Should you worry enough about the fund to stop your SIPs? We don’t think so. And here’s our take on why the fund’s portfolio and performance does not suggest cause for much concern.

Fund size

First, the fund’s asset size. Between December 2009 and 2012, HDFC Top 200’s assets doubled from about Rs 6,000 crore to over Rs 12,000 crore, holding among the largest corpus in the industry. With its NAV expanding by about 25% over this period, clearly, the asset expansion was largely due to inflows.

Now, often times, funds, especially with focus on the mid and small-cap segment struggle to deploy huge inflows at one stretch, given the liquidity issues in this market-cap segment. This is why funds such as IDFC Premier Equity, in fact, restricted lump sum investments at one point. But this is not necessarily true of all funds.

With majority exposure in large-cap stocks, HDFC Top 200 has remained almost fully invested in the last few years, suggesting that it has not been holding cash for lack of deployable avenues. Its large asset size is less than 0.2% of the total market capitalization of the BSE. In the words of the fund manager Prashant Jain, as reported in a newspaper, the above proportion means there is little risk of being crowded out. Or in other words, the fund size is not large enough to start impacting performance.

This is so even as many peers, whether in the pure-large-cap space such as Franklin India Bluechip or those with some mid-caps such as Quantum Long Term Equity have take some cash calls based on market conditions.

Hence, the fund’s performance may have little to do with lack of deployment of your money in equities thus far.

What being fully invested entails

The natural fall out of being fully invested, is, mostly, to also bear a bit more of the pain in a down market. And this is not a new characteristic of HDFC Top 200. Whether it was the 2008 fall or the end of a painful 2011 (holding in equities was just short of 100% in December 2011), HDFC Top 200 had far higher allocation to equities than most others.

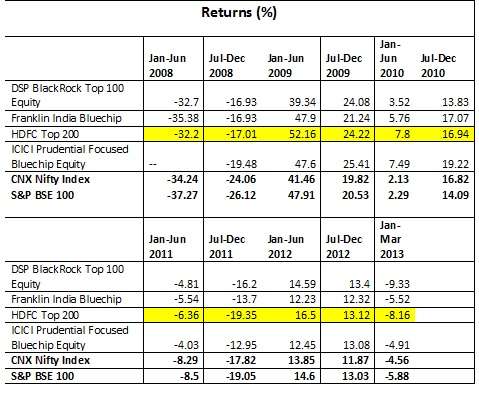

The table below gives a half-yearly performance of the fund, along with few other comparable funds. It is evident that the fund has had a streak of falling more in down markets, as a result of being fully invested, while gaining more at the beginning of an up market. This has been the case, thus far, in the current year beginning 2013.

Large cap and more

HDFC Top 200’s larger fall in down markets is also partly attributable to its ‘other than large-cap’ holdings.

While HDFC Top 200 has always been a little more than a large-cap fund, it is not as diversified as other large and mid-cap or multi-cap funds. Just to provide an example, in the latest declared portfolios (March 2013 and February 2013 in some cases) if we assume stocks with market cap of over Rs 10,000 crore as being large caps, HDFC Top 200 had about 82% exposure in such stocks. Franklin India Bluechip had 89% and ICICI Pru Focused Bluechip held 93% in such stocks.

Only DSP BR Top 100 was the closest with 84% holding in large caps. But that does not necessarily mean that HDFC Top 200 holds as many mid-cap stocks as other diversified funds. For instance, funds from the same stable such as HDFC Equity or HDFC Growth, which are also classified as large and mid-cap focused, had only anywhere between 65-68% in large-cap stocks.

Clearly, HDFC Top 200 is a little more than a pure large-cap and yet nowhere near being as diversified in other market-cap segments as most other funds. This is evident in its performance as well. The fund may not generate top returns like the more diversified Quantum Long Term Equity but beats large-cap funds in market rallies as a result of the additional nascent large-caps it holds.

High beta

Such large-cap plus holding of HDFC Top 200 also makes it a relatively high beta fund compared with other large-cap peers. Its return too therefore, has swung more across ups and downs. But over longer time frames, it has compensated well.

Another notable characteristic feature of HDFC Top 200 is its often contrarian sector/stock exposures. In 2006/07 for instance, the fund stubbornly refused to pick stocks from rallying sectors such as real estate and infrastructure, at the cost of losing out when compared with some peers. But then the decision proved right at a later date.

Similarly now, while banking and finance stocks have high weights in almost all funds, HDFC Top 200’s holding at close to 30% in far higher than the 20-24% held by most peers.

The fund in fact, got bold enough to accumulate stocks such as SBI, when most others were trimming it. Now such conviction may well pay off later but does cause short-term pain. Its top holdings SBI and ICICI Bank fell 16% and 13% year to date. Many other peers shielded their portfolio with top holdings in large-cap tech companies or consumer plays like ITC. But not HDFC Top 200.

Our take

Hence, as an investor, the uncertainty with this fund, as is the case with other funds, would be for you to watch out if its bets pay off well, albeit when the market picks up.

As for its suitability, this is a fund for those who can take a little more than pure large caps in their portfolio. A risk-averse investor should stick to pure large-cap plays if their key requirement is to contain downsides at all cost. HDFC Top 200 is an alpha generator, provided you are willing to hold it over ups and downs.

Hi Vidya,

What is your take on somebody who picked this fund over the last 6-12 months and started SIP in it? Do you suggest to stick with this or there are better funds?

Hi Suhas, If someone did an SIP in the last 6-12 months, I would think it is an excellent time to average costs in the fund. I would say stick to it. If WPI falls (as it did today), then financials will be up, benefiting the fund. Tks, Vidya

Hi Vidya!……..I want to sip Rs.2000 per month can i go with HDFC Top 200? What is your advise?

I would suggest better to invest in bank RD, i am stuck with HDFC top 200 SIP, since june 2010 my fund value is in minus 2.8% return.

If some one suggesting yes then please explain even in last three year why fund is not even returning actual cost 🙁

Hi Saurabh, comparing equity to debt, especially for shorter periods like 3 years may not be entirely appropriate. Yes, HDFC Top 200 fall even with an SIP in 3 years. But so has its index. In other words, if broad equity markets suffer, a fund with a certain mandate cannot do much. If you see the same fund’s 10-year SIP returns, it is at a very healthy 14.2% iRR. That is the kind of perspective one needs to have to enter equity funds.

I would urge you to compare RDs with a class of debt funds called income funds..which is the nearest comparison in terms of the risk-return profile. Pl. find an article on how RDs performed. https://blog.fundsindia.com/blog/mutual-funds/substitute-your-rd-with-sips-in-income-funds/3239

thanks

Hi Vidya!……..I want to sip Rs.2000 per month can i go with HDFC Top 200? What is your advise? I can invest for 5 Years…

Hello Rajender, it would depend on your requirements. As we mentioned in the article, if your risk appetite is very low, the fund will not suit you. You should go for pure large-cap funds. But if you can take some volatility, given your time frame, you can take exposure to HDFC Top 200. tks, Vidya

Hello Vidya,

I want to know what is the prospect of AIG World Gold Fund (G) & DSP BlackRock World Energy Fund. I have been sipping into them for the past 2 years.

Hello Bijay, AIG Gold is a gold fund that invests in equities. You will hence hold the risk of gold price as well as that of equities. IT may hence be a high risk investment. The World Energy fund has not had much of a track record. It looks better now because of weak currency against the dollar. You would be better off with non-thematic international funds, unless you track energy, commodities etc. Tks. Vidya

Thanks, Vidya. If I were to withdraw the entire amount from World Energy, where should I put it? Which fund do you recommend?

Hello Bijay, I cannot suggest an alternative to the World energy fund in the Indian context as there are not any that are investment worthy. If you wish to invest in a diversified equity fund, request you to use the Ask Advisor feature (in your FundsIndia account) and provide details of your risk, time frame or goal and investment value though SIP. You may choose the email or schedule a call for our advisor to respond to you. Tks, Vidya

hii, vidya

i juss now started sipping in HDFC Top 200 fund

isnt it the decision is right..

plz comment as soon as possible

Hi Ravi, this article has defended HDFC Top 200. So not to fear. What we meant was that the fund can be volatile compared with other large-cap funds in the short term. But if you have a reasonbly long-term holding like 5 years, it tends to provide better returns than large-cap funds. Hence, assess your risk appetite. If your aim to expect decent returns and not just contain risks, this fund will suit you. Also, if you have just started and can hold for 5 years, then you can continue. Tks, Vidya

Hi Vidya

Thank You for the Update on HDFC Top 200 .I have selected this fund to create corpous for my retirement ,which is 15 years away.I intend to hold on till that time .I have done a SIP of Rs 5k since last 4 years and Intend to remain Invested till next 15 Years

I am also Investing 5k in IDFC Premier Plan A….again from retirement corpous creation .Your Input PLEASE

Hi Milind,

IDFC Premier Equity is a worthy fund. If you wish to build a retirement portfolio and need our help, you may also pl. use the Ask Advisor feature in your FundsIndia account and mail us or request for a call from our advisor, stating your requirements. It is free for our users. tks, Vidya

Hi Vidya,

I have been investing Rs. 1500/- each in HDFC Top 200 and HDFC Equity, and Rs. 2000/- in IDFC Premier Equity from the last 1 year, for the wealth creation. I have planned to remain invested in equities via mutual fund route for the next 20-25 years.

I want to know should I consolidate the two funds: HDFC Top 200 and HDFC Equity, and start investing the total amount in any one of them instead of both. If yes, kindly suggest me the fund for which I should go for, of the two.

Also, I am planning to add one index fund in my portfolio, hence, suggest me the same as well.

Thanks,

Regards,

Arpit Sharma

Hi Arpit, We don’t think you need to consolidate. As we had mentioned, the fund features are different. HDFC Equity has some more mid-caps and will deliver some kicker returns in the long run. If you wish to add an index fund for the long-term then you might as well go for the fund we have given a call today – HDFC Sensex Plus. As it has little more than index, it can deliver slightly more than index in the long run. If you do not want a HDFC fund as you have 2 already, then pure index funds such as Quantum Index (mirrors Nifty Total Returns index) may be an option. Tks, Vidya

Thanks Vidya..

hi vidya,

are gold funds treated as debt or equity,

what is the tax treatement

Hi Reen,

There are treated like debt funds for tax purpose. Capital gains less than a year are taxed at your income slab rate. Gain over 1 year are taxed at 10% without indexation or 20% with indexation. Tks, Vidya

i am hvg SIP in sundarm BNP Paribas select midcap (G) since Nov 2010 @ 2000 PM. Pl guide me , whether i should continue or skip to some other fund.

HelloRaj,

Sundaram Select Midcap is not a top notch midcap fund but has beaten its category average comfortably. Unless you are unhappy with the returns, you can continue. If you are looking for top performers, IDFC Premier Equity, ICICI Pru Discovery and HDFC Mid-Cap opportunities could be options. Thanks, Vidya

Hello vidya

mai montly 2000/-rs 19 jan 2012 se invest kar raha ho. investment karta rahu ya ise close kardo ?

Hello Sunny, Do continue your SIPs. SIPs should be done for atleast 3 years to benefit from rupee cost averaging. Tks, Vidya

Hi Vidya

Thank you for the article .I have invested 1k on HDFC 200 fund and still I have SIP of Rs2000/month .should I continue for the next 2-3 years or should I shift to ICICI Blue-chip? I have also invested in DSP Black rock top100 and UTi MNC Fund and SBI Emerging Business 1K each and continuing with Rs2000SIP/monthly. These are good funds for 3 year horizon ? Please advice. Thanks..

Hello sir,

You may continue your investments in HDFC Top 200 as we do not see any real concern in the fund. For any other review of your portfolio, request you to use the Ask advisor service in your FundsIndia account to solve your queries.

tks

Vidya

Respected mam,

I have structured my Portfolio for next 15 yrs for kids education:

please advice me on the same:

HDFC Top 200: 2500/- monthly

HDFC Balanced Fund: 2500/- Monthly

ICICI Pru Blue chip focused fund (G); 3000/- monthly

ICICI Pru Discovery fund:3000/- Monthly

I want to add one more mid cap fund please advice me sutable fund for more than 10 yrs investment

.

Shall I add one more large cap fund?

please reply me on my investment.

thanks

Hello Ashish, You have 50% of your choice in large caps. You may not need more. For further fund advice, I would request you to use the ‘Ask Advisor’ feature available free of cost in your FundsIndia account. You may also wish to take a look at our Smart Solutions for children’s education. This will not only determine your asset allocation but enable you to act on our advice both on fund change (if fund does not perform well) as well as asset rebalancing (when the asset allocation moves from the original allocation). You may take a look the presentation available in the link: http://www.fundsindia.com/SmartSolutions

Thanks, Vidya

Thanks mam for your advice,

I have one more doubt: Shall i add one more mid cap fund or continue with the same portfolio.

Thanks in advance.

Hello Ashish, There are no thumb rules to hold midcaps. That would depend on your risk appetite. For a moderately aggressive person, 25-35% can be in mid-caps. You have about 27%. You will have to assess your risk an whether you can take volatility and see your portfolio fall for short time periods when midcaps are volatile. Thanks, Vidya

Hi madam,

I have invested in HDFC top 200 and HDFC equity fund with SIP of Rs.2500 each. Is it a right decision considering the underperformance of HDFC now? What may be the returns after one year as i am planning for a short term investment?

One more thing i wanted to ask is what is your take on investing in gold schemes like SBI gold ETF ?

Hello Tanmay, A one-year tome fraame is inadequate for any equity fund. leave alone the HDFC funds. Ig you are using the SIP route it takes 203 years for the averaging to work well and deliver returns. Hence, a 3-year view is the minimum. HDFC Top 200 has many bluechips and will do well when mkts start rallying. Until then , it may seem like an underperformer. He have a hold on HDFC Equity at present. We do not have any view on gold. It can be part of a long-term portfolio (five yers plus) for the sake of diversification Thanks.

Hello Ma’m

I have 5000 SIP in HDFC Top 200,HDFC Equity Fund,Franklin Blue Chip and Reliance Equity Opportunities for long term.

Do I need any change?

Regards,

Prakash

Hello Prakash,

Kind use the ‘Ask Advisor’ feature, if you have a FundsIndia account for portfolio advisory/review. It is free of cost. Thanks

I am investing Rs.3000/month in SIP HDFC TOP 200 since July 2008 for my daughter but i found through statement It is not growing & going on negative.

Kindly suggest for continue or withdrawal from fund.

Regards.

R.Shivani

Hello sir, Rs 3000 a month invested in HDFC Top 200 since July 2008 should not have given negative returns…it delivered an IRR of about 7.9% annually through SIPs. Pl. check whether you are talking of dividend reinvestment or dividend payout option and not the growth option. In such a case, you will have to recalculate the returns based on dividends received. Ideally you should have growth. Thanks.

Madam,

Devi dent is reinvestment Kindly suggest me to continue this fund

Hello sir, That is why your returns seem low, because the NAV value will be low. You may continue with the same. Thanks, Vidya

Hi vidya i would like to invest around 2k every month which stock should i invest in i can invest 1000 in high risk and rest 1000 in low or medium risk please advise which mutual fund to invest to i can invest for long term say 5 yrs more or less.

Hitesh, I would be unable to recommend stocks. If you are a FundsIndia equity account holder, you will receive stock calls. Similarly,we can help you choose funds based on your risk profile and time frame if you use our ‘Ask advisor’ feature. This facility is free of cost and is available as a call or mail response to all our investors who wish to build a portfolio or occasionally review it. Request you to activate your free account, if you wish to seek advice. Thanks, Vidya

Dear Vidya,

I am investing Rs. 3000/- in HDFC Top 200 (G) since May 2013 i have plan to invest for more than five years shall i continue or close SIP as this fund is not doing well. Please suggest me.

Hi Ashish,HDFC Top 200 did see a blip in performance but has picked up in recent times. If you are not willing to wait it out then stops SIPs (don’t sell) and move to other performing large-cap funds for fresh SIPs. For fund suggestion, you may pl use our ‘Ask Advisor’ feature, available free of cost to all our activated investors. Thanks.

Hi,

My Sip in HDFC top 200 since last 6 years has expired. Is it the right time for fresh investments with a 10 year horizon?

Hi Nithya, This is a very good time for fresh investments, especially if you have a long-term horizon. the current volatility will provide good opportunities to average. we will be glad to help you choose funds if you can send in your query through our ‘Ask Advisor’ feature available free of cost for all activated FundsIndia customers. Thanks.

Sorry for asking a general question here, but i had a doubt and i had to put it

If we say long term as says 10yrs, has MF equity returns always given inflation beating returns over every 10yr period? Like 1990-2000,1991-2001,92-02,93-03……2003-2013…. ?

If some one was investing in SIP monthly diligently without fail in some of the good equity MF over these periods, then what were the returns?

Hi Suhas, Equity returns have definitely beaten inflation for periods you mentioned. But since MFs are not very old to the Indian market, if you take period after 1995, the rolling 10-year returns of funds such as Franklin India Bluechip, or Prima or Magnum global was 25-29% on an average annually over several 10-year periods. While this may not repeat itself, SIps in the last 10 years in Franklin India Bluechip delivered 14.4% annually, HDFC Top 200 delivered 15.3% and ICICI Pru Dynamic 16.6%. Increasingly, good portfolio allocation, with some allocation to debt will become important to not just beat inflation but keep volatility limited in a portfolio. Thanks.

Dear vidya,

i wants to start SIP of Rs. 2000 per month for next 3 years. which fund i should go for.

plz advise

Hi shital, We would be able to offer fund suggestions, based on your investment and risk profile and goals, for FundsIndia investors. Pl actiate your FundsIndia account and avail our free advisory services for portfolio selection and review. Thanks.

Hello Vidya!

I am currently invested in Reliance Regular Savings Fund Equity Growth and looking to switch.

Which among the following should I start in?

HDFC Equity

HDFC 200

Birla SunLife Frontline Equity

Kindly suggest.

Hitesh, Request you to route your query through the ‘Ask Advisor’ feature available in your free FundsIndia account. We will help you build portfolio and review funds through email and scheduled calls services. this is free of cost for all our customers who have an activated FundsIndia account. Thanks Vidya

Hello Vidya,

I have found your answers very helpful. I do have a query, I want to invest in HDFC tpp 200 for the next 30 years, so what minimum return can I expect. I onow its too much to predict, but your experience can predict.

Thanks

Hello sir,

thank you. In a portfolio in which stocks are ever changing, how does one predict its performance? In the past the fund has delivered 18-19% returns annually over 5 and 10 year periods. But the markets may not repeat such performance as the market becomes more mature. But one can look forward to double digit returns. thanks, Vidya

Hi vidya,

I am investing in hdfc top200 for last 22 months in SIP, for me the fund has given decent return in this short period, I want to continue this for next 15 years to build my Retirement corpus, I am in process of transferring this fund to funds india…through ask advisor, I got a reply to stop this and invest in better fund.

What’s your suggestion on this…I researched most on this fund…everthing speaks positive about this fund. should I continue in this fund for some more time and take a call

Hello Paul,

HDFC Top 200 did see a slip in performance for a few quarters in 2013 but picked up pace in more recent times. Yes, there are funds superior to HDFC Top 200 at this juncture and hence our advisors would have asked you to stop SIPs in this and start afresh. However, if you have no reason to complain, you may continue the SIPs. However, any fresh investments can be made in other funds. thanks,

Hi Vidya ,

Thanks for your services.

I have been doing SIP in HDFC top 200 (G) – Rs.2000, Can Rob Equity Tax Saver (G) – Rs.2000, HDFC Mid Cap Opp. (G) – Rs.2000, SBI Emerging Buss (G) – Rs.2000 and PPF- 2500 since from 2 years. I planned to continue my invests through SIP’s for a period of 10 to 15 years. but now my question is to continue with the existing schemes or shift to some other funds like HDFC TOP 200 to Birla Sunlife Frontline equity, because non performing HDFC Top 200 and SBI Emerging Buss. Please review my portfolio and advice me shall i hold or switch to any other funds to generate 15% returns per year.

Hello Ramakrishna, we offer free portfolio review for all FundsIndia active account holders. If you have an account with us, pl use the ‘Ask Advisor’ feature to enable us to answer your queries. If you would like to open one, you may contact our customer support. the account is free but is needed to use our platform and all our services. thanks, Vidya

HDFC Top200 ,

DSP Black Rock ,

Reliance Growth ,

LNT Equity Fund Growth ,

Birla Sun life monthly income …

I have SIPS in all these , which one should I continue and which one should I leave . I have been

investing in these since 2010.

Also please sugggest some good SIPS , I need to repay my home loan in next 10 years , I think SIP is the only way. so if you feel none of these funds are of use please advise new SIPs

Hello Sir, for us to be able to answer your portfolio specific queries, you need to have a FundsIndia account. once the account is activated (it’s free), you can use the ‘Ask Advisor’ feature to ask any of your queries (this is again a free service for accoutn holders) and our qualified advisors will help you. thanks, Vidya

Madam, I was investing through sip in HDFC Top 200 from 2011 (amount 4000). kindly let me know that i should stick with fund or not as i am planning to stick with it till 2018.

Thanks

Hello Arun, you may continue with the fund.

I jst strtd sip in sbi magnum global.my time frame is 15 years.is it a good decision?

Hello Abhijeet, for fund specific queries, please write in through your FundsIndia account and our advisors will respond to you. thanks, Vidya

What is Fundsindia’s view on HDFC Top 200 at this point in time (Sep 2016). I have been an investor in this fund since a long time but feel that the fund is not the same as it used to be . I have been sticking around just for the immense credibility of the fund manager among pundits and analysts.

Debajyoti, Yes, you are right that HDFC Top 200 is not and never been a consistent performer. It is a bull market fund and underperforms peers quite a bit in volatile markets. However, since ti adequately makes up for such underperformance in every rally (like the last 6 months), if you hold the fund, no harm sticking around if it is for 5-10 year time frame. Thanks, Vidya