J.K. Rowling’s Harry Potter is one of the world’s best loved book series, and with good reason. Harry Potter opened our eyes to the world of magic and taught us valuable lessons on friendship, loyalty, bravery, and even investing.

Yes, you read that right. There are personal finance lessons to be learnt even from Harry Potter – a book for young adults. So, with the release of ‘Harry Potter and the Cursed Child’ around the corner, let’s visit the Pensieve to see what the series can teach us about managing our money.

Lesson #1: Set aside money for your family’s future

Lesson #1: Set aside money for your family’s future

Harry’s parents, James and Lily Potter were active members of the Order of the Phoenix, a secret society created to oppose Lord Voldemort and his Death Eaters. Their activities were fraught with danger, and in those dark times, anything could happen to anyone.

Although James was from a wealthy family, he and Lily had the foresight to set aside some money for Harry’s future. They maintained a large sum of money for Harry at Gringotts Wizarding Bank. Though they were killed later by Lord Voldemort, by leaving Harry a sizeable inheritance, they made certain Harry would never have to compromise on his education or living.

What this means for you

You need to plan for your family’s future.

First, you need to get life insurance to ensure your family is provided for, should anything happen to you. Term insurance policies are just what you need. These low-cost policies provide the maximum benefit.

Apart from this, you will have to educate your children, buy a house, buy a car, and go on holidays. Then you need to be comfortable when you retire. For this, you’ll need money. And while a bank account may be the safest place to put your money, with an interest rate of just 4-6% it won’t help your money grow enough to meet all those needs.

The only solution here is to invest in products that deliver the best return. That depends on your goal, how many years you have to reach it, its priority, tax-efficiency, and how much risk you can take. Equities is good for the long term, debt is good for the short term. Mutual funds are generally the best option in both, because of their low cost, professional management, strictly regulated operations, and tax efficiency. Just set your goals, chalk out your investments, and stick to the plan.

Lesson #2: Spread your investments

Surprisingly, this lesson comes from the villain of the series – Lord Voldemort. The Dark Lord wanted immortality and to attain this, he split his soul into fragments, keeping each in different objects. He then hid these objects, or horcruxes as they are known, in different places, protecting them with magical traps and shields. So, while he died trying to kill baby Harry, he managed to return years later because of the backup plan he had in place.

What this means for you

The old adage ‘Don’t put all your eggs in one basket’ applies here. If you put all your money in one asset, it exposes your entire wealth to the same risk. If that asset were to fall, you will lose heavily. Spread your investments across instruments and asset classes so that a loss in one is compensated by gains in the others.

Lesson #3: “Time is galleons”, or in Muggle speak, “Time is money”. So, start early.

Lesson #3: “Time is galleons”, or in Muggle speak, “Time is money”. So, start early.

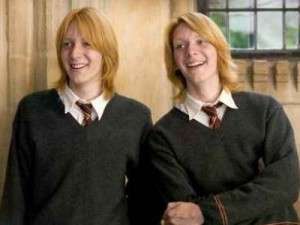

Fred and George realized this quite early in life, apparating and disapparating everywhere they could to save time. They then put the time they saved into furthering their business- Weasleys’ Wizard Wheezes, a shop that sold magical jokes, tricks, toys and more.

What this means for you

The longer you stay invested, the more your money will grow. That is the effect of compounding where your returns (whether debt or equity) are reinvested and thus earn returns in turn and so on.

For example, Rs. 100,000 will amount to Rs. 176,234 if invested for 5 years at a 12% annual return. If you stay for 10 years, the Rs. 100,000 becomes Rs. 310,584!

Lesson #4: Step up your investments in step with your income

Another lesson from the business Fred and George ran. At first, they started it at home with their savings, but they soon moved to Diagon Alley with funding from Harry. They stayed invested in their business and put money right back into it, and soon Weasleys’ Wizard Wheezes grew into an enormous money spinner.

What this means for you

If you’ve got more money in hand, be smart about it. Stepping up your investments will help you reach your goals faster. Add the magic of compounding to an increase in your investments, and your goals will be closer than before.

Lesson #5: Don’t Gamble Away Your Wealth

The Quidditch World Cup was one of the biggest sporting events in the wizarding world. Ludo Bagman suffered an unfortunate fate thanks to a gambling problem. He lost all his money placing bets on the outcome of the World Cup, followed by the Triwizard Tournament. He lived the rest of his life on the run from the goblins he’d borrowed a large amount of gold from.

What this means for you

In trying to make your money grow quickly, you may want to bet a fortune on that one penny stock your friend said was a sure-shot multi-bagger. But ploughing huge sums of money in high-risk penny stocks you don’t know about, or on a friend’s suggestion, is tantamount to gambling. Instead, do your homework, don’t take on excessive risk just because the payoff may be good, and diversify. Put your investments in mutual funds. Mutual funds help diversify your money, and are managed by experts.

Keep these lessons in mind and you’ll do just fine!

Happy investing!

Nice 🙂

Nice 🙂

Nice 🙂

Nice 🙂

Wow. Yo have related the things in such a innovative way. even I am a Harry Potter fan but believe me I never ever imagined that i can get to learn personal finance lessons along with entertainment!! Excellent work. Keep writing..

Wow. Yo have related the things in such a innovative way. even I am a Harry Potter fan but believe me I never ever imagined that i can get to learn personal finance lessons along with entertainment!! Excellent work. Keep writing..

Once the credits roll, the real work begins. Apply the lessons you’ve learned to your own personal experience. If you want to dig yourself out of debt, start by creating a personal budget and cutting out all unnecessary purchases.

Once the credits roll, the real work begins. Apply the lessons you’ve learned to your own personal experience. If you want to dig yourself out of debt, start by creating a personal budget and cutting out all unnecessary purchases.