For those testing waters in equities

Have you traditionally been a debt investor but now wish to test waters in equities? Then, debt-oriented funds such as Birla Sun Life MIP II Savings 5 (Birla Savings 5), which have limited exposure to equities, may fit your requirement.

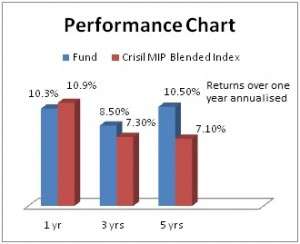

With a five year return of 10.5 per cent compounded annually, the fund managed a good 3-3.5 percentage points more than its benchmark Crisil MIP Blended Index, as well as its category average.

The fund appears well poised to capitalise on a falling interest rate scenario and has increased the average portfolio duration of its debt instruments in recent times.

Suitability

Birla Savings 5 is suitable only for conservative investors. If you want to make a beginning in equities and cannot take any short-term declines in your stride, then this fund will suit you. If you are already an equity investor and want to use a debt-oriented fund merely as a diversifier, then you may prefer peers from the HDFC and Reliance stable over this fund.

The latter funds hold a record of delivering superior returns in the long term, buttressed by a higher equity exposure of 20-25 per cent. Birla Savings 5, on the other hand, has restricted equity exposure to less than 10 per cent in volatile markets and at best goes to 15 per cent in rallying equity markets.

Use the fund as a launch pad into equities and hold a 2-3 year time frame while investing through SIPs. If you have a longer time frame of say five years or over, then lump sum investments can also be considered.

Performance

Birla Savings 5 has been a conservative fund as far as its equity calls go. It kept its equity exposure very low or nil during equity market routs. In the last few years of volatile markets too, it restricted equity holdings to about 10 per cent and focused well on the more lucrative debt segment.

As a result, its five year record is actually even better than top peers. But that also meant losing out on equity opportunities in years such as 2012. Hence, over a three-year period, the fund is next only to peers from HDFC and Reliance fund houses. In fact it marginally lagged its benchmark over a period of one year as a result of lower equities in 2012.

Still, in the last 3 years, on a rolling one-year return basis, it did not see any declines at all, even as its peers did, suggesting that it is suitable for investors wanting to contain falls.

While the fund has bucked the category trend in earlier years too, it did so by taking some risks in the debt component. In 2008 for instance, when most other MIPs and debt-oriented funds fell into negative territory, the fund managed a whopping 28 per cent return.

This return was possible not merely by avoiding equities, but by taking aggressive debt calls when rates fell (and long dated gilt instruments rallied). This did entail some risk. But since then, the fund has not been too bold with its debt exposure.

Portfolio

In the month ending March, quite a few debt-oriented funds have increased the average maturity of their portfolio and Birla Savings 5 too did so. This suggests that it is anticipating an interest rate fall and price rally in ensuing months.

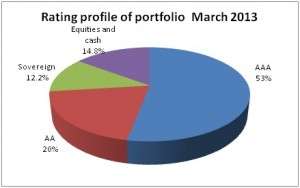

The fund has a majority of its assets in AAA-rated bonds. About 12 per cent of its assets are in government bonds and about 9.7 per cent of them in equities. Its equity portfolio has an eclectic mix of large-cap stocks such as ITC, Reliance Industries and NTPC, as well as mid- and small-cap stocks such as V-Mart Retail, City Union Bank and Jyothy Laboratories.

The fund has a track record since 2004 and is managed by Satyabrata Mohanty and Kaustabh Gupta from June 2009.

WHAT ABOUT BIRLA SUNLIFE WEALTH 25 WHERE I HAVE INVESTED RS 50000 3 YEARS AGO.

Hello Venkatraman, Wealth 25 has a higher proportion of equity – about 25-30%. That means it is a more aggressive debt-oriented fund than Savings 5. As equity has been volatile, Wealth 25’s returnss in the last 3 years will be average. Tks, Vidya

Looks like this fund will be a good substitute for people predominantly parking their savings in FDs and RDs. But is SIP the right way? Or We need to understand interest rate cycles and top up accordingly into such schemes. I guess equity oriented balanced funds will be a better bet via SIP route. Investors will need a timely guidance from Financial adviser to invest into debt funds. However, undoubtedly over long term due to sound money management by expert fund managers and tax arbitrage; liquid and debt category will have an edge over traditional bank demand and time deposits.

Regards,

Aditya

Hi Aditya,

A debt-oriented fund can slip in to negative returns in a bad equity market even if its exposure is low (although this fund has managed to stay positive thus far). Even if they are not negative, poor equity market can pull down an MIP fund’s returns to less than even a debt fund! Hence, the suggestion of SIP if time frame is less. For a time frame of over 3 years, lump sums should be ok with an MIP. Yes, you are right in saying that over the long term mutual funds can offer better post-tax returns over traditional products. Tks, Vidya

WHAT ABOUT BIRLA SUNLIFE WEALTH 25 WHERE I HAVE INVESTED RS 50000 3 YEARS AGO.

Hello Venkatraman, Wealth 25 has a higher proportion of equity – about 25-30%. That means it is a more aggressive debt-oriented fund than Savings 5. As equity has been volatile, Wealth 25’s returnss in the last 3 years will be average. Tks, Vidya

one of my relatives aged about 58 returned from abroad to settle in india. He wants to invest in debt oriented funds and would like to invest around 10 lacs dividing into his name,wife name and son name and plan to do SWP after one year @ .75% per month. I have suggested hdfc mip Ltp ,birla sun life mip 5, bsl dynamic bond fund, reliance mip and sbi bond fund and suggested him to invest the money equally to avoid capitial erosion. Am i right ? Expect your comment on this.

Hello sir

While your fund choices are good, MIPs and dynamic bond funds require at least a 2-3 year time frame to perform. Funds such as SBI Bond have a long duration portfolio that increases their risk profile, although they have performed well as a result of falling rates. If the idea is merely to get some regular income with only a 1-year time frame then ultra short term or short term funds would be safer bets in the mutual fund space. Any further portfolio-specific queries may kindly be routed using our Ask Advisor feature in your FundsIndia account. Tks, Vidya

I have retired recently and wish to put some money in debt/debt oriented mutual funds. Can u suggest some of such low risk funds. How about SBI magnum income gold? it got #1 rank by crisil and return for last one year is about 14%

Hello sir,

You may have meant Magnum Income or Magnum Gold. There is no fund by name Magnum Income Gold. Assuming you mentioned about Magnum Income, it an above average performer. We will be unable to recommend funds without knowing one’s time frame, whether the investment in lump sum or spread out, whether you need regular income from this and what tax bracket you fall under. Even with this, we would prefer answering portfolio queries through our Ask Advisor feature, available for all account holders. You may wish to read this article on income funds and pick any of the funds from what we have mentioned at the end of the article: https://blog.fundsindia.com/blog/mutual-funds/income-funds-score-over-fixed-deposits/1324

Tks

Vidya

Looks like this fund will be a good substitute for people predominantly parking their savings in FDs and RDs. But is SIP the right way? Or We need to understand interest rate cycles and top up accordingly into such schemes. I guess equity oriented balanced funds will be a better bet via SIP route. Investors will need a timely guidance from Financial adviser to invest into debt funds. However, undoubtedly over long term due to sound money management by expert fund managers and tax arbitrage; liquid and debt category will have an edge over traditional bank demand and time deposits.

Regards,

Aditya

Hi Aditya,

A debt-oriented fund can slip in to negative returns in a bad equity market even if its exposure is low (although this fund has managed to stay positive thus far). Even if they are not negative, poor equity market can pull down an MIP fund’s returns to less than even a debt fund! Hence, the suggestion of SIP if time frame is less. For a time frame of over 3 years, lump sums should be ok with an MIP. Yes, you are right in saying that over the long term mutual funds can offer better post-tax returns over traditional products. Tks, Vidya

one of my relatives aged about 58 returned from abroad to settle in india. He wants to invest in debt oriented funds and would like to invest around 10 lacs dividing into his name,wife name and son name and plan to do SWP after one year @ .75% per month. I have suggested hdfc mip Ltp ,birla sun life mip 5, bsl dynamic bond fund, reliance mip and sbi bond fund and suggested him to invest the money equally to avoid capitial erosion. Am i right ? Expect your comment on this.

Hello sir

While your fund choices are good, MIPs and dynamic bond funds require at least a 2-3 year time frame to perform. Funds such as SBI Bond have a long duration portfolio that increases their risk profile, although they have performed well as a result of falling rates. If the idea is merely to get some regular income with only a 1-year time frame then ultra short term or short term funds would be safer bets in the mutual fund space. Any further portfolio-specific queries may kindly be routed using our Ask Advisor feature in your FundsIndia account. Tks, Vidya

I have retired recently and wish to put some money in debt/debt oriented mutual funds. Can u suggest some of such low risk funds. How about SBI magnum income gold? it got #1 rank by crisil and return for last one year is about 14%

Hello sir,

You may have meant Magnum Income or Magnum Gold. There is no fund by name Magnum Income Gold. Assuming you mentioned about Magnum Income, it an above average performer. We will be unable to recommend funds without knowing one’s time frame, whether the investment in lump sum or spread out, whether you need regular income from this and what tax bracket you fall under. Even with this, we would prefer answering portfolio queries through our Ask Advisor feature, available for all account holders. You may wish to read this article on income funds and pick any of the funds from what we have mentioned at the end of the article: https://blog.fundsindia.com/blog/mutual-funds/income-funds-score-over-fixed-deposits/1324

Tks

Vidya