A top-notch performance in the past two years has powered L&T India Value Fund to the top of the charts. The fund has no specific market-cap leaning, and can go anywhere depending on market conditions. It has used this freedom to the best advantage, moving heavily into mid-cap and small-cap stocks over 2014 and 2015. The fund has also seen its AUM shoot higher; its December 2015 AUM of Rs. 880 crore is leaps ahead of the Rs. 121 crore it was the previous December.

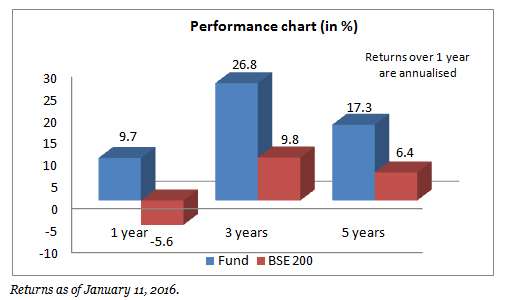

In the one, three, and five-year period (the fund was launched in January 2010 by the Fidelity stable), L&T India Value Fund ranks among the top two in the diversified or multi-cap funds category. Its five-year 17.3 per cent return leaves its benchmark, BSE 200’s, 6.4 per cent return in the dust.

Given its flexible mandate, freedom to pick relatively small stocks, and high volatility, the fund is suitable for investors with a high-risk appetite. L&T India Value Fund is also yet to weather a prolonged downward market cycle.

Gathering steam

L&T India Value Fund delivered less than the benchmark and category average for a stretch in 2011. This is partly attributable to the fund’s launch in 2010, when markets were still in their bullish mood. In the sideways 2013 market, the fund fared reasonably well – its 13.5 per cent loss was a good bit better than the average category loss, and slightly lower than the benchmark loss.

Rolling three-year returns daily since its inception reveals that L&T India Value Fund beat the BSE 200 all the time. The fund’s volatility is, however, on the higher side. This is partly explained by its shifting between market capitalisations (other go-anywhere funds such as Franklin India High Growth Companies and Reliance Equity Opportunities have similar standard deviations) and the high holding of mid-cap and small-cap stocks. For the risk it takes, the fund has delivered commensurate returns.

Dynamic strategy

Given that mid-caps and small-caps offered better valuations, especially in the period in 2013 (since they hadn’t recouped their losses from the 2008 crash as much as large-caps did), the fund shifted its portfolio there. Large-cap stocks accounted for around 30-40 per cent of the portfolio through 2014 and 2015.

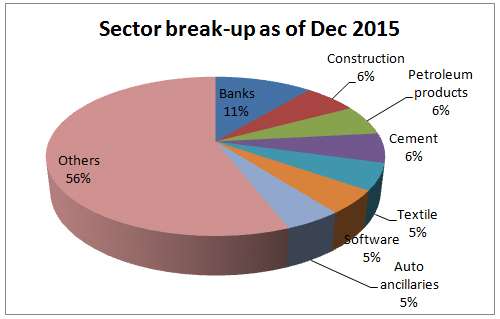

The fund is similarly dynamic in its sector and stock choices. In 2013, for instance, sector weights were reasonably concentrated, and swiftly churned as well. Banking accounted for around 20 per cent for quite a time before being cut sharply as sentiment soured. Software took up 10 per cent, upped later to 18 per cent. Individual stocks often accounted for 4-6 per cent of the portfolio.

By 2015, concentration in both sectors and stocks were more diffused, though still deftly juggled. Banking, while remaining the heaviest weight, had only an 11 per cent allocation by December 2015. The sectors that followed (encompassing a wide range of software, pharmaceuticals, textiles, capital goods, construction, cement, petroleum, financials, and auto ancillaries) all had weights of 5-8 per cent only. Few stocks accounted for more than 4 per cent of the portfolio. Over the past three months, given the overheated mid-cap space and the lack of value stocks, the fund has shifted up to 14 per cent of its portfolio into cash.

The fund bagged a fair number of winners over the past year – FAG Bearings, Ahluwalia Contracts, KNR Construction, BEL, and Wabco India, to name a few. Its current portfolio tends towards cyclical sectors, which can revive if growth picks up as anticipated, with some exposure to consumer and defensive sectors such as auto, pharma, software, textiles, and finance.

The fund is managed by Venugopal Manghat and Abhijeet Dakshikar.

News reports suggest that the AMC has recently started considering a partial stake sale to raise capital. In such an event, there could be changes in investment and stock selection processes across all the AMC’s funds depending on the new partner. L&T India Value Fund, however, has a good strategy in place, and has delivered consistently well. Thus, it remains a good bet. We will revisit this call if such an event happens and if there is any process change that can affect the fund.

FundsIndia’s Research team has, to the best of its ability, taken into account various factors – both quantitative measures and qualitative assessments, in an unbiased manner, while choosing the fund(s) mentioned above. However, they carry unknown risks and uncertainties linked to broad markets, as well as analysts’ expectations about future events. They should not, therefore, be the sole basis of investment decisions. To know how to read our weekly fund reviews, please click here.

Hi

Nice article on L&T Value Fund. Can you please let me know how this fund differs from L&T Equity Fund also a multi cap fund which started in 2005 giving good returns since inception

Hi Satish,

L&T Equity is predominantly a large-cap fund and restricts mid-cap exposure to around 15-25 per cent of the portfolio. L&T India Value can shift allocation as much as it wishes to. The Value fund also is very bottom-up in approach as it looks for stocks that are below their possible valuations. It has no clear sector orientation – as we’ve said in the post, its sector range is vast and shifts quickly. L&T Equity has more of a sector approach although it has a diffused approach as well. Hope its clear now.

Thanks,

Bhavana

I have been invested in HDFC Equity and Top 200 for 3-4 years now. Performance has been sub par compared to other funds in same category.

Many experts are saying it will bounce back. I dont see that happening.

Do I stick with it or exit. My horizon is 30 years not 3 years

Mode is SIP.

Hi Jatin,

Both funds are mid-quartile funds. As you’re a long term investor, it should be fine to hold them. HDFC Equity, for example, has a tendency to bounce back very sharply in bull markets and sink in bad markets, going by past performance. The AMC also is very valuation and long-term focused. For any further queries, if you are a FundsIndia investor, please write to us through your account (advisor appointment feature in your help tab). This blog is not meant as an advisory forum.

Thanks,

Bhavana

Thanks Bhavna for your reply

I have seen many experts saying that these two funds have past its prime, huge corpus letting down etc.. what do you feel

your views on HDFC Top 200. what is mid quartile funds

Hi Jatin,

Mid-quartile funds are middle-of-the-road performers. They are not the best of the lot nor the worst of the lot. HDFC Top 200 falls in the bottom half of performers in the three year period. The best to do with the fund is to continue to hold it, especially since you have a long horizon. Exiting at this point will not be prudent, given the way the market is currently. As I said before, it can bounce back well when the markets take off, and if expecations on sector recovery pan out.

What is your take on DSPBR Microcap F-RP(G) ?

Hi Mala,

DSPBR Mircocap specifically sticks to small companies. To that extent, it is far more volatile than even mid-cap funds. The risk tolerance needed for this fund is consequently much higher. It has, however, been a relatively consistent performer over the long term.

Thanks,

Bhavana

What is your take on DSPBR Microcap F-RP(G) ?

Hi Mala,

DSPBR Mircocap specifically sticks to small companies. To that extent, it is far more volatile than even mid-cap funds. The risk tolerance needed for this fund is consequently much higher. It has, however, been a relatively consistent performer over the long term.

Thanks,

Bhavana

Hi,

as usual very nice article. However, I have only one question.

How come BSL MNC and UTI MNC fund is not recomended by you and L&T Value Fund is?

Almost every other rating agency accepts BSL MNC Fund as the best fund(also low risk) and its long term record also suggests that. Whereas L&T Value fund is considered to among more volatile ones.

Can you throw some light?

Thanks

Hi,

MNC funds are a different category. L&T Value is a regular equity fund – i.e., it is a fund that has no mandate of sticking to specific sectors the only thing the fund looks at is value. It is comparable to any diversified equity fund. Yes, the fund is volatile, and that’s because it churns its portfolio quickly and because it has a very high mid-cap allocation. All mid-cap and small-cap stocks are extremely volatile so while we do include mid-cap funds in long-term portfolios, their allocation will not be high.

The MNC funds are, on the other hand, like a theme fund. They are restricted to invest only in multi-nationals and thus the universe of stocks they can invest in is small. MNC is a theme. These funds have been doing well because MNCs are generally cash-rich, low-debt, high in corporate governance, and this market has so far preferred quality companies. MNC stocks have thus soared and their valuations are also high. The call now is whether this kind of run will persist – these stocks may not crash but they may not gain much more from here given the high valuations and that there are cheaper alternatives available. We have reviewed MNC funds in the past, though – https://blog.fundsindia.com/blog/mutual-funds/fundsindia-reviews-mnc-funds/7409. Hope this makes it clearer.

Thanks,

Bhavana

Hi,

as usual very nice article. However, I have only one question.

How come BSL MNC and UTI MNC fund is not recomended by you and L&T Value Fund is?

Almost every other rating agency accepts BSL MNC Fund as the best fund(also low risk) and its long term record also suggests that. Whereas L&T Value fund is considered to among more volatile ones.

Can you throw some light?

Thanks

Hi,

MNC funds are a different category. L&T Value is a regular equity fund – i.e., it is a fund that has no mandate of sticking to specific sectors; the only thing the fund looks at is value. It is comparable to any diversified equity fund. Yes, the fund is volatile, and that’s because it churns its portfolio quickly and because it has a very high mid-cap allocation. All mid-cap and small-cap stocks are extremely volatile so while we do include mid-cap funds in long-term portfolios, their allocation will not be high.

The MNC funds are, on the other hand, like a theme fund. They are restricted to invest only in multi-nationals and thus the universe of stocks they can invest in is small. MNC is a theme. These funds have been doing well because MNCs are generally cash-rich, low-debt, high in corporate governance, and this market has so far preferred quality companies. MNC stocks have thus soared and their valuations are also high. The call now is whether this kind of run will persist – these stocks may not crash but they may not gain much more from here given the high valuations and that there are cheaper alternatives available. We have reviewed MNC funds in the past, though – https://blog.fundsindia.com/blog/mutual-funds/fundsindia-reviews-mnc-funds/7409. Hope this makes it clearer.

Thanks,

Bhavana

Hi

Nice article on L&T Value Fund. Can you please let me know how this fund differs from L&T Equity Fund also a multi cap fund which started in 2005 giving good returns since inception

Hi Satish,

L&T Equity is predominantly a large-cap fund and restricts mid-cap exposure to around 15-25 per cent of the portfolio. L&T India Value can shift allocation as much as it wishes to. The Value fund also is very bottom-up in approach as it looks for stocks that are below their possible valuations. It has no clear sector orientation – as we’ve said in the post, its sector range is vast and shifts quickly. L&T Equity has more of a sector approach although it has a diffused approach as well. Hope its clear now.

Thanks,

Bhavana

I have been invested in HDFC Equity and Top 200 for 3-4 years now. Performance has been sub par compared to other funds in same category.

Many experts are saying it will bounce back. I dont see that happening.

Do I stick with it or exit. My horizon is 30 years not 3 years

Mode is SIP.

Hi Jatin,

Both funds are mid-quartile funds. As you’re a long term investor, it should be fine to hold them. HDFC Equity, for example, has a tendency to bounce back very sharply in bull markets and sink in bad markets, going by past performance. The AMC also is very valuation and long-term focused. For any further queries, if you are a FundsIndia investor, please write to us through your account (advisor appointment feature in your help tab). This blog is not meant as an advisory forum.

Thanks,

Bhavana

Thanks Bhavna for your reply

I have seen many experts saying that these two funds have past its prime, huge corpus letting down etc.. what do you feel

your views on HDFC Top 200. what is mid quartile funds

Hi Jatin,

Mid-quartile funds are middle-of-the-road performers. They are not the best of the lot nor the worst of the lot. HDFC Top 200 falls in the bottom half of performers in the three year period. The best to do with the fund is to continue to hold it, especially since you have a long horizon. Exiting at this point will not be prudent, given the way the market is currently. As I said before, it can bounce back well when the markets take off, and if expecations on sector recovery pan out.