Short on time? Listen to a brief overview of this week’s review.

[soundcloud url=”http://api.soundcloud.com/tracks/270318202″ params=”color=ff5500&auto_play=false&hide_related=false&show_comments=true&show_user=true&show_reposts=false” width=”100%” height=”166″ iframe=”true” /]

If you are looking for a debt fund to replace your bank deposits, here is an emerging class of debt funds that provides liquidity, carries low risk and volatility, and can generate reasonably stable returns – banking and PSU debt funds.

Those of you familiar with debt funds will know that ultra-short-term debt funds are meant for short time-frames and have relatively low risk; short-term debt funds have a slightly higher risk and a longer maturity, and provide marginally higher returns; and income funds hold the potential to deliver higher returns albeit with higher risks and a much longer time-frame.

What if you had a fund with the low-risk profile of an ultra short-term debt fund and the return potential of an income fund? Banking and PSU funds may be providing just that. A caveat though – most of these funds have a limited track record, and while they exude these traits now, we will have to see if they deliver, sporting similar traits, in a sustained manner.

The funds and where they invest

There are about a dozen funds which fall under the banking/banking and PSU debt fund category. But if you check the category for these funds on any mutual fund website, you will see them listed under the ultra short-term/short-term and income fund categories. Be that as it may, these funds have some common traits:

- These funds mostly invest in bank certificates of deposits or bonds/debentures of public sector companies – mostly in the AAA-rated category. Almost the entire portfolio for most funds is, therefore, of high credit quality.

- Most of them have instruments with reasonably high liquidity and low average maturity. The average maturity in the last 12 months for this category was about two years.

- The PSU bonds they hold are mostly liquid, medium-term debentures of companies such as REC, PFC, IRFC, NABARD and SIDBI, to name a few.

- The portfolios are built in such a way that there is active management, the focus is on high credit quality and the instruments have short-term to medium-term maturities.

Strategy

The instruments in which these funds invest generate returns in two ways: One, accrual income arising from the coupon of the instruments held. This is typically the case with certificates of deposits (CDs) of banks. Two, while the bonds and debentures held provide accrual income, there are also capital appreciation opportunities in these instruments in a falling interest rate scenario, such as the one seen in the past year.

Given that PSU bonds are also reasonably liquid and well traded, fund managers can easily sell these bonds to gain from capital appreciation opportunities when rates fall.

Performance

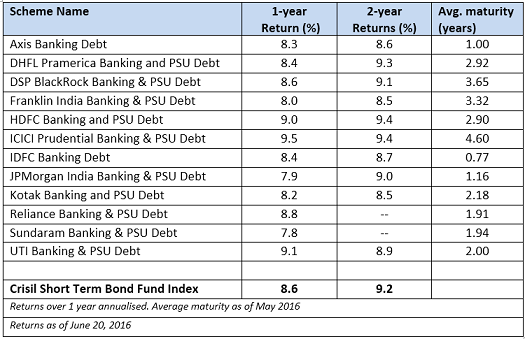

As many funds in this bucket have been launched in the last two years, there is not much of a track record to look at. However, in the past one year, these funds have delivered a return of 8.6 per cent on an average. In the past two years, this return was 8.9 per cent, annualised. This return is certainly way higher than what you would have got in traditional debt options such as bank deposits. And while the return potential in bank deposits is further diminished now, it remains good in these funds.

While the volatility in this class of funds can be expected to be low (as their average maturity is not high), do note that these funds too can sport negative returns on days when yields go up. Since the bonds/debentures are all traded, when yields move up, mark-to-market losses are inevitable.

We tried to check whether these funds weather falls well, when the returns are rolled daily. Our rolling return analysis, rolled over the last three years, for returns of 1, 2 and 3 months showed that while these funds did sport negative 1-month returns (especially as a result of the debt turmoil in July 2013) in a few instances (and some even sported marginal negative returns over 2-month time-frames on a few occasions), none of them had negative returns over time-frames of 3 months or above. Avoiding even short-term negative returns is possible if the funds invest more in certificates of deposits than in PSU bonds (as the later is mark-to-market). But then, they may compromise on returns.

Limitation

Most of these funds have not really seen a prolonged flat or rising rate scenario. It is possible their returns would not be too different from ultra short-term funds as they will likely predominantly invest in bank CDs, as bonds would not deliver capital appreciation opportunities. Hence, return expectations need to be tempered, and should not be based on the performance of the past 1-2 years. On this count, longer term income funds may score – if you have a 3-year plus horizon.

Suitability

As discussed earlier, these funds fit the bill of an investor looking for higher returns than those offered by bank deposits, without taking significantly higher risks. A time frame of 1-2 years would be the minimum holding period.

These funds will also suit seasoned debt investors looking for lesser volatility, and a steady credit profile and maturity.

While it may be early days yet to see which are the most consistent performers in this category, funds such as Axis Banking Debt and IDFC Banking Debt have shown low volatility and steady returns. If you are looking for funds with low risk (low volatility) and low maturity (with a portfolio of almost entirely certificates of deposits), then these funds would be good fits, albeit with marginally lower returns.

If you wish to hold a more active portfolio of high-quality AAA-rated PSU bonds, besides bank CDs, then funds such as UTI Banking & PSU Debt and HDFC Banking and PSU Debt look to be promising. These options may also yield slightly higher returns than the earlier mentioned funds, in the current rate scenario.

FundsIndia’s Research team has, to the best of its ability, taken into account various factors – both quantitative measures and qualitative assessments, in an unbiased manner, while choosing the fund(s) mentioned above. However, they carry unknown risks and uncertainties linked to broad markets, as well as analysts’ expectations about future events. They should not, therefore, be the sole basis of investment decisions. To know how to read our weekly fund reviews, please click here.

Vidya madam, I am following your articles regularly from few months. It provides very useful key informations to the beginners like me in mf feild. I am Investing 2000 rs per month in sbi small and midcap fund and pharma fund from one year.is my portpholio on right track? Could you please sujest other than this? If any.

Raghu Sorry for the delayed response. A mid cap fund and a sector fund cannot be the core of any portfolio. Please add some large-cap or diversified fund to ensure your portfolio is not hit too hard in downturns. Thanks, Vidya

Hello Vidya,

Thanks for the useful information. I have started investing recently in MF based on some market research and expert articles like yours. Below is my portfolio currently:

4000 Rs per month ICICI Value Discovery Fund

1500 Rs per month Franklinn Templeton Smaller Companies fund

2500 Rs in SBI Magnum Balanced Fund

Planning to take 1-2 large cap fund like Birla Sun Life Frontline Equity, SBI Bluechip. Please suggest if I am on the right track as my investment horizon is for longer duration > 7 years

Hi Gaurav,

Sorry for the delayed response. Portfolio sepcific questions may please be routed through your FundsIndia account, if you are a FI investor. The blog is a general discussion forum and specific advice/review is made only through our platform, if you are an investor.

Thanks, Vidya

Vidya madam, I am following your articles regularly from few months. It provides very useful key informations to the beginners like me in mf feild. I am Investing 2000 rs per month in sbi small and midcap fund and pharma fund from one year.is my portpholio on right track? Could you please sujest other than this? If any.

Raghu Sorry for the delayed response. A mid cap fund and a sector fund cannot be the core of any portfolio. Please add some large-cap or diversified fund to ensure your portfolio is not hit too hard in downturns. Thanks, Vidya

Hello Vidya,

Thanks for the useful information. I have started investing recently in MF based on some market research and expert articles like yours. Below is my portfolio currently:

4000 Rs per month ICICI Value Discovery Fund

1500 Rs per month Franklinn Templeton Smaller Companies fund

2500 Rs in SBI Magnum Balanced Fund

Planning to take 1-2 large cap fund like Birla Sun Life Frontline Equity, SBI Bluechip. Please suggest if I am on the right track as my investment horizon is for longer duration > 7 years

Hi Gaurav,

Sorry for the delayed response. Portfolio sepcific questions may please be routed through your FundsIndia account, if you are a FI investor. The blog is a general discussion forum and specific advice/review is made only through our platform, if you are an investor.

Thanks, Vidya

Hi Madam, I have invested around 30 lakhs in a debt and euity mutual fund portfolio in 20:80 ratio. I have ICICI long term fund (g) in my debt portfolio. Now for my regular monthly SIP of 1 lakh(80% in equity & 20%in debt), I want to add one Debt fund. Should I select BSL Dynamic Bond Fund(g)? then both my debt funds would be dynamic funds! or should I try HDFC Medium term opp(g) or BSL short term opp(G)? or anyother better fund?

I also do not know if I need to opt for daily dividend reinvestment option, I come under 30% tax bracket.

As they say, Debt funds should not be in SIP mode, it’s better to invest in lumpsum. Should I invest in lumpsum, say one years SIP amount in one go?

My next financial goal is my son’s education which is 5 years away.

thank you and waiting your advice

Hi Madam, I have invested around 30 lakhs in a debt and euity mutual fund portfolio in 20:80 ratio. I have ICICI long term fund (g) in my debt portfolio. Now for my regular monthly SIP of 1 lakh(80% in equity & 20%in debt), I want to add one Debt fund. Should I select BSL Dynamic Bond Fund(g)? then both my debt funds would be dynamic funds! or should I try HDFC Medium term opp(g) or BSL short term opp(G)? or anyother better fund?

I also do not know if I need to opt for daily dividend reinvestment option, I come under 30% tax bracket.

As they say, Debt funds should not be in SIP mode, it’s better to invest in lumpsum. Should I invest in lumpsum, say one years SIP amount in one go?

My next financial goal is my son’s education which is 5 years away.

thank you and waiting your advice