SBI, Bank of Baroda and more recently Axis Bank cut their savings bank rate to 3.5%. This may mean that the already low FD rates may also dip further. Most of you perceive risk as the possibility of investments losing value. However, what would you call a scenario where your money earns less tomorrow compared with yesterday? This is exactly the risk you subject your FDs to. Read on to know why FDs are not risk-free.

Interest rate risk

When you put money in an FD, the rate of interest is guaranteed. However, there is no guarantee that the rate of interest will be the same the next time you want to put money in FD. This is reinvestment risk – the risk of earning different returns on an investment when you had initially invested for a return different from the new rate.

Suppose you put all your money in a 3-year deposit when the interest rate is 7.25%, thinking that it’s a high figure. But in the next month, interest rates are revised to 7.5% for the same duration deposit. You effectively end up losing money in your old FD because you lost that higher-returning opportunity.

You’re however comforted by the fact that rates are higher and that you’d be able to get that higher rate when your deposit matures. But at that renewal time, the interest rate is even lower at 6.5%.

As banks tweak their lending rates, deposit rates will also change as banks seek to maintain their profit margins. Bank rate action also depends on the Reserve Bank monetary policy and the overall economic environment. So while there is certainty that your money is safe in a deposit, there’s no certainty that you can correctly predict how much you will earn from it over time.

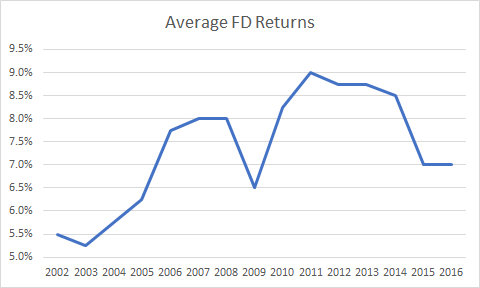

The accompanying graph shows the average 3-5 year FD rates since 2002. As you can see, the interest rates have been pretty volatile since 2002. While they hit a low of 5.25% in 2003, they have also seen highs of 9%. This volatility is what poses risk to your investments.

Taxability risk

Fixed deposit interest is taxed at your income tax slab rate. So if you’re in the 20% tax slab, you also pay 20% of your interest as tax. Even if TDS, where it is applicable, is at 10%, you will have to pay up more tax if your tax liability on interest is more than the TDS deduction. TDS also reduces the compounding effect.

And since your income and the tax rates keep changing, your tax slab does too. When you put money in FD today, you might think you will have to pay only 5% in taxes. However, if your earnings rise, it is very well possible that your taxes change through the term of your deposit. This is not theoretical. People do not realise that their tax slabs can quickly change as their incomes rise. They put in substantial sums in FDs and RDs thinking that they will pay lower tax. However, one job switch and the tax slab hits 30%. The amount of tax that needs to be paid at this rate then starts to pinch.

And when your deposit sums are huge, your tax slabs can change simply because of your interest income. For example, say your salary income was ₹9,80,000 and you might have paid tax at 20%. However, if you had earned ₹1,30,000 as interest from your FDs, it can push you into the 30% slab rate and you will then have to pay additional ₹37,000 as tax on this interest income.

Your post tax returns too dwindle significantly as you move up the tax slab. Current 3-year deposits from SBI fetch 6.25%. Post tax, at the 5%, 20%, and 30% slabs, the returns work out to 5.9%, 5%, and 4.4%, respectively.

Inflation risk

The Reserve Bank has only recently been aiming at maintaining interest rates above consumer inflation (CPI), or what is called a positive real rate of interest. Interest rates on FDs have rarely beaten inflation over the past 2 decades. Currently India is in a rare phase where inflation rates are abnormally low. Normally, the rate of inflation in India has been high and FDs fail to give inflation beating returns.

If your investment is not generating inflation beating returns, then it is effectively losing value. This is because the cost of buying something is rising faster than your investment is growing.

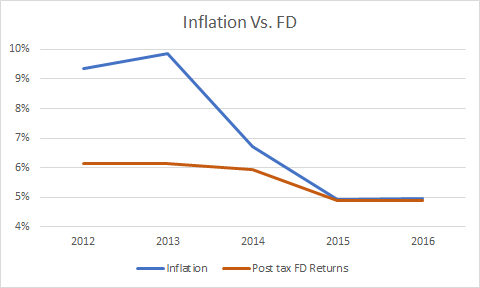

The graph here shows you the post-tax returns from FDs since 2012. Even when the inflation started coming down in 2015, FDs found it difficult to give inflation beating returns.

Liquidity risk

This is the risk that you will not be able to quickly liquidate your investment when you need the money. Think about it – you have accumulated a lot of FD accounts over the past years. To prevent TDS, you split your FDs across banks and now you have FDs with four banks. You have internet banking, but not all banks provide the facility to liquidate FDs online. On top of that, if you have tax saving FDs, you are not even allowed to liquidate those. You have urgent need of money, but all your money is locked in FDs which you can’t liquidate easily. Now you would have to run around from bank to bank to get your money back. More, many banks also impose penalties on premature closure of your fixed deposit.

Are you willing to take the above risks?

As can be seen above, FDs are not the fail-safe investment. They carry their own drawbacks which most investors do not recognise due to the allure of assured return. So what is the solution?

Debt mutual funds address most of this risk. For one thing, you’d get returns higher than FDs because debt funds invest in papers that pay higher interest rates. True, some debt funds take higher risk by investing in debt of low-quality companies. But ensuring that you invest in only those funds that stick to high-quality papers removes this risk.

Debt funds also manage their portfolios in way to maximise returns across interest rate cycles. So when interest rates fall, debt funds try to capture trading gains as bond prices rise when rates fall. This boosts returns even during falling interest rates. The reinvestment risk, thus, is addressed to some extent.

On taxation too, debt funds solve most of the problems associated with FDs. There is no TDS on debt funds. Your money compounds as long as you remain invested. You pay taxes only when you redeem the fund. When you hold a debt fund for more than 3 years, you get indexation benefits which reduces your taxes. Holding for shorter periods has capital gains taxed at slab rates, but then debt funds anyway deliver FD-plus returns. Finally, debt funds are easily liquidated and proceeds credited to your account on redemption.