For those of you who rejoice with the equity market now and think it’s time to join the India growth story – good for you. But then if you think the elections alone are game changers and invest in the equity market blindly based on just ‘euphoric sentiments’ then you may, when the dust settles, feel disappointed.

You may even burn your fingers through investments that were, looking back, not so discreet and then swear never to return again to equities. And so equities remain an under owned asset by individuals; accounting for less than 6% (equities and equity mutual funds) of their financial wealth.

This is why understanding the fundamentals and not getting too swayed by market momentum (although it is good to adequately participate in the momentum) is important when it comes to equity investing.

If you are new to equity investing and entering now or are an equity investor (directly or through mutual funds) it first helps to understand why Indian equity markets can build long-term wealth for you.

This alone, in our opinion, can provide you conviction – first to stay for the long term and two to not lose faith when markets go through very testing phases.

What you need to know about the fundamentals

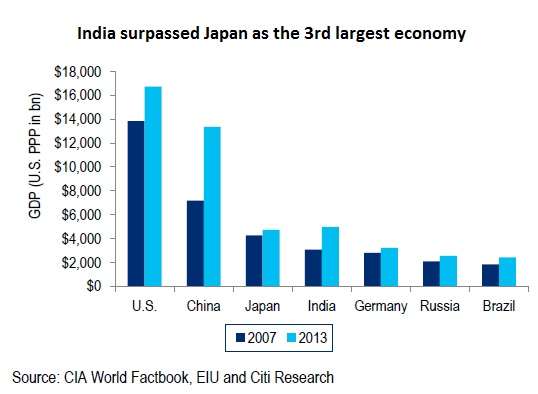

It’s the economy: For those of you who wonder whether Indian markets are a big deal to stay invested in, you should probably look at the size of the Indian economy in relation to the rest of the world. The domestic economy after all, is a sum of all the productive activities of companies (and individuals).

Take a look at the chart above to know where India stands among world economies.

The chart will tell you that the sheer size of the Indian economy means that you cannot ignore Indian equity markets.

This is also one (not the only) reason why we reiterate that Indian equities should form part of your core holding and to use international equities only for diversification.

And the markets: If you are wondering how economic performance translates into equity returns, India is the second best performing market, over a 10-year period, among the top 20 countries by world market capitalisation (taking the MSCI country indices including large countries such as US and China).

MSCI India index’ local currency returns over the last 10 years was close to 16% compounded annually, while in US dollars it was 13.2% annually. Among the larger emerging markets this is next only to Brazil which delivered 14.8% annually in dollar terms and was the top performer.

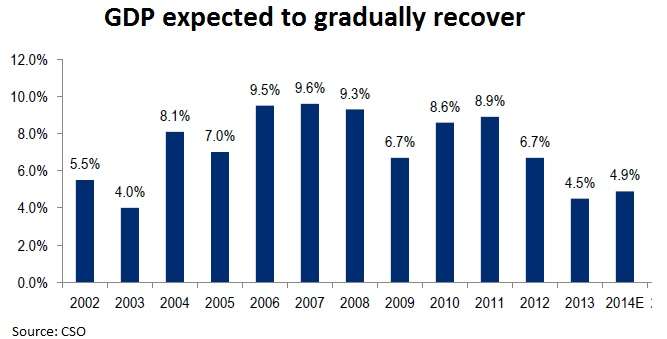

Of course, a downturn in the economy, as was seen in recent times, simply means poor performance of companies in the country. Currently, as the chart below shows, the economy has shown signs of bottoming out and estimates suggest a gradual recovery.

This is also visible in March quarter ended results that showed double digit (12% year-on-year) revenue growth for companies that have declared results thus far.

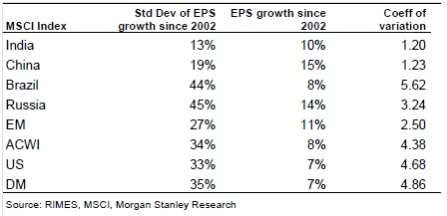

Corporate fundamentals: Next, earnings growth of companies would be a key factor that determines upside potential in your stocks and the markets in general. Interestingly, according to data in a recent report from Morgan Stanley, India’s earnings growth is highly stable when compared with emerging markets’ average and even developed markets such as the U.S.

According to the report, while the earnings growth in India may not be as high as emerging markets such as China or Russia, it does not swing much and is less volatile, as suggested by the standard deviation.

Institutional investors often view this characteristic as one deserving premium.

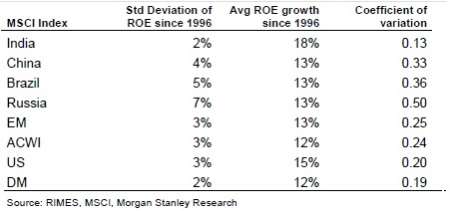

The report also provides data (given below) on the high return on equity of companies in India (note that many of the emerging markets are commodity-dependent and suffer from lower ROEs).

The ROE of India is also among the least volatile – in fact lower than developed markets such as the US.

That means Indian companies, mostly being in their growth phase, generate high returns for investors and do not also swing too wildly from their average capital return compared with other markets.

What you need to know about the risks

High dependence on FII: Having discussed the positives of investing in a growing market like India, it is equally important to take note of the risks in the Indian equity market.

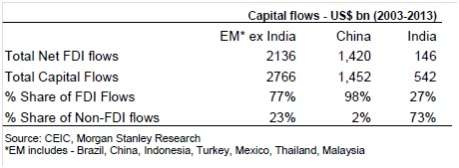

India’s foreign inflow through the non-FDI route is too high for comfort. At 73% (see table), the non-FDI flows, predominantly FII, makes our equity market highly volatile; as such money can be pulled out any time. Low domestic equity saving is also a reason behind Indian equity markets having a high share of FII money.

What is the risk behind this? High dependence on global money means that India is more exposed to global market cycles. In other words, events in other parts of the globe can cause a shift in foreign money to or from India.

FDI money on the other hand is considered more stable as it results in creation of assets in India or participation of global money in long-term businesses in India, unlike FII money.

Hence, despite relatively low volatility in Indi’s earnings growth, high volatility in the market means that your investments can react wildly to short-term global events.

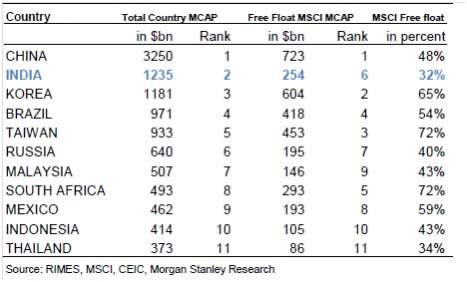

Low free float: Similarly, the free-float marketcap – the shares available for freely trading (rest being with promoters) is also low in India compared with other emerging markets.

With FIIs taking up a majority of this, the available free float is much lower for the Indian public.

As a result, the price impact on stocks especially in the mid and small-cap segment can be high and you may also suffer when there are exits by institutional investors in such stocks.

The above risks can of course be mitigated by holding for the long haul and avoiding risky, illiquid stocks and those companies with poor corporate governance.

If these fundamental facts convince you, then looking for opportunities in segments and sectors could be next thing to do while investing. Please read our article on the opportunities now.

If you do not have the wherewithal to scout for opportunities and still wish to participate in equities, then equity mutual funds is the right vehicle for you.

Data exhibited sourced from research reports of Citi, Morgan Stanley

Dear Vidya,

Thanks for the article.

In view of the expected economic growth story of India after this election, What is your take on international funds, especially the U.S. based funds?

Do you still advise the investors to go ahead with it, even if for pure diversification?

The 2 factors which affects the real return are the rupee appreciation and taxation (considerd as a debt fund)

Rgds

Ajith

Hello Ajith, Yes, for diversification purpose, US and Europe remain good regions for the long term. Taxation is a given. Leaving that out, rupee risk and the risk of earnings growth in those regions will remain, although the risk of lower returns from rupee appreciation in the long term remains low; as the rupee has been steadily depreciating (long term) with higher inflation. On earnings, certainly Indian companies have higher average earnings growth over 5-10 year periods. But then, the short bursts of declines leave you unhedged. That is where diversification helps. And with both markets esp Europe showing lower correlation with Indian markets, they can be good ways to diversify as long as you have adequate core holding in India. thanks, Vidya

Dear Vidya Mam, refreshing and insightful as always. More importantly, it is laying adequate emphasis on having a right approach and developing a robust process to create wealth in the long term. In this era of ‘buying on rumour and selling on news’, your article will prove to be of tremendous value to retail investors.

Warm Regards,

Aditya.

Aditya, Thanks!

Thank you

Hi,

I Have just opened a Funds India Equity Account, and i am absolutely new to the stock market and investing in it. How should i go about the whole process, which companies should i start with to build a good portfolio, and how can i read about the companies and their performance in stock in the past years. I want to invest in some long term stocks in which i can maybe assign a monetary goal that i need to fulfill from the returns i get, also would follow the advice and start investing small money in the companies that are expected to do well.

What would be your advice for somebody like me who has just entered this area and would like to invest around 5000-8000 rupees to start with every month??

Hello Rohan,

I suppose you are invested in MFs. Your query is on equities. I have asked our equity team to get in touch with you on what resources are made available for investors. They will get in touch with you soon to help you get started. I hope you are getting the daily mails from our equity team. thanks, Vidya

Hi Vidya mam, Am new to equity and just created account with FundsIndia, I’ve been using MF with fundsindia since an year and I’m need of equity markets advice too just to build a good portfolio. Thank you!

Hi Chatanya, I head mutual fund research. I can ask one of my colleagues from the equity team to talk to you regarding this. They will get back to your shortly. But do remember that direct equities, unlike mutual funds, require lot of time and tracking from your side as well. thanks, Vidya

Hi mam, I have plan to invest around 2 lacs lump sum in a couple of months for over a period of 6 years for my childrens education. Please advice a portfolio which would return atleast 15% thanks

Hello Krishnakumar, Thank you for writing to us. Since you are an account holder with us, we would like to know your requirements and your current exposure before providing the right funds. I shall ask our advisor to get in touch with you to help you with this. thanks, Vidya

Both fundamental and technical analysis can be done independently or together. Some analysts use both methods of analyses, while others stick to one. Either way, using stock analysis to vet stocks, sectors, and the market is an important method of creating the best investment strategy for one’s portfolio. Thanks for sharing.

Both fundamental and technical analysis can be done independently or together. Some analysts use both methods of analyses, while others stick to one. Either way, using stock analysis to vet stocks, sectors, and the market is an important method of creating the best investment strategy for one’s portfolio. Thanks for sharing.

Thank you

Dear Vidya,

Thanks for the article.

In view of the expected economic growth story of India after this election, What is your take on international funds, especially the U.S. based funds?

Do you still advise the investors to go ahead with it, even if for pure diversification?

The 2 factors which affects the real return are the rupee appreciation and taxation (considerd as a debt fund)

Rgds

Ajith

Hello Ajith, Yes, for diversification purpose, US and Europe remain good regions for the long term. Taxation is a given. Leaving that out, rupee risk and the risk of earnings growth in those regions will remain, although the risk of lower returns from rupee appreciation in the long term remains low; as the rupee has been steadily depreciating (long term) with higher inflation. On earnings, certainly Indian companies have higher average earnings growth over 5-10 year periods. But then, the short bursts of declines leave you unhedged. That is where diversification helps. And with both markets esp Europe showing lower correlation with Indian markets, they can be good ways to diversify as long as you have adequate core holding in India. thanks, Vidya

Dear Vidya Mam, refreshing and insightful as always. More importantly, it is laying adequate emphasis on having a right approach and developing a robust process to create wealth in the long term. In this era of ‘buying on rumour and selling on news’, your article will prove to be of tremendous value to retail investors.

Warm Regards,

Aditya.

Aditya, Thanks!

Hi,

I Have just opened a Funds India Equity Account, and i am absolutely new to the stock market and investing in it. How should i go about the whole process, which companies should i start with to build a good portfolio, and how can i read about the companies and their performance in stock in the past years. I want to invest in some long term stocks in which i can maybe assign a monetary goal that i need to fulfill from the returns i get, also would follow the advice and start investing small money in the companies that are expected to do well.

What would be your advice for somebody like me who has just entered this area and would like to invest around 5000-8000 rupees to start with every month??

Hello Rohan,

I suppose you are invested in MFs. Your query is on equities. I have asked our equity team to get in touch with you on what resources are made available for investors. They will get in touch with you soon to help you get started. I hope you are getting the daily mails from our equity team. thanks, Vidya

Hi Vidya mam, Am new to equity and just created account with FundsIndia, I’ve been using MF with fundsindia since an year and I’m need of equity markets advice too just to build a good portfolio. Thank you!

Hi Chatanya, I head mutual fund research. I can ask one of my colleagues from the equity team to talk to you regarding this. They will get back to your shortly. But do remember that direct equities, unlike mutual funds, require lot of time and tracking from your side as well. thanks, Vidya

Hi mam, I have plan to invest around 2 lacs lump sum in a couple of months for over a period of 6 years for my childrens education. Please advice a portfolio which would return atleast 15% thanks

Hello Krishnakumar, Thank you for writing to us. Since you are an account holder with us, we would like to know your requirements and your current exposure before providing the right funds. I shall ask our advisor to get in touch with you to help you with this. thanks, Vidya