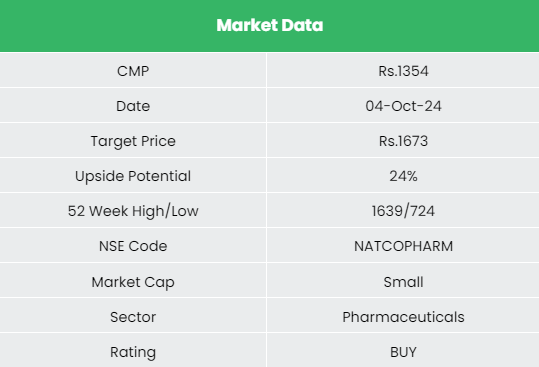

Natco Pharma Ltd – Making specialty medicines accessible to all

Founded in 1981 and based in Hyderabad, Natco Pharma Ltd. is a leading pharmaceutical company specializing in finished dosage formulations (FDF), active pharmaceutical ingredients (APIs), and intermediaries. With 9 advanced facilities in India, including 2 API and 5 FDF plants, the company serves both domestic and global markets. As of FY24, Natco operates in over 50 countries, employs 4,800+ people, including 450 scientists, and holds 111 Indian and 204 international patents. The company also offers 80+ active FDFs in India and 182 internationally (excluding the US).

Products and Services

Natco Pharma’s product portfolio includes specialized formulations in oncology, specialty pharma, cardiology, and diabetology for both domestic and global markets. The company also offers APIs, contract manufacturing services, and crop health sciences solutions.

Subsidiaries: As of FY24, the company has 11 subsidiaries.

Growth Strategies

- Complex Specialty Medicine Focus: Natco targets niche and complex molecules with limited competition, leveraging its R&D expertise and first-to-market strategy.

- Oncology Innovations: The company is fast-tracking oncology products, planning to launch 10 new treatments next financial year, with a focus on various cancers including Leukemia, Lymphoma, and Multiple Myeloma.

- Investment in CAR-T Research: Approximately $2 million invested in Cellogen Therapeutics for CAR-T cancer treatment R&D, enhancing its oncology pipeline.

- Para IV Applications Pipeline: 25 Para IV applications are in the pipeline, with 13 already approved; notable First-to-File applications include Semaglutide for diabetes/weight loss and Olaparib for ovarian cancer.

- Agro-Chemicals Expansion: Natco expanded into agro-chemicals with the launch of Chlorantraniliprole (CTPR) products, reporting revenue growth from ₹40 crore in FY23 to ₹108 crore in FY24.

- Market Presence Development: The company is focusing on building brand presence in the agro-chemical segment through enhanced sales and marketing efforts while exploring export opportunities.

Financial Performance

Q1FY25

- Revenue: ₹1,411 crore, up 22% from ₹1,160 crore in Q1 FY24

- EBITDA: ₹853 crore, representing a 56% YoY increase from ₹548 crore

- Net Profit: ₹669 crore, a growth of 59% compared to ₹420 crore in Q1 FY24

- EBITDA Margin: Improved from 47% to 61%

- Net Profit Margin: Increased from 36% to 47%

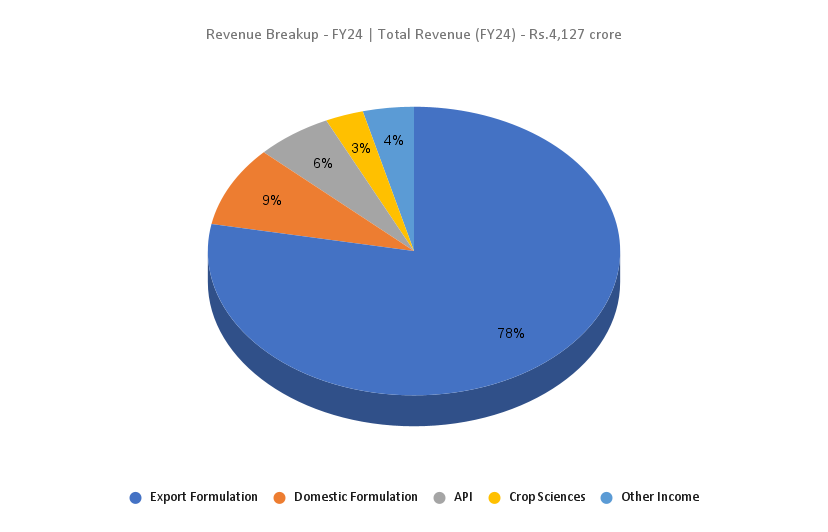

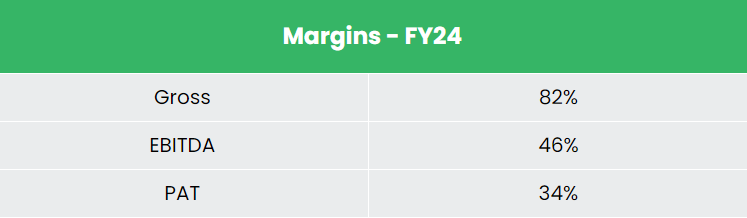

FY24

- Total Revenue: ₹4,127 crore, up 47% from FY23

- International Business Growth: Contributed significantly with a 57% YoY increase

- EBITDA: ₹1,880 crore, reflecting an 81% YoY growth

- Net Profit: ₹1,388 crore, a 94% increase YoY

- New Product Launches: Over 15 new products introduced

- Key Filings: Successfully filed Semaglutide for weight loss and submitted 3 additional Para IV applications during FY24

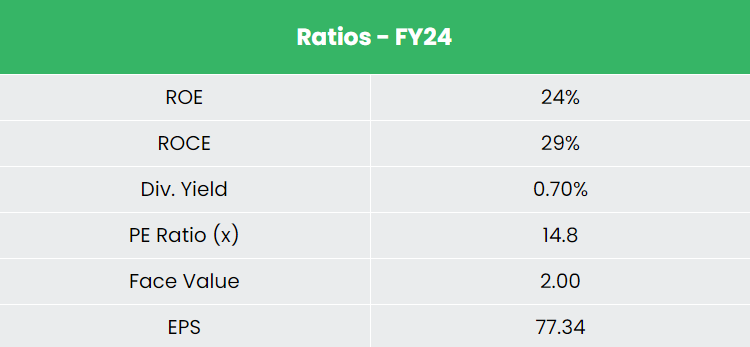

Financial Performance (FY21-24)

- Revenue CAGR: ~25%

- PAT CAGR: ~49%

- 3-Year Average ROE: ~16%

- 3-Year Average ROCE: ~17%

- Debt-to-Equity Ratio: 0.06 (strong capital structure)

Industry outlook

- Strong Pharmaceutical Sector: India is a global leader in pharmaceuticals, benefiting from a low manufacturing cost (30%-35% lower than the US and Europe) and cost-efficient R&D (87% less than developed markets).

- Global Ranking: Currently ranked third globally in production by volume, the Indian pharmaceutical industry is projected to grow at a CAGR of over 10%, reaching US$ 130 billion by 2030.

- Regulatory Compliance: India boasts the largest number of USFDA-compliant pharmaceutical plants outside the US and over 2,000 WHO-GMP approved facilities.

- Global Reach: The industry serves demand from over 150 countries, supported by more than 10,500 manufacturing facilities.

- Medicine Spending Growth: Projected medicine spending in India is expected to grow by 912% over the next five years, positioning India among the top 10 countries for medicine expenditure.

- Market Expansion: The Indian pharmaceutical sector has experienced significant growth and aims to reach approximately 13% of the global pharma market while improving quality, affordability, and innovation.

Growth Drivers

PLI Scheme for Pharmaceuticals: The Production Linked Incentive (PLI) scheme has a total outlay of ₹15,000 crore (US$ 2.04 billion) and is set to run from 2020-21 to 2028-29.

Foreign Direct Investment (FDI):

- Up to 100% FDI is permitted through the automatic route for Greenfield pharmaceutical projects.

- For Brownfield projects, FDI is allowed up to 74% automatically, with government approval required for any amount beyond that.

Support for Bulk Drug Parks: The government has allocated ₹1,000 crore (US$ 120 million) for promoting bulk drug parks in FY25, marking a significant increase from the previous year.

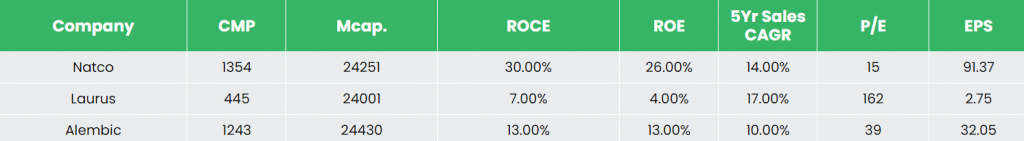

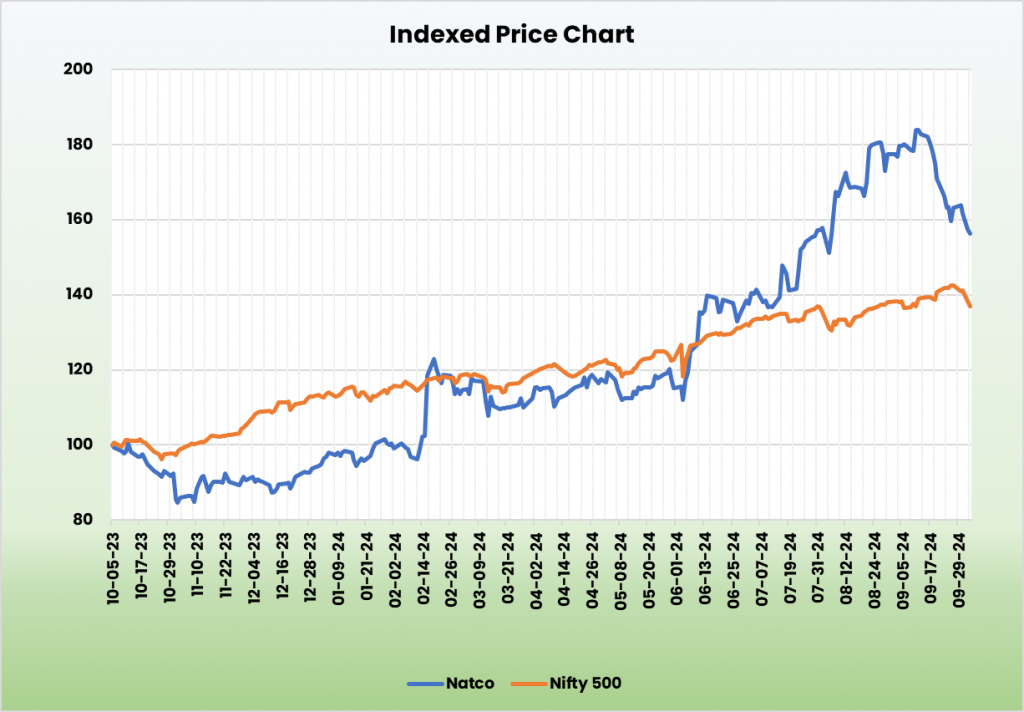

Competitive Advantage

Natco stands out as an undervalued stock compared to competitors like Laurus Labs Ltd and Alembic Pharmaceuticals Ltd, with significant potential for P/E expansion driven by its strong margin and earnings growth.

Outlook

- Global Expansion: Natco aims to grow its presence in Southeast Asia, MENA, LATAM, and other global markets, building on its established foothold in the US, Canada, and Brazil.

- Niche Molecule Development: The company focuses on developing high-potential niche molecules in specialty pharmaceuticals.

- Sales Team Expansion: Plans to double its sales team in FY25 to boost market reach and product visibility.

- Cardiology Portfolio Enhancement: Enhancing its cardiology offerings with innovative anticoagulant and anti-hypertensive therapies.

- Strategic Investments: Investing in sales and marketing to drive growth in specialty pharma, cardiology, and diabetology.

- Advanced Therapeutics Development: Progressing in the development of peptides and oligonucleotides to strengthen its pipeline.

Valuation

The company boasts a robust pipeline of first-to-file (FTF) opportunities, featuring assets like Semaglutide, Olaparib, and Ibrutinib. These are expected to contribute to long-term growth, alongside the company’s goal of filing 2 to 3 limited competition products in the US annually. We recommend a BUY rating in the stock with the target price (TP) of Rs.1,673, 20x FY26E EPS.

Risks

- Regulatory Risk: The industry faces high regulatory scrutiny, particularly from agencies like the USFDA, which could lead to product limitations or bans, negatively impacting revenue.

- Forex Risk: With significant operations in foreign markets, the company is exposed to foreign exchange risk. Unforeseen fluctuations in the forex market could adversely affect financial performance.

Note: Please note that this is not a recommendation and is intended only for educational purposes. So, kindly consult your financial advisor before investing.

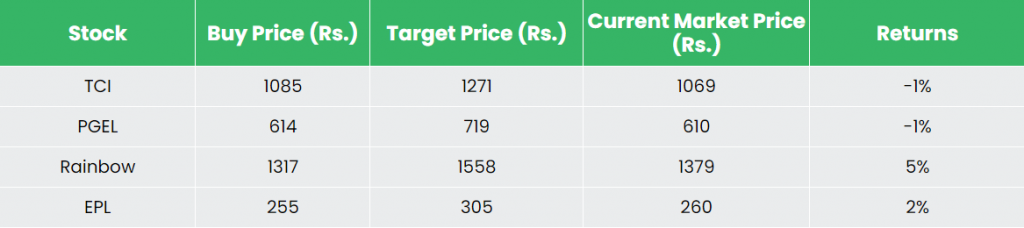

Recap of our previous recommendations (As on 04 October 2024)

Rainbow Children’s Medicare Ltd

Transport Corporation of India Ltd