When we look to invest in mutual funds, we come across various options for a single fund such as growth, dividend payout and dividend reinvestment.

Many investors want to know if a fund will pay dividend and, if yes, how much it will pay and so on. But from where exactly is the dividend paid and what happens to your NAV on such payment?

Dividend in equity funds

Let us first look at the case of dividend in equity funds.

First, the dividend paid by companies (stocks) that funds hold should not be confused with the dividend declared by an equity fund. All the dividends a fund receives in the stocks it holds are simply reinvested and show up as growth in your NAV.

Whenever a fund chooses to, it may pay dividend from the your NAV, if you have chosen the option. What happens then? A part of your NAV is stripped and paid to you in cash as dividend. There is no dividend distribution tax (DDT) for equity funds.

When a dividend is paid out, the NAV falls to the extent of dividend paid. In other words, a part of your profits are given back to you.

Suitability:This option can be opted by investors who are more risk averse and also like to have some cash flow from the funds they have invested in. But equity funds seldom declare regular dividends and are also not required to do so. Also, since equity funds are meant for building your wealth, it is not a good idea to be cashing out on it and curtailing your wealth building process.

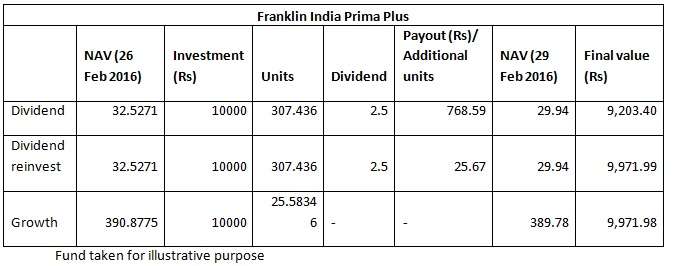

A variant of the dividend option is dividend reinvestment. Under this option, the dividend that is paid out is reinvested back in the scheme as additional units. When a dividend is declared, the NAV of the scheme falls by the quantum of dividend but units are credited at the post-dividend NAV. Technically for an equity scheme the dividend reinvestment and the growth option should yield the same final value on your investment.

From the above table, it can be noticed that the dividend reinvest and the growth option yields the same final value of investment in equity.

Dividend in debt funds

The major difference between dividend declared in an equity and debt fund is that there is dividend distribution tax on the dividends paid by the debt fund.

Under the growth option, since there is no dividend that is distributed, the NAV of the fund reflects the appreciation in your holding.

In a dividend payout option, your NAV is reduced to the extent of dividend paid as well as for DDT paid. DDT is 28.84% comprising of 25% tax, 12% surcharge and 3% cess. This is not taxed on the dividend you receive. The dividend you receive is considered as being post-DDT and DDT is calculated by working back.

Suffice to know that it is done by the fund itself and reduced in your NAV. Hence while it is not taxed in your hands, you are the one who ultimately bears it as it is reduced from your NAV.

Under the dividend reinvestment option too, DDT is applicable.

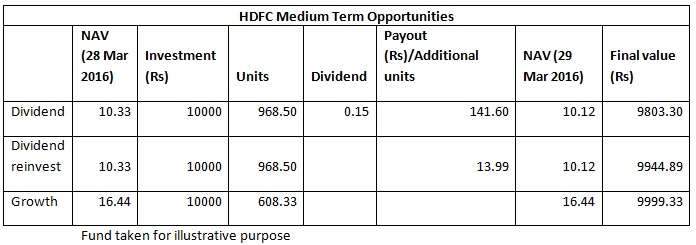

Hence the dividend reinvestment option and growth option are not the same. The former will be lower to the extent of DDT reduced in your NAV.

It can be noticed from the above table that the final value of the investment under the dividend reinvestment option is slightly lesser than the growth option.

Suitability: If you are in the 10-20% tax bracket you should avoid dividend payout/reinvestment option and simply use a systematic withdrawal plan (SWP) under growth option as your tax outgo will be lower. Also if you do not need any income, it is best to keep the growth option to help compound your money. If you are in the 30% tax bracket and need regular income, it is still better to rely on a SWP than go for dividend payout option. This will ensure you get steady income and get capital gains indexation benefit after 3 years. If you do not need regular income, allow the money to compound with growth as you will get indexation benefits after 3 years.

Which is a better option for 30% tax bracket person, investing in debt funds for short term basis – growth or reinvestment?

Hello Pooja, if you are looking for short term (less than 3 years) go for dividend reinvestment. Vidya

Which is a better option for 30% tax bracket person, investing in debt funds for short term basis – growth or reinvestment?

Hello Pooja, if you are looking for short term (less than 3 years) go for dividend reinvestment. Vidya

Which is best for long term (> 5 years) ?

Hi Shibu, As discussed in the article, it depends on a host of factors such as your cash flow requirements, the tax bracket you are in and would you be investing in equity or debt. Depending on all these an appropriate option can be chosen.

Which is best for long term (> 5 years) ?

Hi Shibu, As discussed in the article, it depends on a host of factors such as your cash flow requirements, the tax bracket you are in and would you be investing in equity or debt. Depending on all these an appropriate option can be chosen.