I am certainly not claiming you can time the markets when I say buy low and sell high. But then, you can book profits in inflated assets and buy more in to assets that have devalued in a systematic manner. Yes, it’s all about portfolio rebalancing.

Most of you would be aware of our recently launched Smart Solutions that offers portfolios for various life goals. Yes, choosing right funds is only one part of the solution. The rest is all about disciplined portfolio maintenance, and rebalancing plays a key here especially if you have long-term goals.

Here’s what rebalancing is all about and how a disciplined rebalancing strategy can boost your portfolio.

Portfolio rebalancing simply means bringing your asset allocation back to the originally targeted allocation. That means bringing it back to the desired risk and return proposition you bargained for, when the portfolio goes out of kilter.

If you had targeted a 60:40 equity:debt allocation and started investing accordingly but find a while later that your equity is inflated to 72% because of a rally (and debt consequently fell to 28%), then by rebalancing it, you simply book some profits at higher valuations and deploy them in a lesser valued asset, such as debt in this example.

Realignment

By helping you book profits when asset prices have risen and invest when asset prices have fallen, portfolio rebalancing helps you to control risk and realign it with your own investment goals. In this process it helps enhance your portfolio performance.

While there is no guarantee that rebalancing improves performance at all times, over longer periods, history suggests that portfolio rebalancing helps you gain a ‘not-so-insignificant’ sum compared with a portfolio that was not rebalanced.

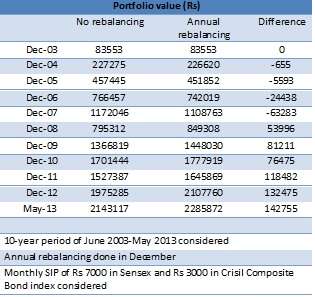

The illustration below shows 70:30 equity:debt portfolio invested through monthly SIPs of Rs 10,000 over the last 10 years. One of them did not undergo any portfolio rejig, although the monthly SIP was continued in the 70:30 ratio. The other portfolio was asset balanced during the last instalment of every calendar year. In other words it was brought back to the 70:30 ratio.

The table below shows that portfolio rebalancing did not do much to boost gains in a one-sided rally. The benefits begin to show in volatile markets beginning 2008. Overall, the IRR of the portfolio without rebalancing was 11.3% while the one that had an annual rebalancing done delivered 12.5% annually.

Hot assets, cold assets

Why should you rebalance? Because historical data suggests that asset classes mostly (note the emphasis) mean revert.

Shun these stylish terms; it simply means that something that has gone out of norm will turn back. That means the super performers of a few years will turn out to be mediocre/underperforming ones over the next few years and vice versa.

By rebalancing, you ensure that you sell those investments that have turned hot (or are about to burst) and invest into those that are currently cold or out of favour but should go up, if history suggests anything.

Yes, you certainly cannot time your investments in a way that you exit the Sensex at its peak or enter debt just before a yield fall. What you can do is periodically shuffle your portfolio to bring it back to where it started off with.

Easier said than done. If you are holding a portfolio of funds, this requires you to sell a few funds, buy in to a few others and of course do your math. If you can do it, nothing like that. If you are a FundsIndia customer, then you have a readymade solution.

The solution

Smart Solutions will provide you with simple rebalancing solutions periodically, which can be executed (the sell transactions and the buy transactions in specific funds) with a click of a button. The original equity:debt:gold allocation will be balanced to ensure that your risks are reigned in and your portfolio performs efficiently.

Dear Vidya,

A plain article re-iterating the importance of Portfolio Balancing.

Lately, i have been going through this topic to understand the core of re-balancing a portfolio, of which i have few doubts to ask.

1. How often should a portfolio be re-balanced?

a). In case of a rallying market?

b). In case of a volatile market – as we are in now?

c). In case of any crash that happens (be it a market crash that happens in a months time or that takes a few years).

2. When i am rebalancing a portfolio, should i just look at the end investment ratio? – Let me explain this.

Say i have invested 1000 into Quantum Long Term Equity, 1000 into Franklin India Blue Chip, these being Diversified Equity Funds.

And, say i have invested 1000 into Birla Sun Life Dynamic Bond Fund.

Would my allocation be 66% into Equity and 34% into Debt??? (Ignoring the decimals).

And hence, if my original asset Allocation was 66-34 Equity and Debt respectively, any deviation from this allocation will assertain the need for balancing right??

Is this a way to rebalance?

OR

Should i be seeing the actual Equity Allocation of my Diversified Equity Investments, Cash parts and Debt Investment, and every time they buy into or sell Stocks (IN Equity Funds) should i be rebalancing my portfolio.

FYI. I understand that minimum rebalancing time should be 6 months (Review in 6 months and act upon).

Could you please clear my doubts.

Thanks in Advance,

Sunil.

Hello Sunil,

That’s a very detailed comment. If you wish to do your own rebalancing, you can read up a bit on the internet. There is plenty of material on the subject. Here’s one such: http://www.forbes.com/sites/rickferri/2013/02/21/choices-in-portfolio-rebalancing/

To answer your questions:

Portfolio rebalancing can be done:

1. either on a regular periodicity, typically annually or even once in 2 years for a long portfolio. A review can be done 6 months but rebalancing should be longer to avoid unnecessary churning costs.

2. or on a trigger basis. say your market value of allocation has moved say 5-10% from original portfolio allocation, then rebalancing can be done.

The second is more difficult; the first is simple to follow.

Thanks,

Vidya

Thanks Vidya,

I shall go through the material.

Yes, i feel so that my first approach is going to be easy than the second one.

Yes, i have this threshold set on my portfolio upto 5%.

Thanks once again for your articles.

Regards,

Sunil.

I posted the following comment using the Facebook plugin, but no one responded.

So re-posting in FundsIndia blog’s own comments section:

When you say “The other portfolio was asset balanced during the last instalment of every calendar year… “, do you mean you did not sell off the overvalued part of the equity/debt component & bought the undervalued part? Rather just adjusted the buy amount of the equity/debt components so as to maintain the 70:30 ratio?

Hello Amit, Thanks. We got your Facebook comment. We check and respond to comments in a periodic manner.

Yes, in this instance, the overvalued part is sold and the undervalued asset is bought. But there is another way of doing rebalancing, where one can bring in fresh money if they can spare such a sum. Thanks, Vidya

Dear Vidya,

A plain article re-iterating the importance of Portfolio Balancing.

Lately, i have been going through this topic to understand the core of re-balancing a portfolio, of which i have few doubts to ask.

1. How often should a portfolio be re-balanced?

a). In case of a rallying market?

b). In case of a volatile market – as we are in now?

c). In case of any crash that happens (be it a market crash that happens in a months time or that takes a few years).

2. When i am rebalancing a portfolio, should i just look at the end investment ratio? – Let me explain this.

Say i have invested 1000 into Quantum Long Term Equity, 1000 into Franklin India Blue Chip, these being Diversified Equity Funds.

And, say i have invested 1000 into Birla Sun Life Dynamic Bond Fund.

Would my allocation be 66% into Equity and 34% into Debt??? (Ignoring the decimals).

And hence, if my original asset Allocation was 66-34 Equity and Debt respectively, any deviation from this allocation will assertain the need for balancing right??

Is this a way to rebalance?

OR

Should i be seeing the actual Equity Allocation of my Diversified Equity Investments, Cash parts and Debt Investment, and every time they buy into or sell Stocks (IN Equity Funds) should i be rebalancing my portfolio.

FYI. I understand that minimum rebalancing time should be 6 months (Review in 6 months and act upon).

Could you please clear my doubts.

Thanks in Advance,

Sunil.

Hello Sunil,

That’s a very detailed comment. If you wish to do your own rebalancing, you can read up a bit on the internet. There is plenty of material on the subject. Here’s one such: http://www.forbes.com/sites/rickferri/2013/02/21/choices-in-portfolio-rebalancing/

To answer your questions:

Portfolio rebalancing can be done:

1. either on a regular periodicity, typically annually or even once in 2 years for a long portfolio. A review can be done 6 months but rebalancing should be longer to avoid unnecessary churning costs.

2. or on a trigger basis. say your market value of allocation has moved say 5-10% from original portfolio allocation, then rebalancing can be done.

The second is more difficult; the first is simple to follow.

Thanks,

Vidya

Thanks Vidya,

I shall go through the material.

Yes, i feel so that my first approach is going to be easy than the second one.

Yes, i have this threshold set on my portfolio upto 5%.

Thanks once again for your articles.

Regards,

Sunil.

I posted the following comment using the Facebook plugin, but no one responded.

So re-posting in FundsIndia blog’s own comments section:

When you say “The other portfolio was asset balanced during the last instalment of every calendar year… “, do you mean you did not sell off the overvalued part of the equity/debt component & bought the undervalued part? Rather just adjusted the buy amount of the equity/debt components so as to maintain the 70:30 ratio?

Hello Amit, Thanks. We got your Facebook comment. We check and respond to comments in a periodic manner.

Yes, in this instance, the overvalued part is sold and the undervalued asset is bought. But there is another way of doing rebalancing, where one can bring in fresh money if they can spare such a sum. Thanks, Vidya

Dear Vidya,

I have one more doubt related to Balancing a portfolio.

Say for example, i have 50% Equity and 50% Debt proportion in my portfolio, and if all my assets are depreciating…. every time i will be left with only 50% Equity and 50% Debt.

I understand this scenario will rarely occur, but in current situation, where in the Debt and Equity both are getting beaten down, what process should one follow in order to rebalance (If at all he has to do it).

Also, as per your latest answer on how to rebalance, inducing more money to adjust the asset allocation would be more efficient or rebalancing “overvalued part is sold and the undervalued asset is bought”

Hello Sunil, its highly theoretical for equity and debt to fall at the same pace. Equity’s pace of fall is normally much higher. Even assuming, your question is possible, clearly if you are running an SIP, then you would be adding more money in any case to average on lows and there is no need to infuse fresh money for rebalancing as the balance is maintained. In case of lump sum, you will have to be careful about infusing fresh money as timing becomes important then.

Bringing in fresh money is evidently more wealth accretive because you are simply saving more. But obviously much would depend on your ability to infuse more money. Hence, rather than efficiency, it is ability which should determine your choice.

thanks

Vidya

Dear Vidya,

I have one more doubt related to Balancing a portfolio.

Say for example, i have 50% Equity and 50% Debt proportion in my portfolio, and if all my assets are depreciating…. every time i will be left with only 50% Equity and 50% Debt.

I understand this scenario will rarely occur, but in current situation, where in the Debt and Equity both are getting beaten down, what process should one follow in order to rebalance (If at all he has to do it).

Also, as per your latest answer on how to rebalance, inducing more money to adjust the asset allocation would be more efficient or rebalancing “overvalued part is sold and the undervalued asset is bought”

Hello Sunil, its highly theoretical for equity and debt to fall at the same pace. Equity’s pace of fall is normally much higher. Even assuming, your question is possible, clearly if you are running an SIP, then you would be adding more money in any case to average on lows and there is no need to infuse fresh money for rebalancing as the balance is maintained. In case of lump sum, you will have to be careful about infusing fresh money as timing becomes important then.

Bringing in fresh money is evidently more wealth accretive because you are simply saving more. But obviously much would depend on your ability to infuse more money. Hence, rather than efficiency, it is ability which should determine your choice.

thanks

Vidya

Dear Vidya

Your articles are very much informative and most importantly they are written in very simple & lucid language.

Thanks

Thanks Mohit. Rgds, Vidya

Dear Vidya

Your articles are very much informative and most importantly they are written in very simple & lucid language.

Thanks

Thanks Mohit. Rgds, Vidya