Short on time? Listen to a brief overview of this week’s recommendation.

What

- Equity fund that can move across market capitalisations

- Concentrated portfolio with limited number of stocks

Why

- Strong performance compared to market and peers

- Picks companies with quality managements and long-term growth prospects

- Does not churn portfolio frequently to chase returns

Whom

- High-risk investors with at least a 4-5 year horizon

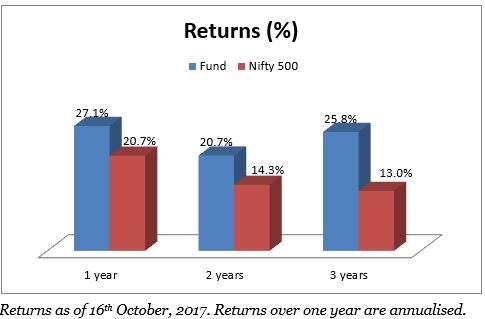

With a one-year return of 27%, Motilal Oswal MOSt Focused Multicap 35 soars above other diversified equity funds. The category on an average holds at 18.8% in the one-year period. The Nifty 500 index delivered a 20.7% return in the same period. Launched in 2014, the fund has just crossed the three-year mark. But its performance even in this short period is top-notch, with the fund beating the category average virtually all the time when rolling 1-year returns since its inception. The fund is also a new entrant in our Select fund list in this quarter’s review, in the high-risk equity category.

Strategy and portfolio

MOSt Focused Multicap 35 (MOSt 35) follows its sponsor’s buy-right-sit-tight approach, picking stocks based on the four factors of company quality, higher return on equity, longevity of its business, and valuations. It does not follow a pure value strategy and can buy high PE stocks if the return the company generates and its competitive advantage hold strong.

It also follows a concentrated or focused approach – by mandate it can hold a maximum of 35 stocks. The top 10 stocks in the portfolio have accounted for anywhere between 60-70% of the portfolio, with the total number of stocks between 20 and 30. A focused approach, when picks work well, affords a higher outperformance over the market. MOSt 35’s average 11 percentage point excess when rolling 1-year return since its inception is much more than other diversified funds. Of course, this huge margin is partly attributable to the good timing of the fund’s launch. The fund’s top holdings such as HPCL, HDFC Bank, HDFC, Bajaj Finance, and Eicher Motors, have all delivered well.

MOSt 35 doesn’t add and delete stocks to its portfolio frequently. Instead, it juggles stock exposures within its portfolio, buying more into some stocks to step up their concentration, or booking profits, or paring stake in others. Stocks such as Interglobe Aviation, Maruti Suzuki, Eicher Motors, Britannia Industries, and Ajanta Pharma, all of which were top portfolio holdings at some point or the other are examples where the fund has played around with exposures based on their performance and other opportunities. These stocks have also clocked strong gains, apart from Interglobe Aviation. The fund also exits stocks if the prospects don’t play out or have run their course, such as Infosys, Lupin, Page Industries, and SBI. Other timely calls were in energy stocks, and consumer stocks such as Avenue Supermarts and Manpasand Beverages.

| Stock | % of portfolio | Sector |

| HDFC | 9.2 | Financial Services |

| HDFC Bank | 8.9 | Financial Services |

| Maruti Suzuki India | 7.7 | Automobile |

| HPCL | 6.8 | Energy |

| IndusInd Bank | 6.2 | Financial Services |

| BPCL | 5.7 | Energy |

| Bajaj Finance | 5.4 | Financial Services |

| PNB Housing Finance | 5.3 | Financial Services |

| Eicher Motors | 5.2 | Automobile |

| Max Financial Services | 4.6 | Financial Services |

| As of September 2017 | ||

Given the stock-focused approach and limited holding, the fund doesn’t really have any sector themes going for it. For example, there is a focus on the consumption side through financials and consumer stocks but also on the cyclical side in energy, and still further on the value side in pharmaceuticals. The fund’s sector weights, therefore, have minimal correlation with its benchmark Nifty 500.

Performance

MOSt 35 has held in the top quartile in the 1, 2, and 3-year periods. On rolling 1-year returns since inception, the fund also beats the Nifty 500 index all the time in addition to the category average. This indicates a consistency in outperformance.

While stock markets from 2014 haven’t had a meaningful downturn to test MOSt 35’s mettle in containing losses, the brief spurts of corrections in late 2015 and 2016 suggest that the fund is able to weather well. Its losses in those periods were 1-2 percentage points lower than the average and the fund ranked in the top quartile even in those times. Rolling its 3-month return daily over the past 3 years, the instances of losses was much lower than the Nifty 500. It was also lower than other low-volatile funds such as Parag Parikh Long Term Value and ICICI Prudential Dynamic Plan. Its Sharpe ratio, which measures the return delivered for the risk taken, is also well above the category average.

Suitability

MOSt 35 is a good fit for high risk investors, with a 4-5 year horizon despite a large-cap portfolio tilt. One, a focused approach itself requires higher risk. The strategy can pull returns down sharply in correcting markets or if even a couple of calls go wrong and the fund takes time to address it. The fund’s growing AUM – it’s Rs 9,178 crore now – could mean that somewhere down the line it may not be able to take as highly concentrated calls as it currently does. To some extent, this could reduce the margin of its outperformance

Two, the fund does not have a record in a steeply falling market like that of 2011 or 2008. The stock market itself is undecided right now – it could simply carry on consolidating waiting for earnings to catch up, or it could correct if growth takes longer to come about than expected. Either way, to enter a fund whose strategy hasn’t gone through a downturn is on the riskier side.

Goutam Sinha Roy is the fund’s manager since inception. Siddharth Bothra is the co-manager.

FundsIndia’s Research team has, to the best of its ability, taken into account various factors – both quantitative measures and qualitative assessments, in an unbiased manner, while choosing the fund(s) mentioned above. However, they carry unknown risks and uncertainties linked to broad markets, as well as analysts’ expectations about future events. They should not, therefore, be the sole basis for investment decisions. To know how to read our weekly fund reviews, please click here.

If Most 35 multicap fund has been a stock trading at P/E of 40+,have you bought it?

I have not.I would have waited for correction or better earnings in the Sensex.

Hi,

MOSt 35 is not a stock, and that’s the important difference. You’d need to look at a stock’s future in relation to its valuations today and then either book profits or move to another stock. In a mutual fund, the fund manager is doing this entry and exit of stocks so all you need to do is to hold the fund. You don’t book profits in funds, unless you hold a sector or theme fund. There is no high PE or low PE for a fund. As far as the stocks the fund holds go, they are mostly those delivering growth more than the Sensex. Yes, stock markets are high. But you can still invest in a mutual fund because you’re not entering a single stock and you can invest through SIPs to avoid bad market timing. SIPs are anyway the best method to invest in markets, regardless of broad valuations. As we’ve noted in the article, a correction may or may not happen. If it happens, your SIP investments will help average costs. If it doesn’t happen, you haven’t lost the opportunity to invest. The consensus in March 2015 was also that the market was high, and waiting for a long correction to bring valuations down would have meant one would have missed the rally since then. The corrective periods since then did not last long at all. We also always look at consistency in a fund’s performance to ensure that it delivers above-market and above-average returns; MOSt 35 fits the bill. If you’re truly value conscious as an investor and are willing to wait it out, ICICI Pru Value Discovery is an option. We have a call on it here.

Thanks,

Bhavana

Is it the right time to buy this fund among various uncertainties like US-N. Korea war situation or our own growth data or should I wait for the correction to enter in this fund ?

Hello,

As far as market timing goes, it applies for all equity funds and not this one alone. Some funds just manage the downturn better than others; the ability of a fund to weather corrections is a key metric we look at. As we’ve noted in the post, this fund hasn’t seen any steep correction yet and this is one of the reasons we say its a high-risk fund. Coming to the market itself, there is no way to know ahead whether we’re at a peak or at the bottom. That’s hindsight only. We thought markets were peaking in 2015, but there was no prolonged correction since. You are correct – markets look overheated now and are at the higher end of valuations. But as we said, it could correct or it could stay in a sideways range until things improve. It’s an opportunity loss if one waits for a correction and it doesn’t come. The way around it is to invest through SIPs. So you can average costs down if correction happens or you will be invested if markets don’t. If you have a large sum to invest, put it in a liquid fund and run STP from tht into equity fund for several months.

Thanks,

Bhavana

Hi Bhavana,

Thanks for your mail , but i did not find your name in drop down where Fund India asked “This transaction is based on an advice received through ”

Please guide me on this so i can complete my transition.

Regards,

Kamal Gupta

Thanks for pointing it out, Kamal. In the interim, if you want to go ahead with your investment, you can select the Blog option in the first dropdown and the name of Vidya Bala, since calls are generated by FundsIndia’s Research team. However, please note that not every call we give here is suitable for you – it would depend on the existing funds in your portfolio and your risk appetite. Please ensure that you understand the fund or talk to your advisor before proceeding.

Thanks,

Bhavana

Thanks Bhavana for the reply.

Could you please arrange the call , i do not have advisor please.

Thanks

Kamal Gupta

Hi Kamal, all investors on our platform have an advisor. Your advisor will contact you shortly. Any time you wish to talk to your advisor, you can either contact them directly or use the Talk to your advisor feature on your MF dashboard.

Thanks,

Bhavana

The article states – MOSt 35 is a good fit for high risk investors, with a 4-5 year horizon despite a large-cap portfolio tilt. One, a focused approach itself requires higher risk”

Do you think same applies for small cap top performing funds like FISmaller Companies Fund or L&T Emerging business?

MOST falls in multi cap category like IPru Value Discovery.vs Franklin India Prima Plus

Your views are appreciated on managing risk and staying true to the fund objective among the three

Hi,

As noted in the post, MOSt Multicap 35 is high risk despite being a multi-cap fund because it has a focused approach and because it doesn’t have a history of sustaining a bear market. It also can change marketcap orientation suddenly. Small-cap funds would – regardless of strategy – be high risk at all times because of the very nature of the stocks.

Thanks,

Bhavana

Dear Mam,

I have invested Rs 30000/- per month in the below Mutual Funds through broker.

1. HDFC Balanced Fund (G) 5000/-

2. L&T India Prudence Fund (G) 4000/-

3. Mirae Asset Emerging Bluechip Fund – Regular Plan (G) 5000/-

4. SBI Magnum Multicap Fund (G) 5000/-

5. Motilal Oswal MOSt Focused Multicap 35 Fund – Regular Plan (G) 5000/-

6. Motilal Oswal MOSt Focused Long Term Fund – Regular Plan (G) 3000/-

7. Aditya Birla Sun Life Monthly Income Plan II – Wealth 25 Plan (G) 3000/-

Please advise the above portfolio is okey or need any changes

Hello, please contact your advisor or broker to review your portfolio. We cannot provide portfolio-specific advice on this forum, since it is meant for discussion only.

Thanks,

Bhavana

Dear Mam,

I have invested Rs 30000/- per month in the below Mutual Funds through broker.

1. HDFC Balanced Fund (G) 5000/-

2. L&T India Prudence Fund (G) 4000/-

3. Mirae Asset Emerging Bluechip Fund – Regular Plan (G) 5000/-

4. SBI Magnum Multicap Fund (G) 5000/-

5. Motilal Oswal MOSt Focused Multicap 35 Fund – Regular Plan (G) 5000/-

6. Motilal Oswal MOSt Focused Long Term Fund – Regular Plan (G) 3000/-

7. Aditya Birla Sun Life Monthly Income Plan II – Wealth 25 Plan (G) 3000/-

Please advise the above portfolio is okey or need any changes

Hello, please contact your advisor or broker to review your portfolio. We cannot provide portfolio-specific advice on this forum, since it is meant for discussion only.

Thanks,

Bhavana

Very very thankful to fundsindia

Your blog is just mind boggling

It make very clear what to do Tx

Thanks, Vikram!

Regards,

Bhavana

Very very thankful to fundsindia

Your blog is just mind boggling

It make very clear what to do Tx

Thanks, Vikram!

Regards,

Bhavana

If Most 35 multicap fund has been a stock trading at P/E of 40+,have you bought it?

I have not.I would have waited for correction or better earnings in the Sensex.

Hi,

MOSt 35 is not a stock, and that’s the important difference. You’d need to look at a stock’s future in relation to its valuations today and then either book profits or move to another stock. In a mutual fund, the fund manager is doing this entry and exit of stocks so all you need to do is to hold the fund. You don’t book profits in funds, unless you hold a sector or theme fund. There is no high PE or low PE for a fund. As far as the stocks the fund holds go, they are mostly those delivering growth more than the Sensex. Yes, stock markets are high. But you can still invest in a mutual fund because you’re not entering a single stock and you can invest through SIPs to avoid bad market timing. SIPs are anyway the best method to invest in markets, regardless of broad valuations. As we’ve noted in the article, a correction may or may not happen. If it happens, your SIP investments will help average costs. If it doesn’t happen, you haven’t lost the opportunity to invest. The consensus in March 2015 was also that the market was high, and waiting for a long correction to bring valuations down would have meant one would have missed the rally since then. The corrective periods since then did not last long at all. We also always look at consistency in a fund’s performance to ensure that it delivers above-market and above-average returns; MOSt 35 fits the bill. If you’re truly value conscious as an investor and are willing to wait it out, ICICI Pru Value Discovery is an option. We have a call on it here.

Thanks,

Bhavana

Is it the right time to buy this fund among various uncertainties like US-N. Korea war situation or our own growth data or should I wait for the correction to enter in this fund ?

Hello,

As far as market timing goes, it applies for all equity funds and not this one alone. Some funds just manage the downturn better than others; the ability of a fund to weather corrections is a key metric we look at. As we’ve noted in the post, this fund hasn’t seen any steep correction yet and this is one of the reasons we say its a high-risk fund. Coming to the market itself, there is no way to know ahead whether we’re at a peak or at the bottom. That’s hindsight only. We thought markets were peaking in 2015, but there was no prolonged correction since. You are correct – markets look overheated now and are at the higher end of valuations. But as we said, it could correct or it could stay in a sideways range until things improve. It’s an opportunity loss if one waits for a correction and it doesn’t come. The way around it is to invest through SIPs. So you can average costs down if correction happens or you will be invested if markets don’t. If you have a large sum to invest, put it in a liquid fund and run STP from tht into equity fund for several months.

Thanks,

Bhavana

The article states – MOSt 35 is a good fit for high risk investors, with a 4-5 year horizon despite a large-cap portfolio tilt. One, a focused approach itself requires higher risk”

Do you think same applies for small cap top performing funds like FISmaller Companies Fund or L&T Emerging business?

MOST falls in multi cap category like IPru Value Discovery.vs Franklin India Prima Plus

Your views are appreciated on managing risk and staying true to the fund objective among the three

Hi,

As noted in the post, MOSt Multicap 35 is high risk despite being a multi-cap fund because it has a focused approach and because it doesn’t have a history of sustaining a bear market. It also can change marketcap orientation suddenly. Small-cap funds would – regardless of strategy – be high risk at all times because of the very nature of the stocks.

Thanks,

Bhavana

Hi Bhavana,

Thanks for your mail , but i did not find your name in drop down where Fund India asked “This transaction is based on an advice received through ”

Please guide me on this so i can complete my transition.

Regards,

Kamal Gupta

Thanks for pointing it out, Kamal. In the interim, if you want to go ahead with your investment, you can select the Blog option in the first dropdown and the name of Vidya Bala, since calls are generated by FundsIndia’s Research team. However, please note that not every call we give here is suitable for you – it would depend on the existing funds in your portfolio and your risk appetite. Please ensure that you understand the fund or talk to your advisor before proceeding.

Thanks,

Bhavana

Thanks Bhavana for the reply.

Could you please arrange the call , i do not have advisor please.

Thanks

Kamal Gupta

Hi Kamal, all investors on our platform have an advisor. Your advisor will contact you shortly. Any time you wish to talk to your advisor, you can either contact them directly or use the Talk to your advisor feature on your MF dashboard.

Thanks,

Bhavana