If you kept up with the news lately, you know that the Employee Provident Fund Organisation will invest in the equity market through Exchange Traded Funds (ETFs). There is also the advice doing the rounds that, for risk-averse investors, ETFs are a great way to participate in the stock markets.

Theoretically, this advice is true. For investors in the Indian stock market, though, an ETF is not a good fit. One, given the wide array of stocks available outside the basic indices, it’s possible to get returns that are higher without taking on too much more risk. Two, the choice of ETF products is narrow. Three, the indices themselves are designed keeping liquidity criteria in mind more than any other factor.

An ETF’s merits

An ETF is based on a stock market or debt market index, or a commodity. An ETF’s portfolio exactly mimics the securities in its underlying index, in the same weightage. As and when the composition of the index is changed, the ETF will incorporate it in its own portfolio.

An ETF’s returns are thus almost exactly in line with the index. This is one reason why ETFs are suggested – in funds that actively switch around portfolio composition as the fund manager sees fit, you run the risk of returns falling short of the market. For the novice investor, there’s no need to study, understand and judge fund performance either.

The second reason is that expenses are low in an ETF. There is no fund manager fee for one, as the fund only requires tracking the index’s changes. For another, the limited churn of the portfolio keeps expenses down. Indian ETFs have an average expense ratio of less than 1 per cent. Actively managed funds have much higher ratios of between 2 to 3 per cent.

ETFs are traded on the exchanges and you need a demat account to invest or sell it. This apart, mutual funds have schemes called index funds that are akin to ETFs. The only difference is that an index fund is not traded, and you invest in it just as you would with any other fund scheme.

Limited choice

Globally, the ETF commands immense popularity; the NYSE alone has 1,262 ETFs listed on it as of June this year, up from the 1,176 last June.

Compare that to the grand figure of 39 ETFs listed on the NSE. More, the underlying indices or commodities of these ETFs are limited. Of the NSE-listed ETFs, over a third are gold. The Nifty index is the next most popular with 9 ETFs based on it. The handful left is spread across banks, public sector enterprises, liquid bonds, and some thematic indices. Index funds too are concentrated on the Nifty index or gold. This lack of a variety in products to choose from is a huge limitation in the Indian ETF market.

Next, buying the Nifty does not mean that you hold companies or sectors with good long-term growth prospects. Yes, the Nifty (and the Sensex) represents the market mood, but it does so by simply capturing stocks with the most liquidity; stocks’ impact cost and free-float market capitalisations are the primary selection criteria. The indices, including others such as the Nifty Junior or BSE 500, do not take into consideration revenue growth, profitability, management quality, or business prospects.

The NSE and BSE do have indices along strategic and sector lines such as dividend, manufacturing, consumption, volatility, and so on. But barring a couple such as Reliance AMC’s ETFs based on the Dividend Opportunities or NV20, or Motilal Oswal and Goldman Sachs’ funds on the Nasdaq and Hang Seng, none have ETFs or index funds with such indices as their benchmark. These strategic indices are also new.

Global ETFs, on the other hand, have a wide variety of themes and indices to play on – emerging market groups, country-wise markets, currencies, several strategic indices, sector indices, market capitalisation-based indices, treasury bonds, and so on.

Further, because ETFs are traded on the market, your return will be that captured by the ETF’s market price movement. And due to the vagaries of liquidity and trading, the market return may be lower or higher than the fund’s NAV return. We will address this point in detail in a separate post later.

Get active

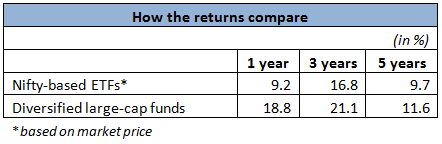

Besides, the sheer number of sectors and stocks outside the two bellwethers, or even the CNX 100, means that funds have good chances of snagging outperforming stocks. Sample this: the average market price return on ETFs based on the Nifty stood at 9.2, 16.8, and 9.7 per cent for the one, three and five year periods (see table). Moderate risk diversified large-cap funds, in comparison, returned 18.8, 21.1, and 11.6 per cent in the same timeframes.

True, large-cap funds don’t always stick to blue-chips and include riskier stocks. But even those that take on only moderate levels of risk have managed to comfortably outpace the market on a consistent basis across market cycles. Of course, fund selection is important here, but it’s well worth the effort as the level of outperformance is higher.

In a nutshell, ETFs are good when you want to invest in gold or global markets. But for your core portfolio, they are not a good fit.

Please do not discourage ETF investing. The issues you mentioned like liquidity, sector ETF etc will be fixed over time. Demand for ETF will spur innovation in ETF industry. EPO investing in ETF is the first step in creating demand for ETFs.

Comparing performance of ETF Vs mutual fund does not make sense because mutual funds are actively managed whereas ETF is passively managed. All around the world it is proven that with ETF low cost structure they beat actively managed mutual funds over long time.

One of the reason indian financial advisors recommend mutual funds over ETF is because mutual fund AMC offer commission to financial advisors.

Yes, ETFs are low-cost products, and globally, active-managed funds are finding it hard to beat ETF returns. But right now, the Indian equity ETF market is not large by any means and hasn’t developed to the extent that global ETFs have. Most Indian active funds are able to beat the market. Investors may thus lose out on higher returns if they stick to ETFs – the opportunity loss can be significant. When the Indian ETF market achieves the kind of variety and size global ETFs have, investors could certainly invest in ETFs. But at this point in time, ETFs aren’t a good idea for holding a chunk of your portfolio.

And please note that the return/outperformance of active funds is post all the expenses and commission (expense ratio). If that outperformance spread remains high, so does opportunity loss of not investing in active funds.

Indian Mutual Fund’s are able to beat the market as its currently trending market. In longer term when Indian market matures and gets into Mean Reversion like other developed markets beating Indices will get increasingly difficult. In current markets MF is better option but it might not be same down after 2 years.

“Most Indian active funds are able to beat the market.”

Oh yeah, for sure. But when it’s a bull market. Go back and see what happened back in 2008.

Hi,

All funds in the 2008 crash did not fall more than the market. Among large-cap funds, 70% of them actually did better than the market, and by a good margin at that. We’re not saying all funds will beat – this is where fund selection and consistency of a fund’s performance becomes important. And as we said, Indian index funds are not varied enough or the market deep enough for it to warrant an interest. There are far more investment opportunities outside the Nifty 50 and the Sensex, which is where most index funds are.

Thanks,

Bhavana

the problem is not with the ETF, but with the regulatory policy that prohibits Active ETFs

Hello,

Do you mean smart beta ETFs? Regulatory policy doens’t prohibit such ETFs. There are indices such as the NV20 or Quality 30 which have ETFs based on them. These indices are in a sense different from the plain marketcap weighted Nifty 50/100/ Sensex indices.

Thanks,

Bhavana

I agree with your points. Liquidity is the main concern. for ETFs. If one buys the ETFs like HangSengBees or JuniorBees, one has to struggle a lot to even sell them.

I agree with your points. Liquidity is the main concern. for ETFs. If one buys the ETFs like HangSengBees or JuniorBees, one has to struggle a lot to even sell them.

Hello readers,

Why to worry about the market fluctuations and economic strategies when we have ETF and it’s fundmanagers. It is designed mainly for investors who can not anticipate what is happening and going to happen in the market and for those who don’t want to take risk of hasty decision from their end.

My advise is to go for etf if not able to keep intact with market moves.

There is no point in thinking if this is the time to enter in to for etf or not. Once again no need to think about market in case of etf. But do invest slowly and intermittently.

I am winning

So u can.

From Govinda

Hello,

We aren’t asking investors to time markets with active mutual funds. Simply investing each month in a proper asset-allocated portfolio will be the best thing people can do. You don’t need to time the markets if you invest systematically and periodically, even if the funds are active funds and not ETFs. Do note also that you still are exposed to market fluctuations and you still need to understand and know market risks even if you’re investing in ETFs. They are lower risk and not zero risk. The situation today for us is that active funds are easily able to beat passive funds. The indices simply aren’t built the way they are in other markets, making them easier to beat.

Thanks,

Bhavana

Hi Bhavana,

Have just started investing 🙂

What do you recommend if your investment horizon would be something like 20-25 years with a buy it and forget it mindset ?

Also if you could recommend some books to read for investing in mutual funds in India for the long term.

Thanks

AJ

Hi Amit,

Congrats on starting your investments! Given your horizon, the majority of your investments should be in equities. Buy and hold is the best approach o follow, provided you stick to it :). Many don’t, because they cannot deal with market volatility. You’d need to put a portion in debt to balance your portfolio out and protect it from slipping badly when equity markets are in a downtrend. The exact allocation and the types of funds to invest in depends on your risk level, age, what you need it for, what manner you would be investing in and so on. We cannot provide such advice here, on this forum. You can request an advisor appointment through your FundsIndia account, to help you draw up your portfolio. Else, you can sign up for an account – its free! As for books on mutual funds, I’m not too sure about which ones are there and what your requirement is. If it’s general knowledge you are looking for, its available both on this blog and several others.

Thanks,

Bhavana

hi, is there is possibility where ETFs stop getting traded, similar to what you can see with stocks where there are no buyers? such thing usually can not happen with mutual fund

Hello,

ETFs have liquidity concerns, yes. This is also why there is tracking error – the ETF’s returns will not exactly match the underlying index because the market liquidty affects its market price and thus an investor’s returns. Look for ETFs with higher volumes to avoid any risk of liquidity and minimise tracking error. ETFs are supposed to use market makers to ensure that buyers and sellers match, but it may not always work out. You would always be able to liquidate a mutual fund, but note that even in index mutual funds, there will be a bit of tracking error. This is because funds see constant redemptions and infusions, and they need to maintain some holding in cash to meet those redemption requirements.

Thanks,

Bhavana

hi, is there is possibility where ETFs stop getting traded, similar to what you can see with stocks where there are no buyers? such thing usually can not happen with mutual fund

Hello,

ETFs have liquidity concerns, yes. This is also why there is tracking error – the ETF’s returns will not exactly match the underlying index because the market liquidty affects its market price and thus an investor’s returns. Look for ETFs with higher volumes to avoid any risk of liquidity and minimise tracking error. ETFs are supposed to use market makers to ensure that buyers and sellers match, but it may not always work out. You would always be able to liquidate a mutual fund, but note that even in index mutual funds, there will be a bit of tracking error. This is because funds see constant redemptions and infusions, and they need to maintain some holding in cash to meet those redemption requirements.

Thanks,

Bhavana

bhavana

Please confirm me that

1) can I invest in ETF funds in India without demat a/c

2)where could I check my current value of my etf fund

3)is there any charges applicable on redemption. means will I get the money as per nav or different from nav.

I want to take risk with etf funds inspite of having any experience with it.

Pls suggest

Thanks

Hello Paul,

You can’t invest in an ETF without a demat account. You can check market prices of ETFs on stock exchanges. There aren’t any charges other than the brokerage fee and associated taxes. You get market prices at the time of purchase and redemption, and not NAVs.

Thanks,

Bhavana

bhavana

Please confirm me that

1) can I invest in ETF funds in India without demat a/c

2)where could I check my current value of my etf fund

3)is there any charges applicable on redemption. means will I get the money as per nav or different from nav.

I want to take risk with etf funds inspite of having any experience with it.

Pls suggest

Thanks

Hello Paul,

You can’t invest in an ETF without a demat account. You can check market prices of ETFs on stock exchanges. There aren’t any charges other than the brokerage fee and associated taxes. You get market prices at the time of purchase and redemption, and not NAVs.

Thanks,

Bhavana

Hi, i’d like to know if ETFs pay dividends when the underlying stocks do?

If yes, then is it all ETFs or a chosen few?

If no, then is the dividend reinvested and reflected as growth in NAVs?

ETFs can do either – some reinvest it, or issue units equivalent to it, or pay it out as dividends. It depends on the ETF.

Thanks,

Bhavana

Hi, i’d like to know if ETFs pay dividends when the underlying stocks do?

If yes, then is it all ETFs or a chosen few?

If no, then is the dividend reinvested and reflected as growth in NAVs?

ETFs can do either – some reinvest it, or issue units equivalent to it, or pay it out as dividends. It depends on the ETF.

Thanks,

Bhavana

Hi Bhavana

I was just going through the downside capture ratio of iPru Next nifty 50 Index fund. it’s much better than most of the actively managed multicap/large cap funds. I think most of our fund manager’s are showing better alpha by luck.

After present regulation by Sebi the large caps may not be able to generate better alpha by investing a portion in midcaps.

Hi Santhosh,

An index fund should ideally be equally good on upside and downside. You’re right in that several funds don’t contain downsides well. Those definitely are poorer performers – in fact, one of the metrics we look at in fund performance is the ability to contain downsides. There are still several that do – even in markets like 2008, the better funds did keep their losses smaller than the indices. It’s not all pure luck. For some funds, it also depends on strategy in that they do extremely well on the upside which compensates for their inability to contain downsides. You are right, however, in that alpha generation in the large-cap space is likely to shrink once the new categorisation rules come in. We need to see how to tweak portfolios in such a case. Actively managed funds still have some steam left before they become poorer choices in comparison to passive funds.

Thanks,

Bhavana

Thank You Bhavana for the reply

Hi Bhavana !!

Just wanted to know , Do index funds (like Nifty 50 ) and ETF also payout full “Dividends” as underlying stocks declare their dividends on regular basis ? If no, then where does all the dividend goes ?

Please tell me , I am new in investment world. I want to invest & go with Index:Nifty 50 with regular dividend option.

Hi Deepak,

Apologies for the delay in reply. ETFs may declare dividends based on what is paid out by its constituent companies, or it can reinvest the dividend amount back into the index. It depends on the ETF. You can check for its dividend history to know. Please understand, however, that dividends are not “regular”. It depends on the company – it may or may not declare dividend and the amounts can also change. This apart, if you’re a long-term investor and you do not need cashflows currently from your investment, then ensure that you reinvest any dividend you receive from your ETF. If it is an index fund, go for the growth option. This way, your wealth compounding will be more effective. If you do require cash flows from your investment immediately, depending on equity dividends is still risky as the amount and regularity may vary.

Thanks,

Bhavana

Please do not discourage ETF investing. The issues you mentioned like liquidity, sector ETF etc will be fixed over time. Demand for ETF will spur innovation in ETF industry. EPO investing in ETF is the first step in creating demand for ETFs.

Comparing performance of ETF Vs mutual fund does not make sense because mutual funds are actively managed whereas ETF is passively managed. All around the world it is proven that with ETF low cost structure they beat actively managed mutual funds over long time.

One of the reason indian financial advisors recommend mutual funds over ETF is because mutual fund AMC offer commission to financial advisors.

Yes, ETFs are low-cost products, and globally, active-managed funds are finding it hard to beat ETF returns. But right now, the Indian equity ETF market is not large by any means and hasn’t developed to the extent that global ETFs have. Most Indian active funds are able to beat the market. Investors may thus lose out on higher returns if they stick to ETFs – the opportunity loss can be significant. When the Indian ETF market achieves the kind of variety and size global ETFs have, investors could certainly invest in ETFs. But at this point in time, ETFs aren’t a good idea for holding a chunk of your portfolio.

And please note that the return/outperformance of active funds is post all the expenses and commission (expense ratio). If that outperformance spread remains high, so does opportunity loss of not investing in active funds.

Indian Mutual Fund’s are able to beat the market as its currently trending market. In longer term when Indian market matures and gets into Mean Reversion like other developed markets beating Indices will get increasingly difficult. In current markets MF is better option but it might not be same down after 2 years.

“Most Indian active funds are able to beat the market.”

Oh yeah, for sure. But when it’s a bull market. Go back and see what happened back in 2008.

Hi,

All funds in the 2008 crash did not fall more than the market. Among large-cap funds, 70% of them actually did better than the market, and by a good margin at that. We’re not saying all funds will beat – this is where fund selection and consistency of a fund’s performance becomes important. And as we said, Indian index funds are not varied enough or the market deep enough for it to warrant an interest. There are far more investment opportunities outside the Nifty 50 and the Sensex, which is where most index funds are.

Thanks,

Bhavana

the problem is not with the ETF, but with the regulatory policy that prohibits Active ETFs

Hello,

Do you mean smart beta ETFs? Regulatory policy doens’t prohibit such ETFs. There are indices such as the NV20 or Quality 30 which have ETFs based on them. These indices are in a sense different from the plain marketcap weighted Nifty 50/100/ Sensex indices.

Thanks,

Bhavana

Hi Bhavana,

Have just started investing 🙂

What do you recommend if your investment horizon would be something like 20-25 years with a buy it and forget it mindset ?

Also if you could recommend some books to read for investing in mutual funds in India for the long term.

Thanks

AJ

Hi Amit,

Congrats on starting your investments! Given your horizon, the majority of your investments should be in equities. Buy and hold is the best approach o follow, provided you stick to it :). Many don’t, because they cannot deal with market volatility. You’d need to put a portion in debt to balance your portfolio out and protect it from slipping badly when equity markets are in a downtrend. The exact allocation and the types of funds to invest in depends on your risk level, age, what you need it for, what manner you would be investing in and so on. We cannot provide such advice here, on this forum. You can request an advisor appointment through your FundsIndia account, to help you draw up your portfolio. Else, you can sign up for an account – its free! As for books on mutual funds, I’m not too sure about which ones are there and what your requirement is. If it’s general knowledge you are looking for, its available both on this blog and several others.

Thanks,

Bhavana

Hello readers,

Why to worry about the market fluctuations and economic strategies when we have ETF and it’s fundmanagers. It is designed mainly for investors who can not anticipate what is happening and going to happen in the market and for those who don’t want to take risk of hasty decision from their end.

My advise is to go for etf if not able to keep intact with market moves.

There is no point in thinking if this is the time to enter in to for etf or not. Once again no need to think about market in case of etf. But do invest slowly and intermittently.

I am winning

So u can.

From Govinda

Hello,

We aren’t asking investors to time markets with active mutual funds. Simply investing each month in a proper asset-allocated portfolio will be the best thing people can do. You don’t need to time the markets if you invest systematically and periodically, even if the funds are active funds and not ETFs. Do note also that you still are exposed to market fluctuations and you still need to understand and know market risks even if you’re investing in ETFs. They are lower risk and not zero risk. The situation today for us is that active funds are easily able to beat passive funds. The indices simply aren’t built the way they are in other markets, making them easier to beat.

Thanks,

Bhavana

Hi Bhavana

I was just going through the downside capture ratio of iPru Next nifty 50 Index fund. it’s much better than most of the actively managed multicap/large cap funds. I think most of our fund manager’s are showing better alpha by luck.

After present regulation by Sebi the large caps may not be able to generate better alpha by investing a portion in midcaps.

Hi Santhosh,

An index fund should ideally be equally good on upside and downside. You’re right in that several funds don’t contain downsides well. Those definitely are poorer performers – in fact, one of the metrics we look at in fund performance is the ability to contain downsides. There are still several that do – even in markets like 2008, the better funds did keep their losses smaller than the indices. It’s not all pure luck. For some funds, it also depends on strategy in that they do extremely well on the upside which compensates for their inability to contain downsides. You are right, however, in that alpha generation in the large-cap space is likely to shrink once the new categorisation rules come in. We need to see how to tweak portfolios in such a case. Actively managed funds still have some steam left before they become poorer choices in comparison to passive funds.

Thanks,

Bhavana

Thank You Bhavana for the reply

Hi Bhavana !!

Just wanted to know , Do index funds (like Nifty 50 ) and ETF also payout full “Dividends” as underlying stocks declare their dividends on regular basis ? If no, then where does all the dividend goes ?

Please tell me , I am new in investment world. I want to invest & go with Index:Nifty 50 with regular dividend option.

Hi Deepak,

Apologies for the delay in reply. ETFs may declare dividends based on what is paid out by its constituent companies, or it can reinvest the dividend amount back into the index. It depends on the ETF. You can check for its dividend history to know. Please understand, however, that dividends are not “regular”. It depends on the company – it may or may not declare dividend and the amounts can also change. This apart, if you’re a long-term investor and you do not need cashflows currently from your investment, then ensure that you reinvest any dividend you receive from your ETF. If it is an index fund, go for the growth option. This way, your wealth compounding will be more effective. If you do require cash flows from your investment immediately, depending on equity dividends is still risky as the amount and regularity may vary.

Thanks,

Bhavana