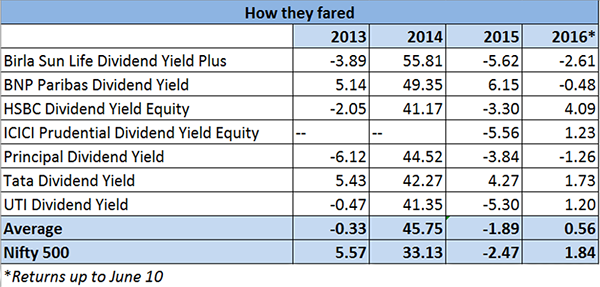

The returns record of dividend yield funds has been patchy for a while now. In 2013, 2014, and 2015, they trailed the average returns of the diversified category by 4-5 percentage points. They failed to beat the large-cap category in 2015 as well, though they outperformed it in the other years. But since January this year, dividend yield funds have returned 0.56 per cent on an average. This figure is better than the 0.48 per cent clocked by diversified or multi-cap funds.

If you hold dividend yield funds, you may be watching their inconsistent performance with some trepidation. What explains it? Much of it stems from the dividend yield strategy itself.

What they are

A dividend yield fund puts a majority of its portfolio in stocks whose dividend yield is higher than the Nifty 50, the Sensex, or the Nifty Dividend Opportunities 50 index. The remaining part of the portfolio can be invested in any stock. Dividend yield is the ratio of the dividend per share to its market price. In order to ensure that the asking price for this stable dividend is not too high, the dividend yield ratio comes into play.

Stocks with a high dividend yield offer the possibility of earning good dividends. However, high dividend yield can also come from huge one-time dividends. Thus, consistency in dividend payouts matters. Typically, this indicates stability of profits, and that these companies are generally more cash-rich and reliable. High dividend yields usually are also a factor of relatively lower prices; i.e., stock prices are low and yields high because the market, at that time, does not prefer them.

That brings up the second reasoning behind a dividend yield strategy. It is that these stocks are also undervalued or cheap. A dividend yield strategy therefore translates into a value-based one, often running contrary to the market sentiment. Being value funds, they also contain downsides better, 2008 and 2011 being testaments to this. The volatility of dividend yield funds, on an average, is lower than that of both diversified and large-cap funds.

Done in by value

The strategy of going after stocks with high dividend yields and low valuations came undone in the past couple of years. This is because the market ignored value and focused only on high-quality companies with growth visibility, regardless of valuations. The Nifty Dividend Opportunities 50 index has trailed the Nifty 500 index a good part of the time since 2013.

Last year, for example, stocks that offered good dividend yields belonged to financials, metals, oil and gas, power and capital goods – ICICI Bank, Axis Bank, Federal Bank, Coal India, Oil India, Power Grid Corp., ONGC, Hindustan Zinc, and so on. These sectors were all out of market favour, and banking continues to be so. Funds that held a higher weight here, such as UTI Dividend Yield, Birla Sun Life Dividend Yield Plus, and ICICI Prudential Dividend Yield Equity, saw their returns drop.

This apart, dividend yield opportunities were also present in software, where funds had a 15-16 per cent exposure. With HCL Technologies, Infosys, and Wipro all having a bad time in 2015, fund returns took a hit. It did not help that other dividend regulars such as Colgate Palmolive, Hindustan Unilever, and ITC were either flat or dropped in the year. Auto was a consumer theme that soared and had good dividend yield stocks in Bajaj Auto and Hero MotoCorp. But apart from Principal Dividend Yield, most funds had smaller exposures to the auto sector.

Similarly, in 2013, banking, industrials, metals, and energy were sectors that offered high dividend yields and were relatively better valued. These sectors, which were stark underperformers for 2013, together accounted for nearly half the portfolio of most dividend yield funds.

Apart from sector weights bogging down returns, the funds’ market cap orientation also played a role. Dividend yield funds maintain a dominant large-cap exposure of 50-70 per cent of their portfolios. In the mid-cap fuelled 2014 and 2015 markets, diversified funds that moved heavily into mid-cap stocks consequently saw better returns. Birla Sun Life Dividend Yield Plus and Tata Dividend Yield were the only ones to have a slightly higher mid-cap exposure.

Individual performers

BNP Paribas Dividend Yield and Tata Dividend Yield are the only two of the six dividend yield funds (with a sufficient history) that have done well and maintained consistent returns across the years. BNP Paribas Dividend Yield has nearly double the playing field compared to peer funds as it has defined high dividend yield as above 0.5%, while others benchmark it to the Nifty 50 or Sensex. Apart from using this to its advantage, the fund also accorded more weight to the consumption theme over the past year and pared holdings in industrials and energy. Tata Dividend Yield followed a similar strategy, besides picking up winners in the software sector that some peers missed, such as Polaris Consulting and eClerx Services, which also sported high dividend yields. It also pared down its holding in financials over the year.

A dividend yield fund simply follows a different investment strategy to keep volatility low and downsides contained. Their name is derived from the strategy they follow; these funds do not have an onus to pay dividends. Due to the value-based strategy dividend yield funds follow, and the contrarian calls they make, such funds necessarily require a long-term time-frame. To hold such funds, you need to be willing to take these contrarian calls, and should have some risk appetite. Given that corporate performance, economic recovery, and therefore the markets have not panned out as expected, value picks have not worked. From here, a more broad-based market recovery based on improved fundamentals can help turn around the story for dividend yield funds.

FundsIndia’s Research team has, to the best of its ability, taken into account various factors – both quantitative measures and qualitative assessments, in an unbiased manner, while choosing the fund(s) mentioned above. However, they carry unknown risks and uncertainties linked to broad markets, as well as analysts’ expectations about future events. They should not, therefore, be the sole basis of investment decisions. To know how to read our weekly fund reviews, please click here.

Analysis is very good, based on excellent research.

I have always wondered about and could not understand this category – what is the purpose of expecting a variable dividend? if you want redeploy it as capital (reinvest), why receive dividend? for spending, do you really need a variable income strategy thru dividends? I prefer simpler approach.

With my little knowledge, I think this is more suited to institutional investors and HNIs. Retail investors can follow a simpler approach that they can understand, and incomes that they can predict. Just my perspective.

Thanks, Bharani! Your take on dividends is spot on. It isn’t a great idea to depend on dividends for income, since it is neither regular in coming nor constant in amount. It’s best to go for the growth option to increase returns or set up systematic withdrawals for regular income.

In the context of dividend yield funds though, the idea is not to give dividends at all. Dividend yield funds are a misunderstood category. Dividend yield strategy is a method of identifying and investing in stocks. Dividend yield stocks are usually more often than not out of market favour – they have high yields because price is low. When there is a good dividend yield, and it is not a one-off situation (i.e. the high dividends haven’t come from a one-time declaration or a sudden massive interim dividend or something like that), it also means that the company is reasonably reliable and profitable. So it is like following a value strategy. The added advantage in dividend yield, apart from the value strategy, is that dividends declared simply add to returns.

Thanks,

Bhavana

Analysis is very good, based on excellent research.

I have always wondered about and could not understand this category – what is the purpose of expecting a variable dividend? if you want redeploy it as capital (reinvest), why receive dividend? for spending, do you really need a variable income strategy thru dividends? I prefer simpler approach.

With my little knowledge, I think this is more suited to institutional investors and HNIs. Retail investors can follow a simpler approach that they can understand, and incomes that they can predict. Just my perspective.

Thanks, Bharani! Your take on dividends is spot on. It isn’t a great idea to depend on dividends for income, since it is neither regular in coming nor constant in amount. It’s best to go for the growth option to increase returns or set up systematic withdrawals for regular income.

In the context of dividend yield funds though, the idea is not to give dividends at all. Dividend yield funds are a misunderstood category. Dividend yield strategy is a method of identifying and investing in stocks. Dividend yield stocks are usually more often than not out of market favour – they have high yields because price is low. When there is a good dividend yield, and it is not a one-off situation (i.e. the high dividends haven’t come from a one-time declaration or a sudden massive interim dividend or something like that), it also means that the company is reasonably reliable and profitable. So it is like following a value strategy. The added advantage in dividend yield, apart from the value strategy, is that dividends declared simply add to returns.

Thanks,

Bhavana

Hey so let me get this straight

if you are investing in a dividend yield funds, I would have two options

1.One is where I get the dividends declared credited to my account

2.The other is where I the dividends are invested back into the mutual fund

Correct ?

And thanks for the post on the Dividend yield funds

No, any mutual fund regardless of type or category has a dividend option, dividend reinvestment option, and a growth option. A dividend option is when the dividends declared are credited to your account. The divdend is taken out of your NAV – your NAV will fall to the extent of dividend. In dividend reinvestment, the dividend declared is used to buy units in the fund. It results in fall in NAV to the extent of dividend and an increase in number of units you hold. In the growth option, there is no dividend paid and your money continues to remain in the fund.

A dividend yield fund buys stocks that are trading at high dividend yields. This is a strategy to identify stocks that are trading at lower valuations. The fund itself may or may not pay dividends to unitholders. Dividends of any mutual fund can be paid only out of distributable surplus that the fund makes – i.e., it has to actually book profits in its securities and pay dividend from that alone.

Thanks,

Bhavana

Hey so let me get this straight

if you are investing in a dividend yield funds, I would have two options

1.One is where I get the dividends declared credited to my account

2.The other is where I the dividends are invested back into the mutual fund

Correct ?

And thanks for the post on the Dividend yield funds

No, any mutual fund regardless of type or category has a dividend option, dividend reinvestment option, and a growth option. A dividend option is when the dividends declared are credited to your account. The divdend is taken out of your NAV – your NAV will fall to the extent of dividend. In dividend reinvestment, the dividend declared is used to buy units in the fund. It results in fall in NAV to the extent of dividend and an increase in number of units you hold. In the growth option, there is no dividend paid and your money continues to remain in the fund.

A dividend yield fund buys stocks that are trading at high dividend yields. This is a strategy to identify stocks that are trading at lower valuations. The fund itself may or may not pay dividends to unitholders. Dividends of any mutual fund can be paid only out of distributable surplus that the fund makes – i.e., it has to actually book profits in its securities and pay dividend from that alone.

Thanks,

Bhavana