Most of you will be worried about potential corrections at this point. This makes it a good time to discuss how your fund manages bearish markets, or, in other words, how it contains downsides. How well a fund curtails losses in a market downturn is equally – if not more – important than how well it does when markets climb. Why? Because the steeper the loss is, the more effort it takes to recover from this loss. It’s only after recovering the loss that gains can be made.

What and why

Say you invested Rs 50,000 each in two funds, Fund A and Fund B. When markets corrected, Fund A lost 20 per cent and Fund B lost 10%. In the recovery that followed, Fund A gained 35%, while Fund B gained 25%. At the end, you would be left with Rs 54,000 in Fund A and Rs 56,250 in Fund B.

This is because much of the gain that Fund A posted went in recouping its loss. Since Fund B managed to keep losses contained, even a smaller gain in a bull market allowed your investment to grow better. Your overall return in Fund A is an absolute 8% while Fund B is an absolute 12.5%.

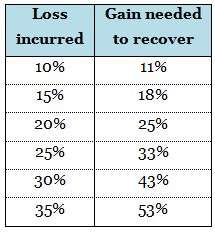

The table summarizes the amount of gain required to recover from different levels of losses. As you can see, a bigger fall requires a fund to work that much harder to first recoup that loss. In funds that fall more than the market or peers in a bearish market, much of the gains in the ensuing bull market would go into getting back to speed. Downside containment, thus, is a fund’s ability to keep losses to a minimum during correcting markets. Downside is simply jargon for losses.

The table summarizes the amount of gain required to recover from different levels of losses. As you can see, a bigger fall requires a fund to work that much harder to first recoup that loss. In funds that fall more than the market or peers in a bearish market, much of the gains in the ensuing bull market would go into getting back to speed. Downside containment, thus, is a fund’s ability to keep losses to a minimum during correcting markets. Downside is simply jargon for losses.

Further, a fund that crashes and soars in each market cycle is a volatile one. For starters, a low volatile strategy delivers better returns in the long term. To give an example, the average 3-year rolling return for the Nifty High Beta index is a 3% loss, against the average 16% gain of the Nifty Low Volatility 50 index. The High Beta index’s volatility measure is about 1.5 times higher than the Low Volatility index. This apart, volatile funds also require higher risk appetites, since you need to be able to withstand sharp falls in your fund value.

To consider a real-time example, in the mid-cap fuelled 2012 rally, funds such as HSBC Midcap Equity or Principal Emerging Bluechip comfortably beat their category averages by 3-4 percentage points. But in the 2011 market downturn, they had had steeper losses than their category to the tune of 9-20 percentage points. Overall gains across the two cycles were thus lower by 16-37 percentage points than peers such as SBI Magnum Global or Canara Robeco Emerging Equities, which didn’t gain as much but then, didn’t lose as much either.

Look for protection

Therefore, a fund that tops the charts in bull markets will not be of much use if it is at the bottom of the heap during bearish phases. Besides, in order to deliver the high returns needed, the fund may be tempted to take riskier bets. This feeds back into the problem, since the tendency would be to pick stocks that are the flavor of the market. The benefit of compounding of returns reduces when losses are steep.