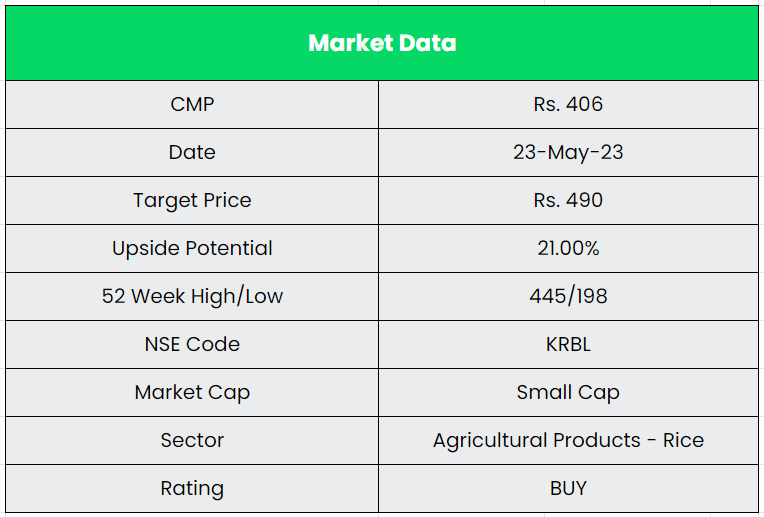

KRBL Ltd. – India Gate Basmati Rice

With a rich industry experience of more than a century, KRBL Limited today has created its place as the top player in the Indian rice industry and also as India’s first integrated rice company. Operating primarily in the realm of manufacturing and marketing of rice products, the Company’ success has been derived by operating responsibly, executing adeptly, manufacturing innovatively and capturing new opportunities proactively. KRBL has its two manufacturing facilities spread across the states of Uttar Pradesh (Gautam Budh Nagar) and Punjab (Dhuri). The four state-of-the-art grading, sorting, and packaging facilities of KRBL are located at Sonipat, Gautam Budh Nagar, Dhuri, and Alipur. With its corporate office in Noida, UP and registered office in Delhi, KRBL has its product presence not only in India but also across the globe. KRBL exports basmati rice products to 90+ countries and leads the basmati rice consuming market in the branded segment.

Products & Services:

The Company offers its rice under a range of brands, including India Gate, Nur Jahan, Telephone, Train, Unity, Lotus, Lion, Doon, Aarati, Shubh Mangal, Al Wisam, Al Bustan, Alhussam, Blue Bird, City Palace, Necklace, Southern Girl, Taj Mahal Tilla, Bemisal and Indian Farm, among others.

Subsidiaries: As on FY22, the Company has two Subsidiaries viz., KRBL DMCC, Dubai and K B Exports Private Limited, India.

Key Rationale:

- Leading player in Indian basmati rice sector – KRBL is a fully-integrated rice company with an operational track record of over three decades. Moreover, the company’s promoters have several decades of experience in the basmati rice industry. It is India’s largest exporter of branded basmati rice. The company’s brand “India Gate” is recognised as the world’s no.1 Basmati Brand. KRBL’s agri-business is integrated in nature with presence across the value chain comprising contact farming and seed development, milling of paddy, captive husk-based power generation and processing of by-products. Moreover, a wide distribution network and established client base have enabled KRBL to emerge as one of the leading players in the industry.

- Expansion – The company’s facilities are suitably located in Punjab, Uttar Pradesh and Haryana, ensuring easy access to the key raw material, paddy, which is procured during the harvest season (October to January). Moreover, these states have numerous other small-to-medium-sized basmati rice milling units, which provide semiprocessed/milled rice to KRBL for its processing facility. The company is on the process of opening three new plants where the first one is situated in Gujarat which is expected to begin production in April 2024. The company has acquired land for its second plant in Karnataka and is looking for land in Madhya Pradesh for its third plant. Total Capex of Rs.250 crs will be spread between the next two financial years.

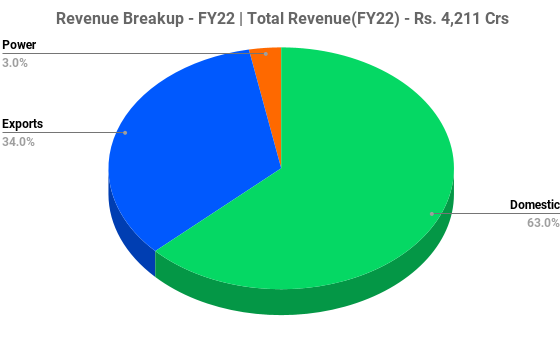

- Q3FY23 – The company reported highest ever quarterly revenue of Rs.1536 crs, an increase of 33% YoY in Q3FY23. The revenue growth is supported by both the domestic and exports segment. Segment wise, Domestic business reported a revenue growth of 32% YoY to Rs.998 crs in Q3FY23 and exports business reported a revenue growth of 38% YoY to Rs.523 crs for the same period. The gross margin of the company improved from 20% in Q3FY22 to 28% in Q3FY23. The EBITDA for the company reported a massive 158% YoY growth to Rs.279 crs with a margin of around 18%. The profit after tax of the company had a growth of 180% YoY to Rs.205 crs. Three new regional variants of rice launched in the market namely Sona Masoori, Gobindobhog and Kolam rice.

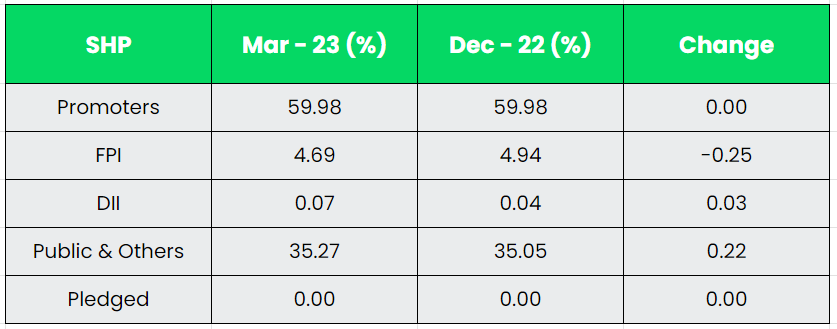

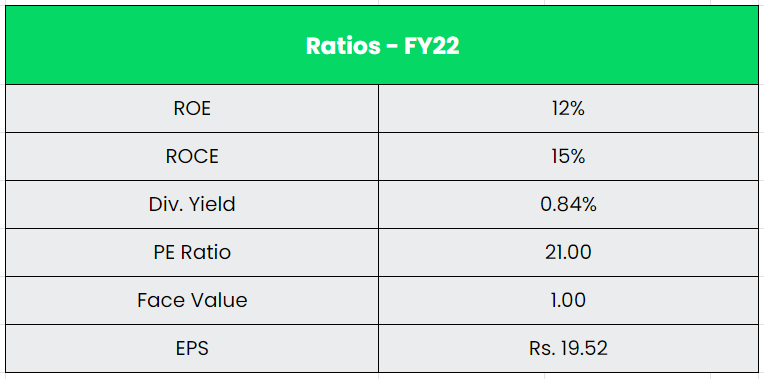

- Financial Performance – The company’s inventory position as on Q3FY23 is Rs.4436 crs vs. Rs.3168 crs last year. The inventory position splits into Paddy segment at Rs.2252 crs and Rice segment at Rs.2018 crs. Working capital days increased on account of higher inventory. The company’s revenue and PAT have grown at a CAGR of 10% and 17% between FY12-22. The company’s reserves have grown at a CAGR of 17% between FY17-22. The company’s liquidity position is strong with an overall cash and Investments of ~Rs.1600+ crs with a low debt to equity ratio of 0.03x.

Industry:

India accounts for more than 22% of the world’s rice production through its 48 million hectares of rice plantation area – only 2.4% of the global land. Considered as the staple food for nearly 70% to 75% of the national population, the Indian rice industry is still being largely dominated by unorganised players because of the easy availability of rice through small retail stores. India has been the world’s largest exporter of rice since 2012. Currently, India exports more rice than the combined shipments of the next three largest exporters – Thailand, Vietnam and Pakistan. India’s rice exports have crossed a record $11 billion in 2022-23, an increase of 16% from FY22. The volume of shipment, however, remained around the same level as last year at 22 million tonnes (MT). In FY22, India, which has an around 45% share in global rice trade, exported more than 21 MT of rice valued at $9.6 billion. The increased realisation in rice exports has been achieved despite banning broken rice shipment and the imposition of exports tax of 20% on white rice in India last year. India has shipped $11.14 billion of rice, which includes basmati ($5 billion) and non-basmati ($6.14 billion) during FY23. In terms of volume, the country has exported 4.9 MT of aromatic and long grain basmati and 16.1 MT of non-basmati rice. India annually exports 4.5-5 MT of basmati rice and has an 80% share in the global trade of aromatic rice.

Growth Drivers:

- India’s branded basmati rice penetration is only at 20% (% of the household penetrated) and the overall basmati rice penetration is at 41%. So, there is a huge room for penetration in the branded Basmati rice segment.

- Provision of Rs.450 crs has been made for the Digital Agriculture Mission started by the Government, and about Rs.600 crs allocated for the promotion of Agriculture sector through technology.

- An increase in demand for personal care and home care products along with rapid urbanisation, higher income levels, and evolving preferences is expected to drive growth in surfactants consumption.

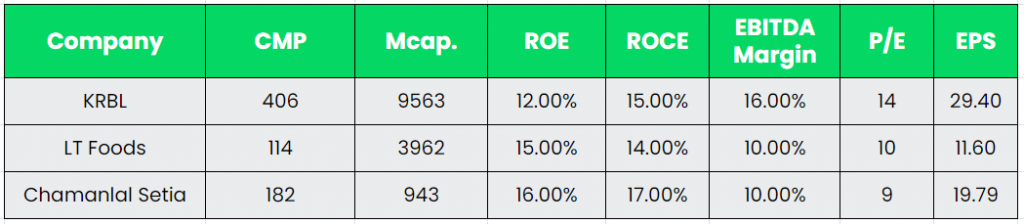

Competitors: Lt Foods Ltd, Chaman Lal Setia Ltd, Kohinoor, etc.

Peer Analysis:

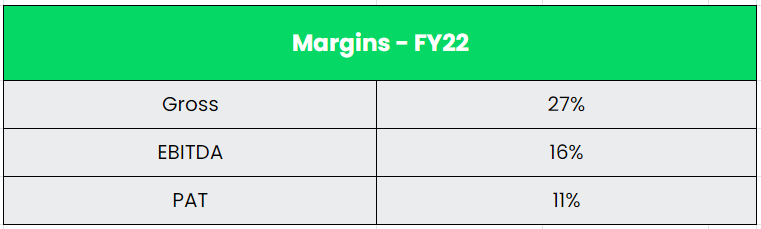

Amongst peers, KRBL has the best operating margin profile backed by its strong brand presence. The balance sheet of the KRBL is strong than its peers in terms of debt profile and reserves growth. We took TTM EPS and P/E for comparison.

Outlook:

KRBL has expanded outlet penetration by 15% YoY to reach a numeric distribution of 39.2%, and has expanded its distributor count by 40% to take the number to an upward of 700-plus dealers and distributors. The company procured around 40% higher basmati paddy this year at a competitive price. Average price of basmati paddy procurement from last year is 15% higher. KRBL is targeting 20%-25% of the HoReCa (Hotels, Restaurants & Café) segment, and is looking at doubling its revenues in this segment in the next two years. It is also developing pesticide-free and resistance-free commodity varieties, which will help capture the European and American markets, and are expected to be available in FY24. The Management highlighted that the market value will always be 15-20% higher than the procured value of the inventory. Based on that, the market value of the company’s inventory will be around Rs.5000 crs. In the exports business, KRBL has shortlisted 2-3 distributors in Saudi Arabia, and hopes to finalize one of them in a very short period. The board hinted that they may discuss on rewarding the shareholders through a dividend or Buyback in the upcoming meeting.

Valuation:

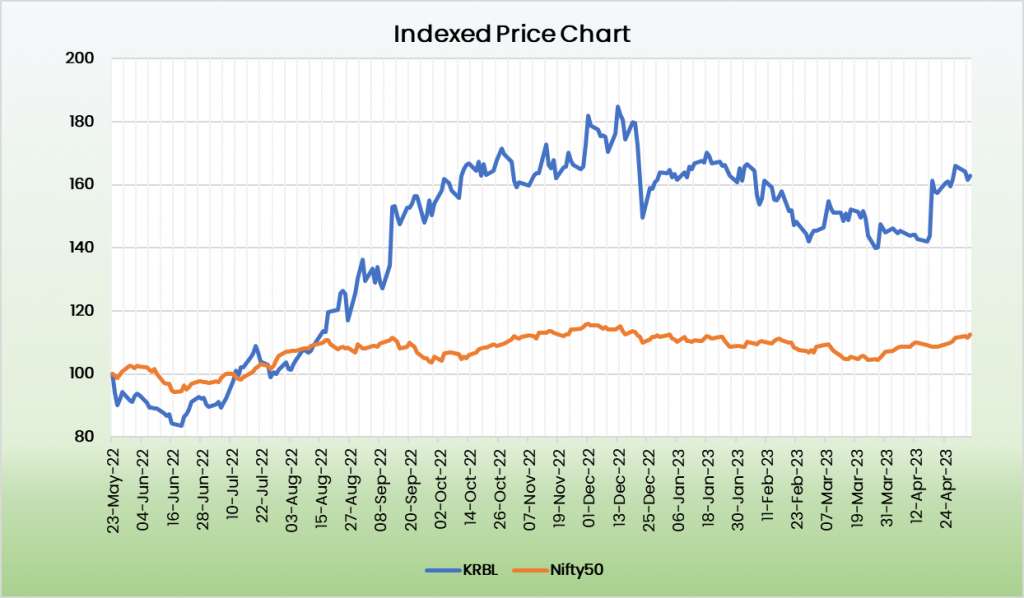

The company has been able to maintain sales and realization growth momentum and is expected to continue to do so on the back of brand strength, market reach, robust selling & distribution network, established presence in Middle-East, ample capacity and right product-mix. We recommend a BUY rating in the stock with the target price (TP) of Rs.490, 16x FY25E EPS.

Risks:

- Regulatory Risk – The company is exposed to the changes in the trade policies of key importing countries, which can impact export revenues. The company is also exposed to the changes in Government regulations, as witnessed recently like the ban on export of broken rice and levy of 20% duty on some varieties of non-basmati rice.

- Climate Risk – Given its operations in the agricultural industry, the company is highly exposed to climate change risk which result in the bad or improper monsoons.

- Competitive Risk –The basmati rice industry is highly fragmented and is marked by the presence of numerous organized and unorganized players. This intensifies competition and limits the pricing flexibility of the industry participants. However, KRBL benefits to an extent because of its strong brand presence.