Hedging risks in a balanced portfolio

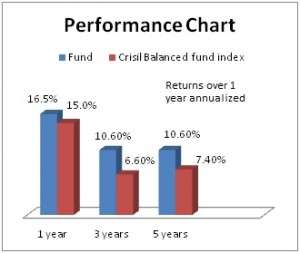

ICICI Pru Equity – Volatility Advantage (earlier called ICICI Pru Equity & Derivatives Fund – Volatility Advantage Plan or ICICI Pru VAP) has adeptly managed the volatile markets of the last 3 years to deliver compounded annual returns of 10.6%, better than the balanced fund category average of 6% as well as benchmark Crisil Balanced index’ return of 6.6%.

Its performance has pushed it to the spotlight in recent quarters. What exactly is this fund’s strategy and how different is it from balanced funds? Read on:

The fund and suitability

ICICI Pru Equity Volatility Advantage is classified as an equity-oriented balanced fund in most online portals. Yes, it seeks to hold at least 65% in equities like most other balanced funds and the rest in debt. Only, its equities need not be only cash positions. The fund will have the flexibility to hedge its equity positions with derivatives and also take on derivative positions in the index.

Simply put, the fund uses derivative hedging strategies in its equity holding. This makes it one notch less risky than normal balanced funds, especially in volatile/down markets.

But that also means that in sudden rallying markets, the fund’s hedged positions, if any, may place a cap on the returns it can manage. The fund is therefore suitable for investors who are looking for returns higher than debt-oriented funds (such as MIPs) and wish to take risks lower than balanced equity funds.

The key positive about this fund is its ability to reduce risks even while being classified as an equity fund for tax purposes. That means, you can have nil capital gains tax in the fund if held for more than a year, while assuming risks that are a few notches higher than regular debt-oriented funds.

Performance

ICICI Pru Equity Volatility Advantage has an excellent track record of beating its benchmark almost all the times on a rolling one-year return basis for the last 3 years. However, over a longer period of 5 years, the fund beat its benchmark a less impressive 72% of the times.

This was because it took a good bit of hit in 2008. Its higher cash equity position at the beginning of the year did cause some damage. But it managed the market fall in 2011 much better, falling by 8.7% even as the benchmark fell by over 14%.

That said, in sharp rallying markets, a defensive position can cap returns. In 2009 for instance, the fund delivered a good 10 percentage points lower than balanced fund category-average return suggesting that its hedging strategy worked against it. But in markets such as 2012, when rallies were more predictable, the fund changed tack with ease and managed returns superior to the category.

It may be fair to position this fund between debt-oriented funds such as MIPs and balanced funds in terms of its risk-return profile.

Portfolio

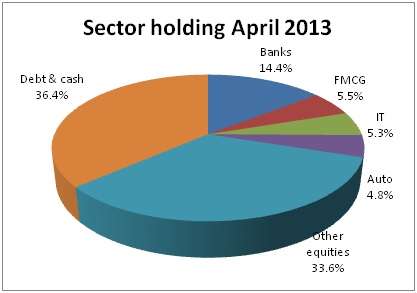

ICICI Pru Equity Volatility Advantage has a portfolio of equities biased towards large-cap stocks. Net of the 3.6% exposure to derivatives, the fund held about two thirds in equities and rest in debt as of April 2013.

The fund’s debt portfolio, unlike its sister fund ICICI Pru Balanced, is skewed towards short-to-medium -term maturity instruments. For instance, as of April, its debt portfolio sported an average maturity of 0.9 years compared with the Balanced fund’s maturity of 5.98 years. Even while it did increase portfolio maturity compared with its holding at the beginning of 2013, it evidently preferred to keep its risks at bay by holding to shorter maturity buckets.

The fund is managed by Manish Gunwani and Manish Banthia. The fund was launched in end 2006 and was renamed twice.

I am a joint holder of this scheme, please let me know how to redeem this mutual fund

Folio no. 2073069/45

Please get in touch with your distributor or download common form 9that includes redemption) in the fund house’s website. If it is offline, then both he joint holders have to sign to redeem.

I am a joint holder of this scheme, please let me know how to redeem this mutual fund

Folio no. 2073069/45

Please get in touch with your distributor or download common form 9that includes redemption) in the fund house’s website. If it is offline, then both he joint holders have to sign to redeem.