All of us dream of becoming a crorepati. But most of us don’t have a clear plan of how much to save and invest to get there.

Here’s a simple guide to help you get started…

How to become a crorepati?

As explained in our earlier blog,

- Wealth creation is broadly influenced by three factors

- Your Savings Rate (read as how much you save every month)

- Time

- Returns

- You cannot completely control your portfolio returns, but you can control your savings rate and time.

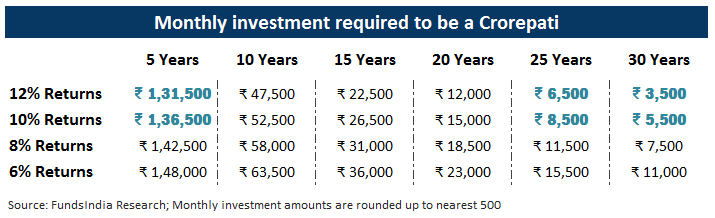

Now that we have set the broad context, let’s figure out how much you need to invest to become a crorepati – for different time frames and return expectations.

The insight is fairly simple.

When you have a short time frame (5 years), you will have to work a lot harder and save a lot more – close to Rs 1.4 lakhs a month (assuming 10% annualized returns).

Meanwhile, with a longer time frame (25+ years), the power of compounding really kicks in. You can become a crorepati by investing less than Rs 10,000 per month.

Great! But before you get too excited, there is a small catch.

Enter Inflation – the simple fact that most things we buy go up in price over time.

Yup, it refers to the same feeling when you are shocked to see petrol prices above Rs 100. And someone (in this case it’s me) decides to rub it in by reminding you of the fact that petrol used to cost Rs 5 per litre in the 1980s!

An excerpt from the article…

Jun 8, 1980: An official press release said that the retail price of petrol in Delhi now fixed at Rs 4.41 per litre will go up to Rs 5.10 per litre.

This is exactly what inflation does to our money.

Even Amitabh Bachchan’s Kaun Banega Crorepati understands this…

The prize money in 2000 was Rs 1 cr. The prize money in 2021 is Rs 7 crs!

Therefore, in order to be a ‘real’ crorepati, the impact of inflation needs to be taken into account.

So, how much inflation should we consider?

In India, the RBI is responsible for keeping inflation in check.

Based on the current mandate, RBI is required to maintain consumer price index (CPI) inflation between 2% to 6%.

As we cannot predict what will happen to the inflation rates over the next few decades, we will assume the rate to be around 6% (upper band of the current framework) for the purpose of our calculation.

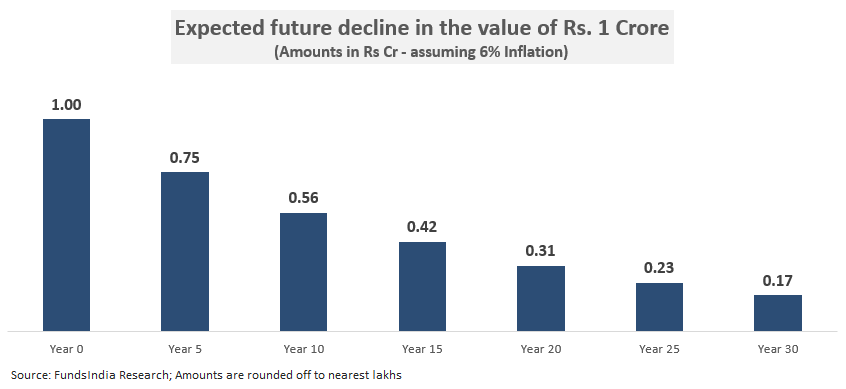

Any guesses what a 6% persistent inflation can do to your portfolio?

Take a look…

Oops! That’s right..

A one-crore rupees portfolio will have a value equivalent to Rs 17 lakhs after 30 years – inflation would have eaten away a whopping 83% of your purchasing power!

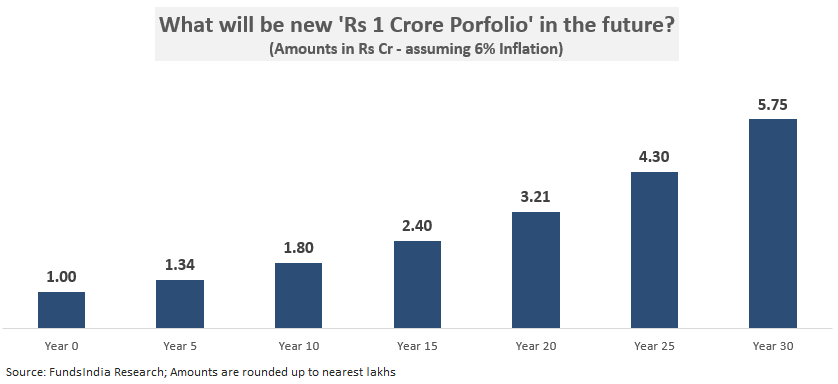

For that reason, a more prudent approach would be to establish inflation-adjusted targets for different investment time frames.

With 6% inflation, a real crorepati should aim for a corpus of Rs 2.4 crores in 15 years and Rs 5.75 crores in 30 years!

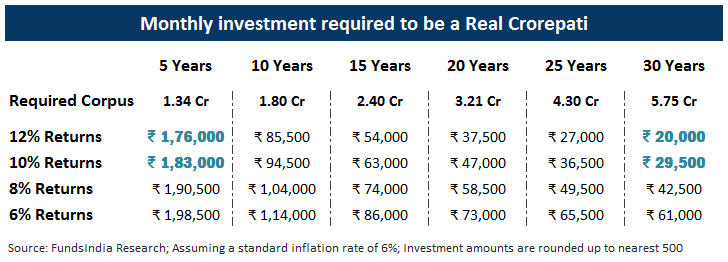

Now, how much should you save to be a real crorepati?

Let us find out…

With a short 5 year time frame, it takes a monthly investment of ~Rs 1.8 lakh to be a real crorepati (assuming >10% annualized returns).

For a much longer time horizon (30 years), we can get there by investing less than Rs 30,000 a month.

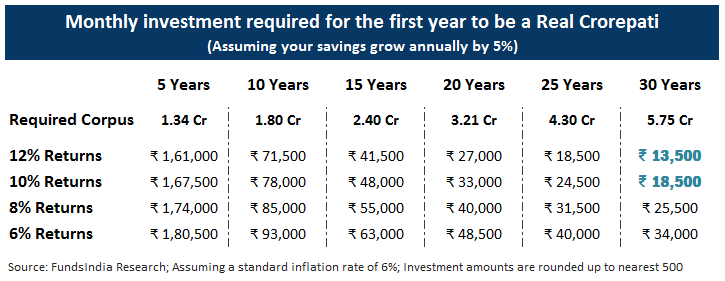

If your investments can be increased by 5% every year consistently over three decades, Rs 18,500 per month is good enough to start your journey to be a real crorepati (assuming 10% returns).

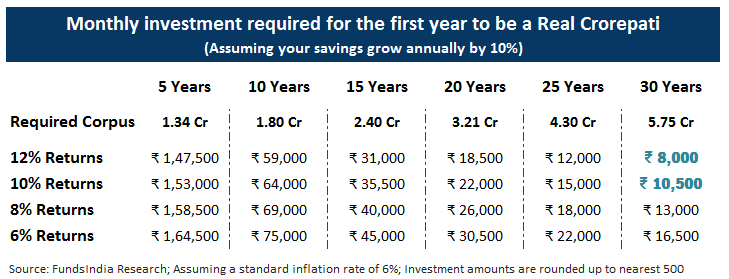

If you can increase your investments by 10% annually, the starting investment can be as low as Rs 10,500 (assuming 10% returns).

Now that you know how much to invest, select 3-5 good equity mutual funds (check our FundsIndia Select Funds and Five Finger Framework) and you can start your SIPs.

There you go. You are all set for your crorepati journey!