Defying gravity, the Nifty continues its march up. We turned bullish right near the recent swing low at 5,477 and expected a rally to 5,800, followed by 5,970. The surge beyond 5,970 took us by surprise, but those holding long positions would be riding the trend as the trailing stop loss has never been under threat.

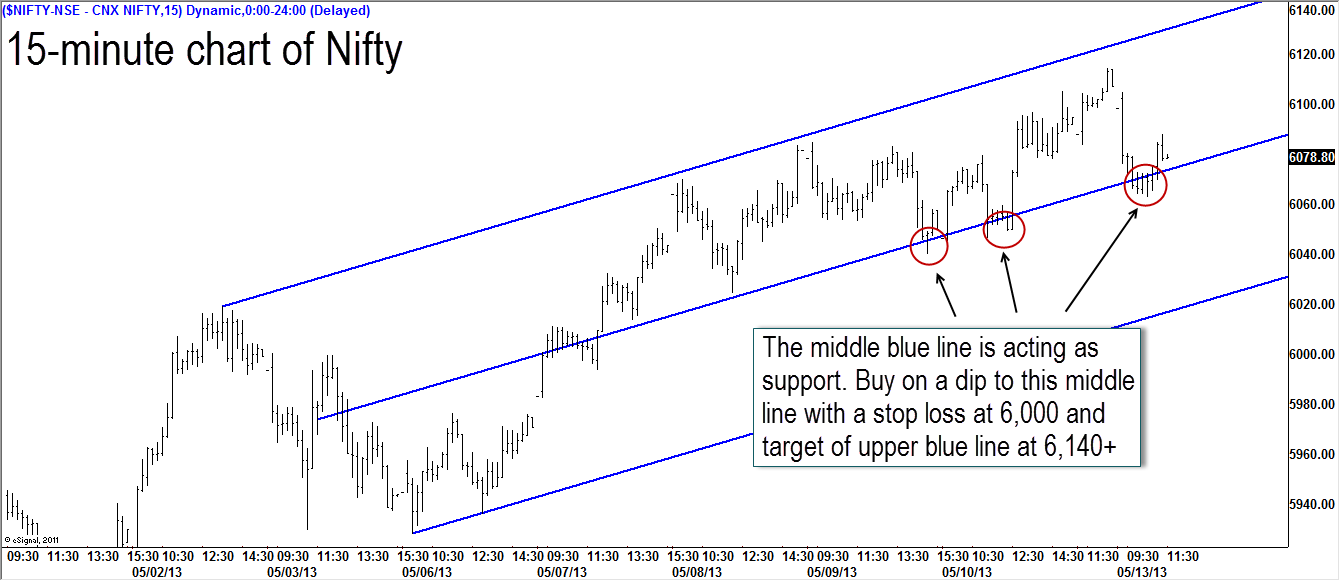

Have a look at the 15-minute chart of the Nifty featured below. The index has progressed in a steady sequence of higher highs and higher lows. This bullish sequence has not been under threat even in this smaller time frame, which is a sign of immense strength.

Given this scenario, it makes little sense to short the Nifty, in anticipation of a turn or a short-term correction. A safer strategy would be to buy on dips, with an appropriate stop loss. For those itchy to short the Nifty, please wait until the swing low of 6,024 (in the 15-minute chart) is breached.

At this point, we do not see any compelling trading idea. Compulsive short-term or intra-day traders may consider long position on weakness, with a stop loss at 6,000 (just below the swing low of 6,024) for a target of the upper blue line at 6,140+.

Trade Safe and Don’t Get Hurt.