Indus Towers Ltd. – Connecting Lives Across the Nation

Formed by the merger of Indus Towers and Bharti Infratel Limited, Indus Towers Ltd. is one of the largest telecom tower companies globally. Incorporated in 2006 and headquartered in Gurugram, the company provides tower and related infrastructure sharing services. As of March 31, 2024, Indus Towers operates over 219,736 towers and 368,588 co-locations across all 22 telecom circles in India, serving major players like Bharti Airtel, Vodafone Idea, and Reliance Jio.

Product Portfolio

- Tower Solutions: Offering a variety of designs—from ground-based and rooftop towers to hybrid poles and monopoles—for mounting operator antennae at optimal heights.

- Power Solutions: Ensuring uninterrupted energy supply to telecom equipment, including sustainable energy options.

- Space Solutions: Partnering with residential and commercial property owners to accommodate telecom and power equipment needs.

Subsidiaries: As of FY23, Indus Towers has one subsidiary and no associates or joint ventures.

Growth Strategies

- Marquee Client Base: Expansion of market share among leading Telecom Service Providers (TSPs) due to 5G deployment.

- Rural Expansion: Ongoing rural expansion efforts by major clients present opportunities for growth.

- Record Tower Additions: Achieved the highest yearly tower additions in FY24, surpassing 200,000 towers.

- VIL Dues and Rollout: Maintained 100% collection against billing and made progress on past dues collection from Vodafone Idea Limited (VIL).

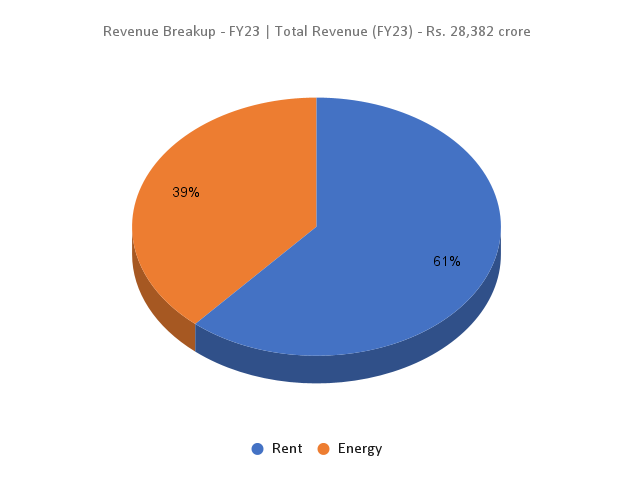

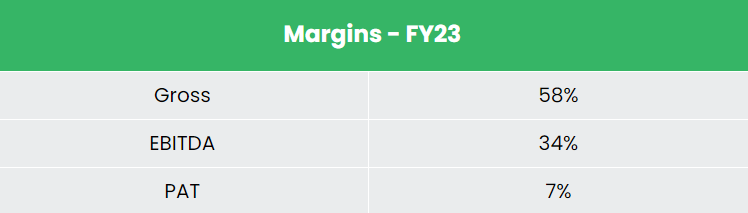

Financial Highlights

Q4FY24 Performance

- Revenue: Rs. 7,193 crore (up 7% YoY)

- Core Rental Revenue: Rs. 4,580 crore (up 7.7% YoY)

- Operating Profit: Rs. 4,072 crore (up 19% YoY)

- EBITDA Margin: 57% (up 6 percentage points YoY)

- Net Profit: Rs. 1,853 crore (up 32% YoY)

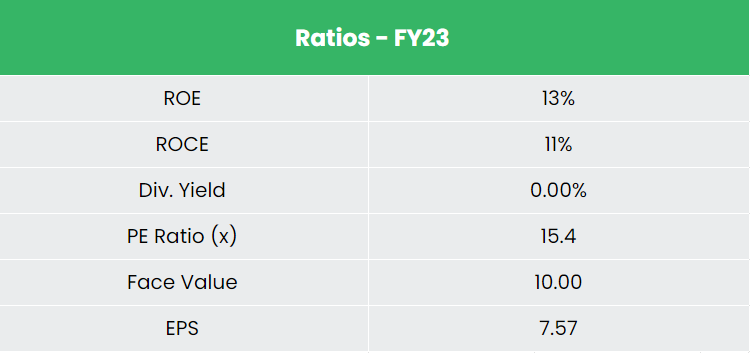

FY19-24 Financial Performance

- Revenue and PAT CAGR: 33% and 22%

- ROE & ROCE: 22% and 20%

- Debt-to-Equity Ratio: 0.76

Industry Outlook

- Market Size: India is the second-largest telecom market with 1,190.33 million subscribers as of December 2023.

- Affordable Tariffs and MNP: Wider availability and roll-out of Mobile Number Portability boost the market.

- Government Initiatives: Support for digitization and conducive regulatory environment.

- Mobile Penetration: Expected addition of 500 million new internet users in five years.

- Tele-density: Overall 85.69%, with rural at 59.19% and urban at 133.72%.

Growth Drivers

- 100% FDI is now allowed in the telecom sector with the inflow at US$ 39.31 billion between April 2000-December 2023.

- In Union Budget 2023-24, the Department of Telecommunications was allocated Rs. 97,579.05 crore (US$ 11.92 billion).

- India is aiming to manufacture mobile phones worth $126 Bn by 2025-26.

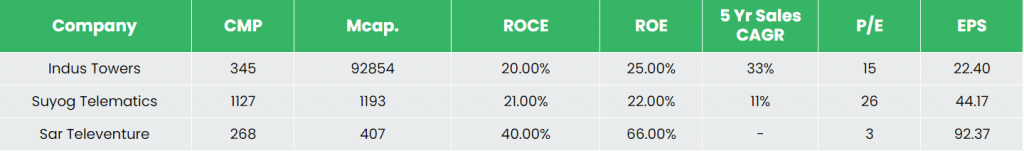

Competitive Advantage

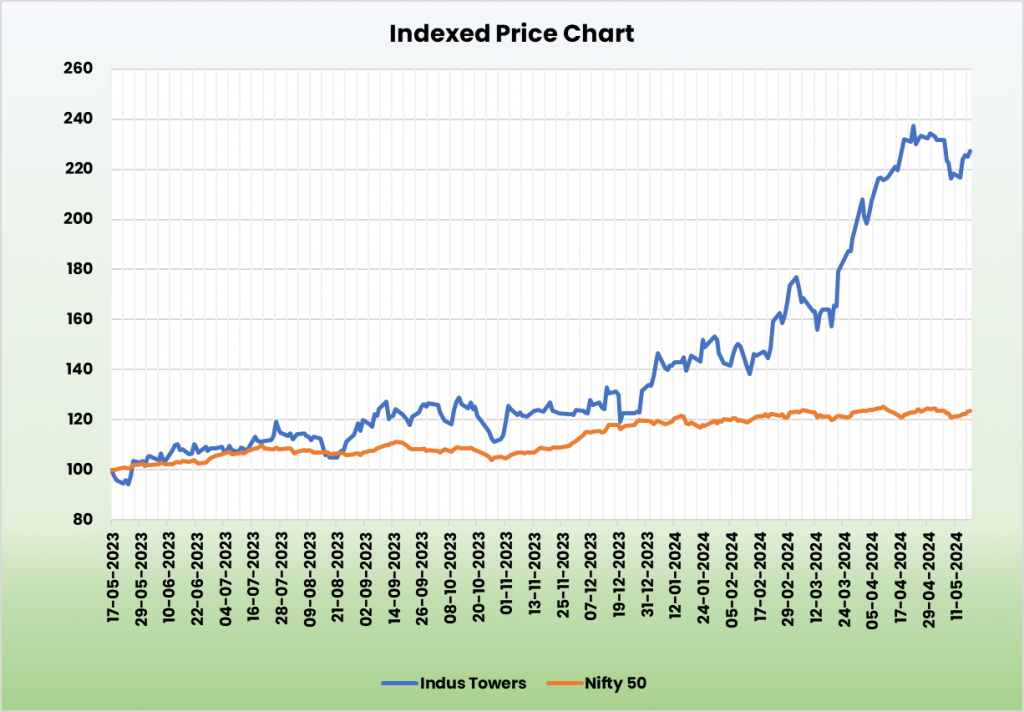

Indus Towers is the most undervalued stock in the large-cap segment, consistently translating steady sales growth into expanding margins and earnings compared to competitors like Suyog Telematics Ltd and Sar Televenture Ltd.

Outlook

- Market Share Gains: Aiming to increase market share.

- Cost Efficiency: Optimizing diesel consumption for cost savings.

- Network Uptime: Ensuring high network uptime.

- Sustainability: Focused on sustainable practices.

- 5G Rollout: Extensive 5G deployment leading to increased revenue streams.

- Growth Opportunity: Positioned to capitalize on the intersection of heightened data usage and rapid 5G adoption.

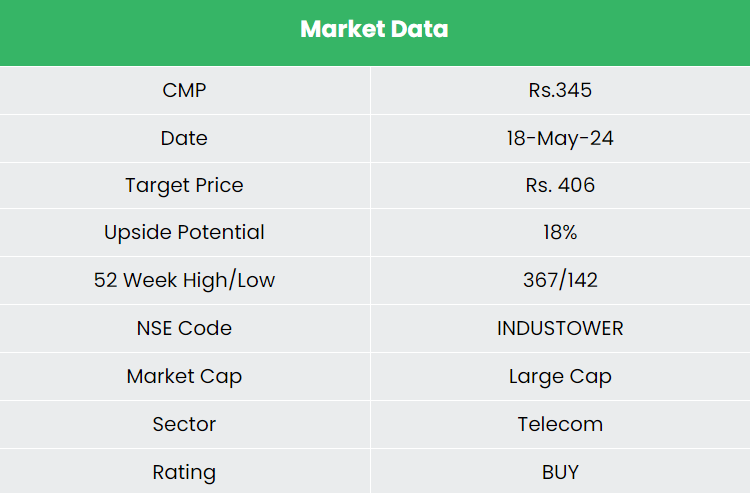

Valuation

The healthy demand outlook for telecom infrastructure, driven by strong data consumption, accelerated 5G rollouts, and gaps in 4G services, positions Indus Towers well for growth. We recommend a BUY rating in the stock with the target price (TP) of Rs. 406, 14x FY26E EPS.

Risks

- Financial Stability of TSPs: Investments in 5G rollouts and spectrum acquisitions may strain TSPs’ financials, affecting payments to Indus Towers.

- Contract Renewal Terms: Unfavorable alterations to contract terms with clients, such as reduced pricing or escalations, pose risks.

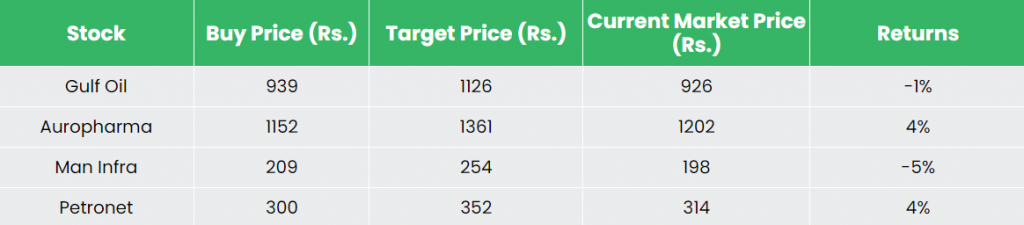

Recap of our previous recommendations (As on 18 May 2024)