Uno Minda Ltd – Driving the New

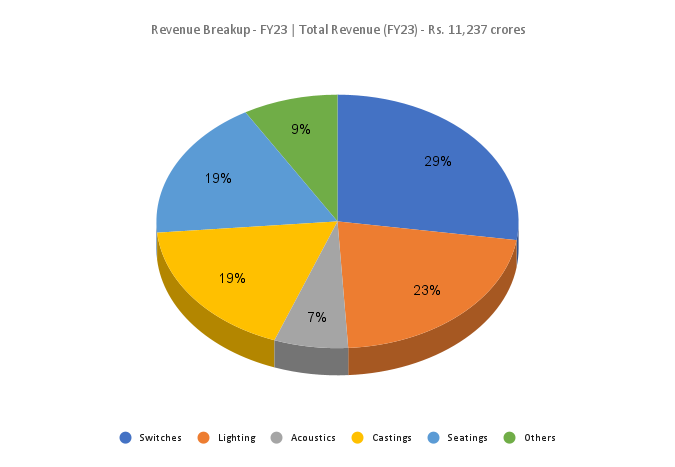

Established in 1992, Uno Minda Limited (UML – formerly Minda Industries Limited) is a leading global manufacturer and supplier of proprietary automotive solutions and systems to Original Equipment Manufacturers (OEMs). UML is one of the most diversified auto component manufacturers in India with presence across multiple product segments, including automotive switches, lighting, acoustics, alloy wheel and die-casting, seatings, and others. The company is the market leader for alloy wheels in passenger vehicles segment and largest supplier of horn in India and second largest internationally. It is a leading seating supplier to commercial vehicles, buses and 2-wheelers. As on 31 March 2023, the company had 29000+ employees, 73+ plants and 30 R&D and engineering centres globally. Over the years it has filed more than 390 patents and have registered 344 design registrations. Uno Minda has recently been awarded National Intellectual Property Award 2023 in the design registration category.

Products and Services

Operating as a diversified auto ancillary supplier, the company’s products are categorised into following divisions – Switch, Sensor, Controllers, Lighting, Acoustic, Alloy Wheel, Seating, Aftermarket, Casting, Advanced Driver Assistance Systems (ADAS).

Subsidiaries: As of FY23, the company had 34 subsidiaries (including step down subsidiaries), 11 joint ventures and 6 associate companies.

Key Rationale

- Expansion plans – Uno Minda has a robust capex plan of Rs.700 crores to Rs.800 crores for the current financial year. It commissioned two new EV plants in H1FY24. During Q2FY24, a new EV systems plant was commissioned under a joint venture with Buehler Motors for manufacture of traction motors, BLDC motors for EV two-wheeler and three-wheeler and the supply is expected to commence from Q4FY24. Supplies have started from the recently commissioned EV systems plant under joint venture with FRIWO. UML got approval from the Board to increase its stake in Minda Westport Technologies Limited anticipating to cement UML as market leader in alternate fuel systems market. The company is setting up new Greenfield plant with capacity of 1,20,000 wheels per month considering the growth potential of four-wheel alloy wheel business. The company completed the acquisition of 86 acres land at Pune, Khed City. Additionally, it is in the process of land acquisitions in different parts of the country.

- New Orders – UML’s product diversification and increasing growth from new products give it better visibility on the revenue front. The company received the first order for capacitive touch-based switch for ambient lighting during the current quarter from an Indian four-wheeler OEM for its EV model. It achieved highest ever quarterly production in 4-wheeler as well as 2-wheeler alloy wheel on account of commissioning of capacity expansion and robust OEM demand. The two-wheeler alloy wheel business has also grown with commissioning of two lines aggregating to additional 1.4 million capacity out of two million planned. The first line started in July 2023, while second plant started in August. The third plant is expected to start commissioning in coming quarter.

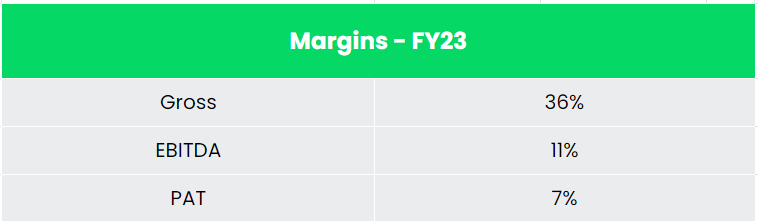

- Q2FY24 – During the period, the company crossed highest ever quarterly revenues and profits. It reported a revenue of Rs.3,621 crores, a 26% growth YoY amidst a flattish production volume of the auto industry during the quarter. EBITDA grew by 26% YoY from Rs.318 crores in Q2FY23 to Rs.402 crores in Q2FY24. Net profit stood at Rs.225 crores, an increase of 32% YoY compared to the same period previous quarter. The EBITDA and PAT margin for the quarter was 11% and 6% respectively, with the recently commissioned plants yet to reach optimal production levels to fully absorb the fixed and semi-variable costs.

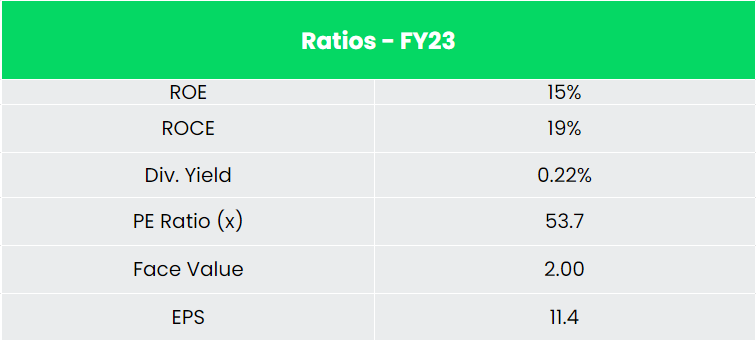

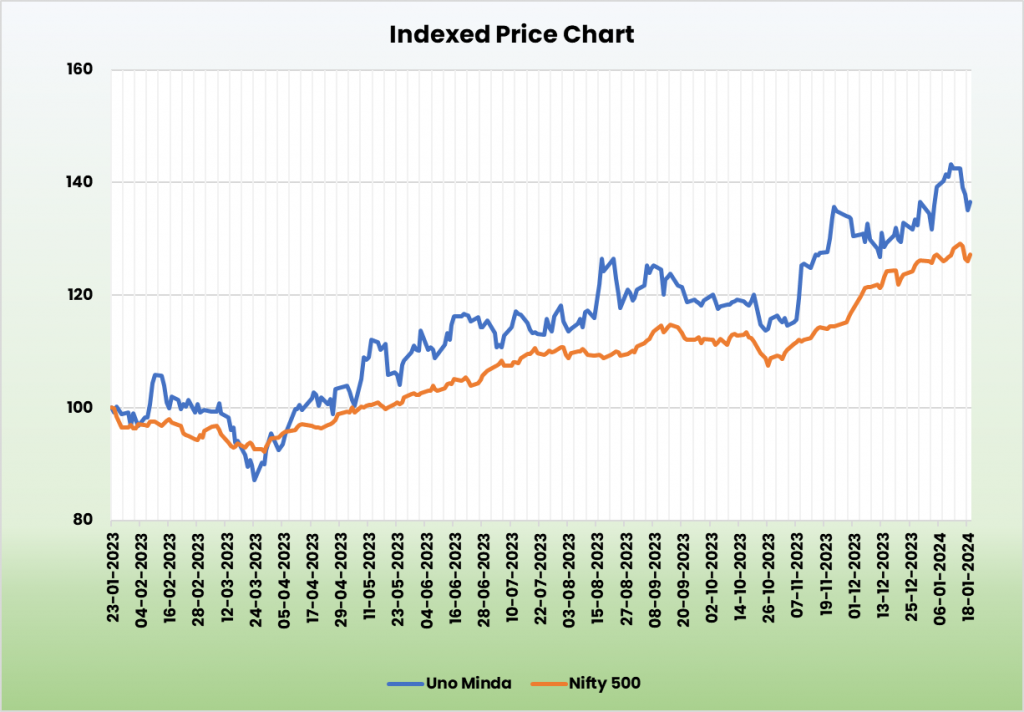

- Financial performance – Uno Minda has generated a revenue and PAT CAGR of 20% and 18% over the period of 5 years (FY18-23). Average 5-year ROE & ROCE is around 14% and 15% for FY18-23 period. The company has strong balance sheet with a robust debt-to-equity ratio of 0.37.

Industry

India is the world’s third-largest automobile market, the largest manufacturer of three-wheelers, passenger vehicles, and tractors, and the second-largest manufacturer of two-wheelers. Rising middle-class income and a huge youth population will result in strong demand in the automotive industry. The Indian automobile industry has historically been a good indicator of how well the economy is doing, as the automobile sector plays a key role in both macroeconomic expansion and technological advancement. The growing presence of global automobile Original Equipment Manufacturers (OEMs) in the Indian auto components industry has significantly increased the localization of their components in the country. The Indian passenger car market was valued at US$ 32.70 billion in 2021, and it is expected to reach a value of US$ 54.84 billion by 2027 while registering a CAGR of over 9% between 2022-27. The global EV market was estimated at approximately US$ 250 billion in 2021 and by 2028, it is projected to grow by 5 times to US$ 1,318 billion.

Growth Drivers

With a view to encourage foreign investment in the automobile sector, the Government of India (GoI) has allowed 100% FDI under the automatic route. The Automotive Mission Plan 2016-26 is a mutual initiative by the Government of India and the Indian automotive industry to lay down the roadmap for the development of the industry. PLI schemes in automobile and auto component sector with financial outlay of Rs 25,938 crore was introduced under Atmanirbhar Bharat 3.0. GoI backed scheme FAME – Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India was extended for a further period of 2 years up to 31 March, 2024.

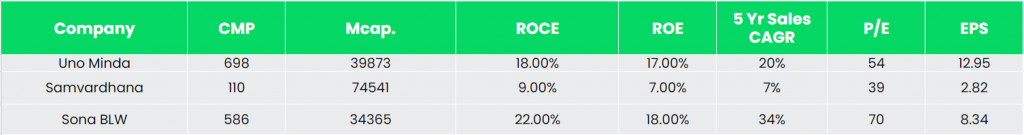

Competitors: Samvardhana Motherson International Ltd, Sona BLW Precision Forgings Ltd etc.

Peer Analysis

In comparison with its listed peers, with a reasonably steady revenue growth, Uno Minda has better return ratios and robust earnings potential, indicating the company’s financial stability and its efficiency to generate income and returns from the invested capital.

Outlook

Amidst the heightened global uncertainty, the Indian economy has proved to be more resilient than many large economies of the world. Historically, growth in overall economy translates into robust growth for auto sector. We expect Uno Minda to sustain its established market position in the expanding Indian automotive component sector. UML’s well-diversified business profile with presence across automotive and product segments, and strong technological collaborations in line with R&D projects builds its business prospects. The company is expected to continue to maintain its leadership position in key product segments, and further strengthen the business profile, going forward, as supplies on newly commissioned plants ramp up further.

Valuation

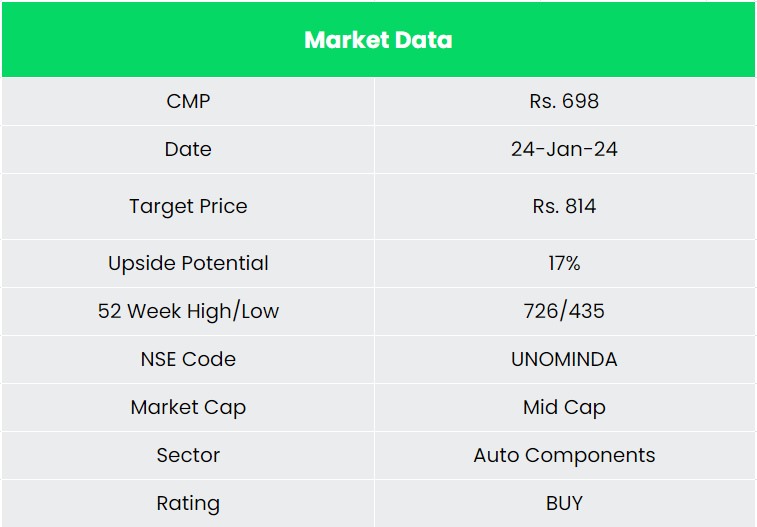

With the introduction of new models, attractive promotional offers and premiumization in the automobile industry, the demand for automobile ancillary products are expected to increase from the OEMs. We recommend a BUY rating in the stock with the target price (TP) of Rs. 814, 17x FY25E EPS.

Risks

- Geopolitical crisis – Geopolitical risks such as war outbreaks, government instability or any other social unrest of the like may result in acute supply chain disruption and impact the production levels of the company.

- Forex Risk -The company has significant operations in foreign markets and hence is exposed to forex risk. Any unforeseen movement in the forex market can adversely affect the company.