Opening an account

FundsIndia is a transactional investment service - what that means is that one can use FundsIndia to make investments in financial instruments and to redeem them. An investor can use the system to transfer money from their bank account to buy mutual funds or other products, and "sell"� the units to get the money back. However, to be able to do so, one would need to "open an account" with FundsIndia. This is a simple investment services account that will allow us to verify an investor's identity and other information to be able to serve them in a regualtorily compliant manner.

This essay addresses opening a Indian resident account. If you are an NRI, please see a separate essay in this same section.

What is needed to open an account

An Indian resident investor needs three simple documents to open an account with FundsIndia:

1. A proof of identity - typically, a copy of the PAN card

2. A proof of address - typically, a bank statement, utility bill, driver's license, passport etc. This is needed for Know Your Customer (KYC) registration only. If you are already KYC registered, you would not need this document to open an account.

3. A proof of bank account - typically, a cancelled cheque of your registered bank account with your name pre-printed on it. If you name is not printed on your cheque, we will additionally need a statement of your bank account to corraborate your ownership.

The process of opening an account

One can get started with opening a FundsIndia account by simply clicking on the 'Open a free account' link on the homepage of FundsIndia. The system will ask for your account details in the subsequent pages. These details will include:

1. Your name and contact details

2. Your PAN number

3. Your bank account details

4. Any nominee that you would like to have on your account

The last part (nominee) is important in that it protects the investments that you make through FundsIndia in case of an unfortunate event later.

However, please note that if you have a nominee specified, we will require their signature in the application form at the time of account activation.

Once the details are provided as above, an application form - pre-filled with all these details - will be created for you. It will be available for you in the 'Downloads' section of your account. You would need to print it out, sign it in appropriate places, and send it to us with the required documents as above. You will also find a handy 'Checklist of documents' as part of your application package generated.

Activation Process

Your account needs to get activated before you can start making investments using our platform.

Once the document is printed, signed, and proofs attached, you have two options:

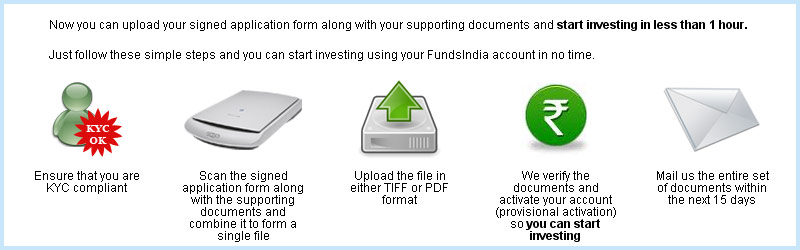

1. If you are already KYC registered (please see short note about KYC registration below), you can scan these documents (application form, terms and conditions document, PAN card copy, and cancelled cheque leaf) and upload it in your account (using the 'Document upload' link on the 'Downloads' page). Our staff will verify the documents thus uploaded and activate your account if everything is in order. You will receive an email about this 'Provisional activation' and you can start investing right away.However, please note that you will subsequently (within 15 days) need to send us the originals of uploaded documents.

2. If you are not KYC registered, or would not like to upload scanned copies of documents, you can simply mail/courier the application form and related documents to us. Again, we will verify the documents and activate your account if everything is in order.

This account opening process is a one-time paperwork. Subsequent investment transactions (other than SIP) will not require paperwork. SIPs will require a one-time ECS mandate signature paperwork done.

Note about KYC: Know your customer (KYC) is a centralized registration process for mutual fund invesments in India. All mutual fund investors are required to be KYC compliant. This KYC is different from the KYC done by a bank for bank account opening, or done by a stock broker for demat account opening. You can verify if you are KYC compliant by visiting www.cvlindia.com and typing in your PAN number.

If you are not� KYC registered, you can easily get it done - it does not cost anything to get KYC registered. There are many places around the country that process KYC registration for investors. You can also send your documents to FundsIndia to get it done. However, please note that if you send the KYC application form to FundsIndia, your proof of address and PAN card copy documents will need to be both notarized and self-attested.