Riding the Dollar Wave

If you thought only international funds generated double-digit returns in the past one year, ICICI Pru Exports and Other Services Fund’s performance may surprise you. With a return of 37% in the last one year, the fund is among the top 5 funds in the equity category, almost at par with returns of US-focused funds.

The Fund

ICICI Pru Export and Other Services Fund, was, until recently, called ICICI Pru Services Industries Fund. Clearly, the name change has been done to emphasize the fact that many of the service industries are also dependent on export revenues for a good part.

That means such companies earn their revenue in foreign currency, mostly in US dollars. And not surprisingly, the appreciating dollar against the rupee has led to a rally in the stocks held by this fund, pushing its short-term record.

ICICI Pru Export and Other Services Fund has a reasonably wide universe that includes sectors such as IT and IT-enabled services, telecom, banking and financial services, healthcare, media and entertainment, and hotels.

Performance

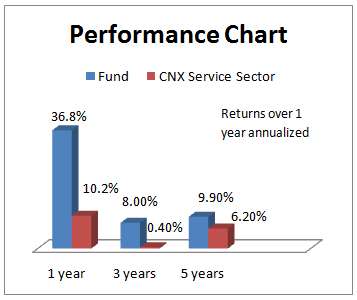

ICICI Pru Export and Other Services Fund may not have an illustrious track record to speak for. The fund delivered 11% annually since its inception in end-2005 and in fact trailed the CNX Service Sector by about 3 percentage points.

Its three-year return at 8% annually, though, is far superior to the nearly negative returns in diversified equity funds and the 0.4% return generated annually by its benchmark. The returns, in fact closely resemble that of technology theme funds.

Clearly, in the last few years of turbulence, it is the service sector that has driven the economic growth, even as manufacturing numbers slackened in pace. That amply explains the pick-up in performance of stocks in these sectors – whether it is IT or healthcare.

Suitability

As is the case with theme funds, ICICI Pru Exports and Other Services Fund too requires timely entry and profit-booking strategies. It is also noteworthy that the fund has underperformed diversified peers in market revival years such as 2009.

If you believed that the export story might have just started, spurred by a revival in markets such as the US, then this fund could be a channel to ride such a boom.

Currently, export numbers are beginning to look up, what with July 2013 exports being 11% higher, even in dollar terms. Stocks, though, have moved up ahead of export numbers and many stocks, especially in the IT space command rich valuations. That apart, the more important question for you to answer would be whether the story will hold steam if you see a domestic economic revival.

Assuming that such an event may be unlikely in the near term, a fund with such a theme would still call for a re-look in a year’s time from now. The fund’s portfolio, although holding stocks that can strike it rich, equally has risky bets that may hurt if they turn sour.

For investors already holding the fund, some profit booking strategy before the end of FY-14 would be in order to make good the paper profits.

Portfolio

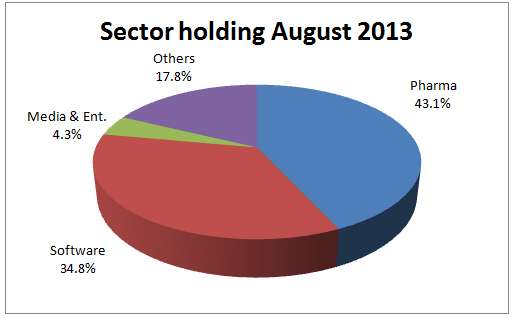

The fund’s portfolio turnover, at 0.77 times (August 2013) suggests that it actively churns its portfolio. Also, being a theme fund, sector concentration can be high, lending itself to higher risk.

Banking and financial services, which was the second top sector last year (after IT), did not find a place in the top 5 sectors as of August 2013. It was replaced by pharma; which took a chunky 43% of assets. The IT space came in next with about 35% of assets.

The usual software suspects – Infosys, TCS and HCL Technologies were seen in the portfolio. But other interesting picks in the sector included Infotech Enterprises and Persistent Systems.

The fund is managed by Yogesh Bhatt.

Dear Vidya,

10% of my portfolio is (SIP) in Sector and thematic funds – Reliance Pharma and BSL MNC fund. I was thinking of stopping SIP in MNC fund and start an SIP in the above mentioned fund.

Appropriately, your fund review on this particular fund has come.

Shall i go ahead with my plan?

Because it has pharma companies as well, does it make sense to stop my pharma fund SIP and put money in this particular fund as well?

My MNC fund has given me an annualised return of 7% since 2011. Since I am not in urgent need of mney. I plan to park that money in MNC fund as well.

rgds

Ajith

Hello Ajith, Thanks for being an active participant in the blog. But portfolio suggestions/ recommendations can be made for our investors only through the ‘Ask Advisor’ feature available free of cost. You will appreciate that it helps us keep track of any advice that we give, if we use such as route. Also given the compliance issues, that is the best forum for customised advice. Thanks.

Dear Vidya,

10% of my portfolio is (SIP) in Sector and thematic funds – Reliance Pharma and BSL MNC fund. I was thinking of stopping SIP in MNC fund and start an SIP in the above mentioned fund.

Appropriately, your fund review on this particular fund has come.

Shall i go ahead with my plan?

Because it has pharma companies as well, does it make sense to stop my pharma fund SIP and put money in this particular fund as well?

My MNC fund has given me an annualised return of 7% since 2011. Since I am not in urgent need of mney. I plan to park that money in MNC fund as well.

rgds

Ajith

Hello Ajith, Thanks for being an active participant in the blog. But portfolio suggestions/ recommendations can be made for our investors only through the ‘Ask Advisor’ feature available free of cost. You will appreciate that it helps us keep track of any advice that we give, if we use such as route. Also given the compliance issues, that is the best forum for customised advice. Thanks.

Dear Vidya,

Thanks for the response. Looking forward to read your future reviews and suggestions even though I do not plan to use the Ask your advisor feature.

I keep following your fund reviews since you were in Business line. Most of my MF investments are based on your suggestions

Thank you , once again

Dr. Ajith

Dear Vidya,

Thanks for the response. Looking forward to read your future reviews and suggestions even though I do not plan to use the Ask your advisor feature.

I keep following your fund reviews since you were in Business line. Most of my MF investments are based on your suggestions

Thank you , once again

Dr. Ajith

Dear Vidya,

It took me more than 2 days to completely digest the material above (not because it’s too hard but because of the content in the Fund itself).

There are many fine lines to understand before actually coming to a closure on this fund.

Is the Fund just flaring because of the US Dollar rise (compared to INR) or the exports that happened? – Answer : it’s because of the Dollar gaining strength.

2. Are exports really going to go up during coming years? – Answer : No idea at all…

And for the Fund to perform it should first have a favourable export environment and good aprreciation of Dollar against Rupee – Please correct me if i am not getting the point.

Rather than timing these 2 points at once, why can’t we just ride a Pharma Fund and an IT Sector Fund?? – I agree it’s the same to what i mentioned above.

However, we shall be getting diversified in number of stocks in both the areas, will that do any good? or am i simply making things complicated?

Also, below line from you make me skeptical on this fund.

“If you believed that the export story might have just started, spurred by a revival in markets

such as the US, then this fund could be a channel to ride such a boom.”

I as a common retail investor lack the source and proficiency to arrive at a point to decide on the above montioned line, hence, can i take the pleasure to ask you on what you feel about the export industry, is it going to revive from the lows or stay low?.

I completely agree that your views what ever provided should not be base for an investment decision.

Sorry for the lengthy post.

Regards,

Sunil.

hello Sunil:

1. Is the Fund just flaring because of the US Dollar rise (compared to INR) or the exports that happened? – Answer : it’s because of the Dollar gaining strength.

Not entirely. It is not like international funds. Service industries that are earning higher export revenues have gained. And yes, indirectly, thier higher export earnings is because of dollar gain.

2. Are exports really going to go up during coming years? – Answer : No idea at all…

And for the Fund to perform it should first have a favourable export environment and good aprreciation of Dollar against Rupee – Please correct me if i am not getting the point.

Yes, right.

3. Rather than timing these 2 points at once, why can’t we just ride a Pharma Fund and an IT Sector Fund?? – I agree it’s the same to what i mentioned above.

The ICICI fund is nto just an IT or pharma fund..it is much more..it has other services that are not necessarily xport driven. It can have media, telecom, transport etc.

4. I as a common retail investor lack the source and proficiency to arrive at a point to decide on the above mentioned line, hence, can i take the pleasure to ask you on what you feel about the export industry, is it going to revive from the lows or stay low?.

Latest data suggests export revival even without rupee conversion. that means export value is higher even in dolalr terms suggested higher exports overall.

BEyond this I do wish to forecast. This is precisely why only investors with knowledge of themes/sectors are well placed to participate in some themes or should be tracking themes if they hold it. Doing fund analysis is one thing, having to track some 28-30 sectors (fund houses have separate analysts tracking them) is another. Currently, we do not track each and every sector in depth to be able to provide sector forecast/analysis. thanks.

Dear Vidya,

It took me more than 2 days to completely digest the material above (not because it’s too hard but because of the content in the Fund itself).

There are many fine lines to understand before actually coming to a closure on this fund.

Is the Fund just flaring because of the US Dollar rise (compared to INR) or the exports that happened? – Answer : it’s because of the Dollar gaining strength.

2. Are exports really going to go up during coming years? – Answer : No idea at all…

And for the Fund to perform it should first have a favourable export environment and good aprreciation of Dollar against Rupee – Please correct me if i am not getting the point.

Rather than timing these 2 points at once, why can’t we just ride a Pharma Fund and an IT Sector Fund?? – I agree it’s the same to what i mentioned above.

However, we shall be getting diversified in number of stocks in both the areas, will that do any good? or am i simply making things complicated?

Also, below line from you make me skeptical on this fund.

“If you believed that the export story might have just started, spurred by a revival in markets

such as the US, then this fund could be a channel to ride such a boom.”

I as a common retail investor lack the source and proficiency to arrive at a point to decide on the above montioned line, hence, can i take the pleasure to ask you on what you feel about the export industry, is it going to revive from the lows or stay low?.

I completely agree that your views what ever provided should not be base for an investment decision.

Sorry for the lengthy post.

Regards,

Sunil.

hello Sunil:

1. Is the Fund just flaring because of the US Dollar rise (compared to INR) or the exports that happened? – Answer : it’s because of the Dollar gaining strength.

Not entirely. It is not like international funds. Service industries that are earning higher export revenues have gained. And yes, indirectly, thier higher export earnings is because of dollar gain.

2. Are exports really going to go up during coming years? – Answer : No idea at all…

And for the Fund to perform it should first have a favourable export environment and good aprreciation of Dollar against Rupee – Please correct me if i am not getting the point.

Yes, right.

3. Rather than timing these 2 points at once, why can’t we just ride a Pharma Fund and an IT Sector Fund?? – I agree it’s the same to what i mentioned above.

The ICICI fund is nto just an IT or pharma fund..it is much more..it has other services that are not necessarily xport driven. It can have media, telecom, transport etc.

4. I as a common retail investor lack the source and proficiency to arrive at a point to decide on the above mentioned line, hence, can i take the pleasure to ask you on what you feel about the export industry, is it going to revive from the lows or stay low?.

Latest data suggests export revival even without rupee conversion. that means export value is higher even in dolalr terms suggested higher exports overall.

BEyond this I do wish to forecast. This is precisely why only investors with knowledge of themes/sectors are well placed to participate in some themes or should be tracking themes if they hold it. Doing fund analysis is one thing, having to track some 28-30 sectors (fund houses have separate analysts tracking them) is another. Currently, we do not track each and every sector in depth to be able to provide sector forecast/analysis. thanks.

Hello Vidya,

I have invested in this fund on 2nd Aug 2013. The return so far is 3.35%. Can you please suggest whether i can continue this fund or redeem at this level.

Regards,

Lalitha.

Hello Lalitha, you may hold the fund. With equity funds have a longer time perspective. But ensure such theme funds do not account for more than 10% of the portfolio. thanks, Vidyaa

Hello Vidya,

I have invested in this fund on 2nd Aug 2013. The return so far is 3.35%. Can you please suggest whether i can continue this fund or redeem at this level.

Regards,

Lalitha.

Hello Lalitha, you may hold the fund. With equity funds have a longer time perspective. But ensure such theme funds do not account for more than 10% of the portfolio. thanks, Vidyaa