This article was originally published in The Times of India. Click here to read it.

There is a fascinating saying in the 2,500 year old Chinese text ‘The Art of War’ authored by Sun Tzu.

“If you know the enemy and know yourself, you need not fear the result of a hundred battles;

If you know yourself but not the enemy, for every victory gained you will also suffer a defeat;

If you know neither the enemy nor yourself, you will succumb in every battle.”

Okay, but what does this have to do with investing?

While this short but powerful quote has little to do with investing, it actually embodies all the wisdom we need to deal with periods of market declines.

Volatility in the equity market is inevitable, but as Sun Tzu says, we can prepare our portfolio for it by knowing the enemy (read: market volatility) and knowing ourselves.

1. Knowing Equity Market Volatility

Equity markets rarely go up in a straight line. Infact, if we take a look at the past 42 years of market history, the Indian equity market (represented by Sensex) has experienced 10-20% declines almost every year.

Further, there have also been declines which were much larger in magnitude such as the Global Financial Crisis in 2008 (61% fall) and the Covid Crash in 2020 (38% fall).

Roughly every 7-10 years, there has been a temporary decline of 30-60%. The market took 1-3 years to recover from such larger market declines.

2. Knowing Ourselves

All of us have our own set of financial goals which we would like to achieve within a specific time frame. We save and invest in order to achieve these goals. And these investments are chosen based on our return expectations, risk appetite etc.

Now that we have a good understanding of the market volatility and of ourselves, let us apply this knowledge to our portfolio.

Here’s how you can prepare your portfolio for market crashes…

1. Choose your ideal asset allocation (factoring in the risk expectations)

You can choose your asset allocation based on your investment timeframe, portfolio return expectations and risk appetite. Figuring out the timeframe and return expectation is fairly straightforward, but determining the risk appetite has always been a challenge.

One way to address this is by determining your portfolio risk expectations, i.e. the temporary declines you might have to deal with in your investment journey.

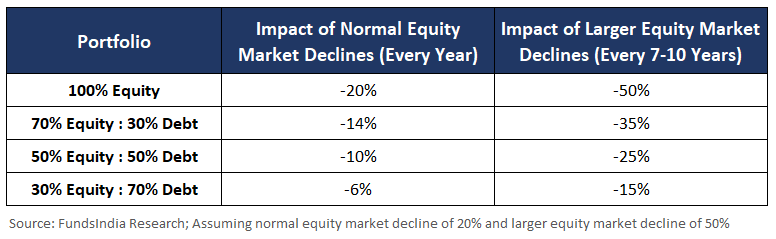

Here is a rough guide indicating the risk expectations at different asset allocation levels

If your asset allocation is ‘50% Equity : 50% Debt’, for example, you implicitly agree to temporary declines of ~10% every year and ~25% every 7 to 10 years in your overall portfolio.

By factoring in these risk expectations in your investment plan, you can be well prepared to accept and handle the market volatility.

2. Rebalance Periodically

Asset allocation tends to change over a period of time depending on the performance of the underlying investments. When your equity allocation significantly exceeds your planned allocation, you may experience declines that are much greater than your original expectation. So, rebalance your portfolio back to your planned asset allocation annually if there is a deviation over 5%.

3. Diversify your Equity Investments

By investing purely based on recent returns, you are likely to end up with a portfolio concentrated in a few styles/themes. When such styles/themes go out of favour, your entire portfolio might go through prolonged underperformance. So, diversify your portfolio across different proven investment styles, market caps and geographies in order to create a well diversified long term portfolio which provides superior returns with lower volatility across a market cycle.

4. Be Ready with a Crisis plan

Even though market crashes can be really frightening when they happen, they often present the best buying opportunities in hindsight.

Earmark a portion of your debt allocation which can be deployed into equities if market corrects

- If Equity Market falls by ~20%, then move x% from the earmarked debt portion to equities

- If Equity Market falls by ~30%, then move y% from the earmarked debt portion to equities

- If Equity Market falls by ~40%, then move z% from the earmarked debt portion to equities

- If Equity Markets fall by ~50%, then move the remaining amount to equities

This is a rough plan for illustration and can be adapted based on your investment goals, time frame and risk appetite.