After a knee jerk reaction to the repo rate hike of 25 basis points by the RBI, equity, debt and currency markets pulled themselves up on Tuesday. The latest rate hike, perhaps postponed from about a month ago, would mean that the government yields are left searching for more clues to discover a recovery path. Please read our take on the rate hike by clicking here.

If you thought the rate hike would mean a hike in your bank deposits, it may not necessarily be the case. With retail deposits, hiking the rate of deposits would be a call that goes hand-in-hand with hiking loan rates. A rise in deposit rates at this juncture would increase the cost of funding for banks, which are already suffering margin pressures. With RBI expecting inflation to cool off, banks may not be in a hurry to hike rates.

If that leaves deposits out of your investment radar, how do you play the higher interest rate regime? Debt funds offer you that opportunity.

Opportunity

Early part of January 2014 saw 10-year gilts easing from 8.85% levels to 8.7 levels, leading to a short rally in long and medium-term gilts funds, as well as income funds. Beginning this month, debt funds rallied 1.0-2.7% as a result of gilt yields coming off.

But with the current rate hike, debt markets may, once again, become more complacent, awaiting further cues, locally and in international markets.

Nevertheless, the current rate hike together with the tight liquidity condition prevailing since mid-December, provides scope for investors to lock in to attractive short-term rates.

Higher recourse to the MSF pipeline by banks, term repos conducted by the RBI and more recent open market purchases; all go to suggest that liquidity conditions remain tight. Also, historically higher demand for liquidity closer to the fiscal year end is likely to keep short-term rates elevated.

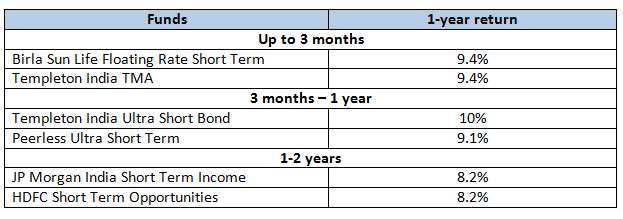

Investors can consider locking into these rates using funds/FMPs that are suitable for the short term (of 1 year). Here’s how we would classify your requirements and suggest funds:

Investing for the short term (about 3 months)

In this case, consider going for liquid funds that will have elevated returns over the next 2 months at least, as liquidity remains tight in the banking system. We would suggest Birla Sun Life Floating Rate Short Term and Templeton India TMA. Both these funds have sufficient corpus, a low maturity profile and reasonable track record.

Please note that there are plenty of options within liquid funds that you can choose based on your requirement. For instance, if you wish to do a systematic transfer plan into equity later, you will do well to choose a liquid fund, within the same fund house, in which you have chosen an equity fund.

Tax efficient: Given that this is suggested for a holding period of less than a year, go for dividend reinvestment option if you are in the 30% tax bracket, and growth option if you are in the 10-20% tax bracket to invest in a tax efficient manner. Please note that you might still have some short-term capital gains tax even under the dividend reinvestment option.

Investing for 3 months – 1 year

While you could ideally consider liquid funds for investments up to even 6 months or to simply park surplus that you may need any time, if you know your time frame to be more than 3 months, then ultra short-term debt funds are an option. For this, please note that your risk appetite should be marginally higher than liquid funds as this category will also invest in commercial papers.

In this category, we recommend 2 funds, Templeton India Ultra Short Bond – for those with shorter time frame and looking for lower risks; Peerless Ultra Short Term – strictly for those with higher risk appetite and 1 year time frame at least. This fund’s near term performance may not inspire confidence but it’s current portfolio has aa higher yield to maturity.

For holdings less than 1 year, follow the tax strategy mentioned for liquid funds. For holding greater than a year, opt for growth and get indexation benefit.

Investing for 1-2 years

This is the time bucket when you will probably gain the most not just from accrual (interest income of the underlying instruments) but also when a price rally does happen, when yields soften (such a rally though may not happen in the near term).

Hence, while the current 1-year return may see lower than the other categories, a capital appreciation opportunity would ensure superior returns.

There could be marginal volatility in this segment when compared with the other two but holding over the said time is likely to smoothen such volatility.

JP Morgan India Short Term Income, with a good dose of certificates of deposits and an average maturity of 2.33 years, would fit a less risky investor while HDFC Short Term Opportunities with higher exposure to AAA-rated short to medium term bonds and average maturity of 1.17 years will fit an investor looking to benefit from marginally higher yields in corporate bonds.

Take the growth option for the above tenure, irrespective of your tax bracket.

The FMP route

Investors can also use the FMP route to lock into high rates for tenure over a year. However, currently FMPs with tenure of about 1 year and 2 months (which will be the minimum tenure to get double indexation benefit) seek to invest in less than AAA rated bonds/debentures and may suit only slightly higher risk investors.

Investors may wait for more FMPs that will come their way in the next couple of weeks. Conservative investors may opt for those that invest a majority in certificates of deposits and bonds. We will keep investors posted through this blog on such offers.

A TIMELY RECOMMENDATION DEFINITELY USEFUL.THANKS

Thanks a Ton Vidya Ji.

Regards,

Sunil.

After reading the blog, I planned to invest in Templeton Ultra India short term through fundsindia. But, fundsindia does not have the option to invest in Templeton AMC.

Could you provide alternative mutual fund? As suggested in your blog, I plan to stay invested for 1 year and expecting better tax-efficient returns than FDs.

Thanks.

Please ignore the earlier comment. I had thought that Templeton is the AMC, when Franklin Templeton is the AMC.

Hello Anil, FundsIndia allows investments in all AMCs.

Dear Madam

In this article u have not commented on Long Term Income funds. Are they out of favor now since rate hikes are now the norm from RBI.

I have invested in Long Term Income fund & Dynamic Bond fund last year.Both the funds have high maturity periods . I am currently in marginal loss in both these funds. After the recent repo hike by RBI , dose it make sense to exit or stay invested.I have holding period of 1-2 years.

I have a plan to exit these funds and invest in Short Term Income funds which are doing pretty well.

Hello Naveen, The article was exploring current investment opportunities. If you are invested in long-term debt funds (income/dynamic) then it is important for you to stick to the time frame for which they need to be held. For instance, income funds require a min. holding of 3 years. The idea is to hold as close as possible to the portfolio maturity of the instruments in these funds. if you have not completed such period (from the time of your purchase), then it is preferable that you adopt a hold strategy. When rates do fall, the rally in these funds will be higher than short-term debt funds. thanks, Vidya

Nice information. Would like to know your comments about ICICI Pru Balanced Fund.

Hello Mohit, As you know ICICI Pru Balanced will have about 25% in debt and is slightly aggressive in that category. thanks, Vidya

After reading the blog, I planned to invest in Templeton Ultra India short term through fundsindia. But, fundsindia does not have the option to invest in Templeton AMC.

Could you provide alternative mutual fund? As suggested in your blog, I plan to stay invested for 1 year and expecting better tax-efficient returns than FDs.

Thanks.

Hello Anil, FundsIndia allows investments in all AMCs.

Please ignore the earlier comment. I had thought that Templeton is the AMC, when Franklin Templeton is the AMC.

Thanks a Ton Vidya Ji.

Regards,

Sunil.

Dear Madam

In this article u have not commented on Long Term Income funds. Are they out of favor now since rate hikes are now the norm from RBI.

I have invested in Long Term Income fund & Dynamic Bond fund last year.Both the funds have high maturity periods . I am currently in marginal loss in both these funds. After the recent repo hike by RBI , dose it make sense to exit or stay invested.I have holding period of 1-2 years.

I have a plan to exit these funds and invest in Short Term Income funds which are doing pretty well.

Hello Naveen, The article was exploring current investment opportunities. If you are invested in long-term debt funds (income/dynamic) then it is important for you to stick to the time frame for which they need to be held. For instance, income funds require a min. holding of 3 years. The idea is to hold as close as possible to the portfolio maturity of the instruments in these funds. if you have not completed such period (from the time of your purchase), then it is preferable that you adopt a hold strategy. When rates do fall, the rally in these funds will be higher than short-term debt funds. thanks, Vidya

Nice information. Would like to know your comments about ICICI Pru Balanced Fund.

Hello Mohit, As you know ICICI Pru Balanced will have about 25% in debt and is slightly aggressive in that category. thanks, Vidya

A TIMELY RECOMMENDATION DEFINITELY USEFUL.THANKS