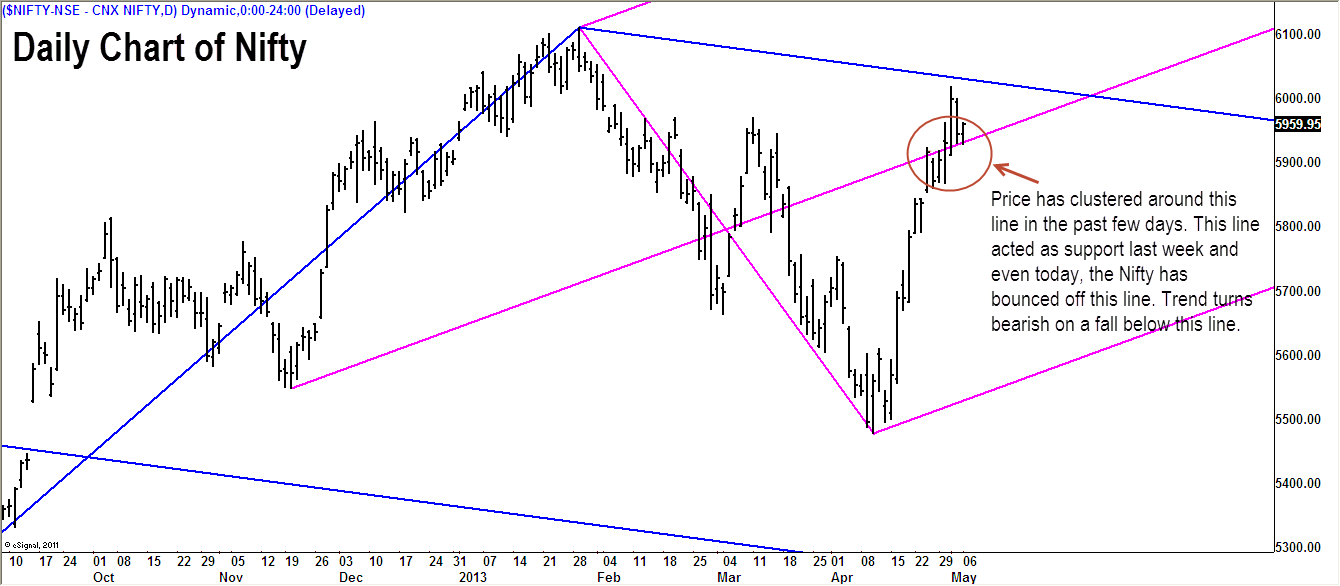

The Nifty managed to move past the well-advertised resistance level of 5,970 on Thursday. It still remains to be seen if this breakout is a genuine one or just a ploy to trap amateur breakout traders. From a trading perspective, the question to ponder is: Have we made a higher low at 5,477 or is the recent high of 6,020 the next lower high. There is no definitive answer to this question and we just have to await clues from the price to indicate one way or the other.

From the above daily chart of the Nifty, it is apparent that there are still no signs of weakness. The rally off the 5,477 low has been strong and has been devoid of any significant correction. Hence, it makes sense to wait for a pull back before considering long position. The other problem with considering long position is the absence of any logical place for stop loss placement.

Those holding long positions in the Nifty, may trail their stop at 5,900. While there is no reason to consider fresh shorts, a fall below the middle magenta line would be a sign of weakness and would justify short positions with a stop loss above the recent swing high. As highlighted in the above chart, the middle magenta line is the key support and the Nifty has bounced off this line today.

To summarize, we still do no see any compelling trading opportunity in the Nifty based on the recent price action. A fall below 5,890 may be used to consider short positions.