This article was originally published in Livemint. Click here to read it

Nowadays, there are new mutual fund launches almost every day!

Thanks to the bull market and increasing equity market participation, in the last year, there has been a significant increase in new fund offers (NFOs) and this trend is expected to continue for sometime.

Now you might be wondering:

Is it a good idea to invest in these new mutual funds (NFOs) or not?

With so many options available it’s often very difficult to make a choice. Don’t worry, we are here to make this decision simple for you with the help of a framework.

Let’s begin…

What are NFOs and how do they work?

NFO stands for New Fund Offer and refers to the launch of a new mutual fund scheme by an Asset Management Company (AMC) or fund house. During an NFO, the fund house invites investors to subscribe to the units of the new scheme. This is the initial phase when the fund is open for investment, and it typically has a fixed subscription period, after which the NFO closes, and regular trading begins.

Below are a few myths about NFO we want to bust before we go into the details.

Myth 1: NFOs are not similar to IPOs

An NFO is not like an IPO. In an IPO, a company is raising funds from the public that it will use for a specific purpose. You have detailed information about the company financials, its business, its prospects, and so on in the prospectus. You therefore know the company’s business, its profits, its growth over the years and whether the current offer price is justified. The company’s price may even soar on listing if more investors (higher demand for the stock) see value in it.

But, in an NFO the asset management company pools in money from investors and invests that in a set of securities (stocks or bonds or government securities and so on), based on a stated strategy. At the time of NFO, the fund does not hold any stocks and you, therefore, do not know whether the underlying stocks are cheap or expensive. The Rs 10 is just a price it begins with to allot units and has no underlying instruments for you to value it.

Myth 2: NFOs are not cheap

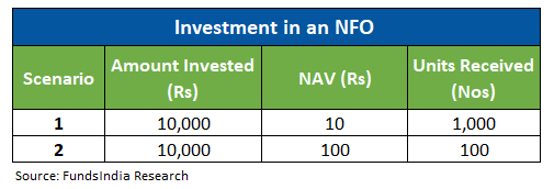

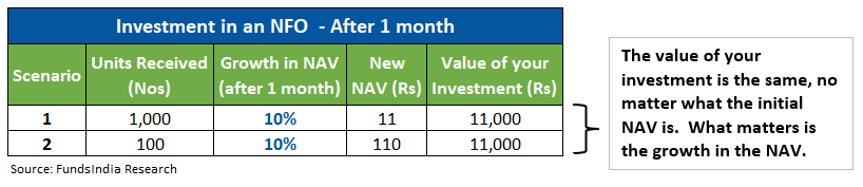

NFO is not cheap – While the NAV could be smaller (for example Rs. 10) usually that is the issue price but that does not mean that you are buying it cheaper. The growth of a fund’s NAV is important which is based on the performance of the underlying instruments it invests in. Let’s understand this with an example.

Myth 3: NEW does not mean better

Do not assume that all NFOs are different and provide better returns – The NFO may not be adding anything new to your portfolio and you may have established alternatives in the same category that are better performers. This makes it rare to find funds that are truly differentiated and better from others in the category.

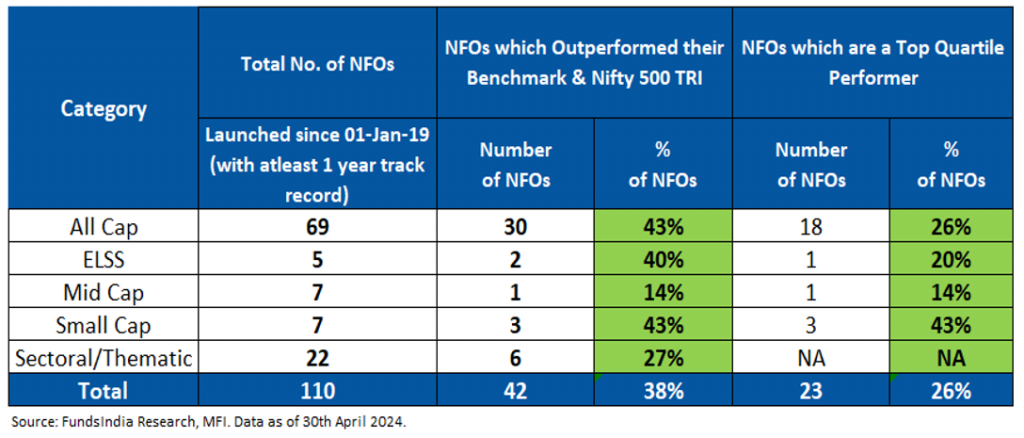

To understand this better, we have checked the performance of the NFOs launched since 1st Jan 2019 (with at least a 1 year track record) till date (30th April 2024).

Out of the 110 NFOs,

- 6 out of 10 NFOs Underperformed

62% of the NFOs have underperformed either their Benchmark or Nifty 500 TRI i.e. 68 funds out of 110 NFOs underperformed.

- Only 1 out of 4 NFOs were in the Top Quartile

Only 26% of the NFOs (excluding sector/thematic funds) ended up in the top performance quartile i.e. 23 funds out of 88 NFOs.

The myths about NFOs have been busted, but how can we decide if investing in them is a good idea?

Should you invest in an NFO?

We have made this decision simple for you with the help of a framework.

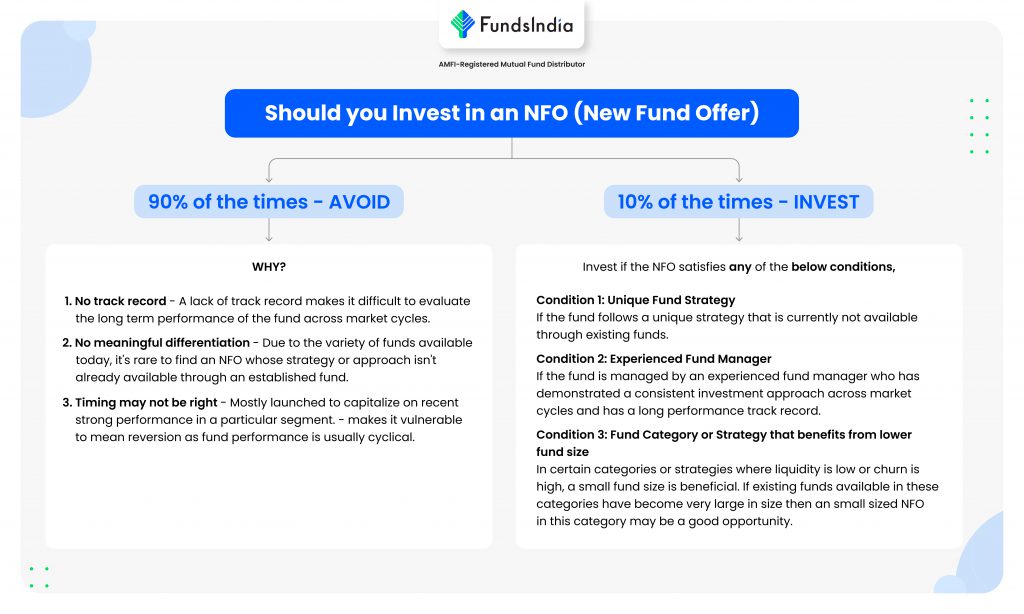

90% of the times – Avoid an NFO

NFOs might look exciting in the first go but it also has risks and uncertainties. Majority of the time it is best to WAIT and WATCH, here’s why

- No track record – A lack of track record makes it difficult to evaluate the performance of the fund across market cycles. The risk you take in an NFO is much higher than when you go for a fund that has already been around for a few years and built up a history.

- No meaningful differentiation – Due to the variety of funds available today, it’s rare to find an NFO whose strategy or approach isn’t already available through an established fund. If an established fund with a proven track record is available then there is very little value added by investing in the NFO.

- Timing may not be right – Mostly launched to capitalize on recent strong performance in a particular segment, which makes it vulnerable to mean reversion as fund performance is usually cyclical. Investors have often piled into these funds at precisely the wrong time, only to be disappointed.

What about 10% of the time? What are the rare scenarios in which you can invest in an NFO?

10% of the times – Invest in the NFO

While most of the time it is better to wait and observe the fund performance before investing, there are rare instances where you can invest in an NFO if it satisfies any of the below conditions.

Condition 1: Unique Fund Strategy

If the fund is going to follow a unique strategy that is currently not available in the existing funds then this may be an opportunity to invest In the NFO.

For example, an International Equity Strategy which can provide portfolio diversification and is currently not available in any existing funds.

Condition 2: Experienced Fund Manager

Because this is a new fund offer with no underlying portfolio to analyse the performance, you will depend mostly on the decisions of the fund manager. If the fund is managed by an experienced fund manager who has demonstrated a consistent investment approach across market cycles and has a long performance track record then this may provide a good opportunity to invest in the NFO.

For example, It may be a good opportunity to invest in an NFO managed by Kenneth Andrade (industry veteran, Ex CIO of IDFC Mutual Fund and CIO of Oldbridge Capital Mutual Fund).

Condition 3: Fund Category or Strategy that benefits from lower fund size

In certain categories or strategies where liquidity is low or churn is high, a small fund size is beneficial. If existing funds available in these categories have become very large in size then a small sized NFO in this category may be a good opportunity.

For example,

- A new fund in the Small Cap category which has a low AUM could have a size advantage compared to an existing small cap fund which has a very large AUM (the small cap space is relatively illiquid in nature, a very large AUM could make it difficult to add value or outperform the broader market)

- A new fund which follows momentum strategy + has a low AUM – this fund could have size advantages which a larger fund may not have (momentum based strategies might become hard to replicate as the fund size becomes too large and the performance might not be sustainable).

Summing it up

- NFO is a new fund offer. It is specifically issued by asset management companies or mutual fund houses whenever they want to raise money for a specific scheme.

- NFOs are not similar to IPOs.

- NFOs are not cheap – While the NAV could be smaller (for example Rs. 10) usually that is the issue price but that does not mean that you are buying it cheaper.

- New does not mean better – Do not assume that all NFOs are different and better

- 90% of the times – Avoid an NFO because of no track record, no meaning differentiation and the timing of the new fund may not be right.

- 10% of the time – Invest in an NFO if any of the conditions are satisfied namely – unique fund strategy or experienced fund manager or fund category or strategy that benefits from lower fund size.