Setting Reasonable Return Expectations

Every day, when I start from my home to office (a routine which I badly miss in the new “work from home” life), I roughly know how long it takes to reach my office. Under normal traffic conditions, it takes me around 40-50 minutes in a car. This helps me plan on when to start in order to reach office on time.

But I also know that there will be those rare occasions, where there is a major traffic breakdown in the city, heavy rains etc where it might take a much longer time.

I am sure all of us have a similar approach when it comes to planning for our daily office travel.

What if we apply the same approach to our investing?

While you would have read several yearly outlook reports with a projection for where the Sensex or Nifty will go next, with all due respect we are not big fans of this “prediction” approach.

Rather we start with a humble acceptance that the world is simply too complex and to predict equity market movements over the short-run (say a year) on a consistent basis is almost close to impossible.

There are several variables, known and unknown which can influence the stock markets in the short run, and therein lies the difficulty of an accurate prediction. Think about it – to get the direction of the market right we have to get three complex predictions right –

- The trajectory of all the known and unknown variables (interest rates, geo political issues,oil prices, macro, scams, virus, elections, budget, latest crisis etc)?

- The exact impact of these events on the market direction?

- How different sectors of the market will respond?

Now while we have given up on our ability to exactly predict the short term direction of equity markets, that doesn’t mean all is lost. We can still build reasonable expectations when it comes to equity investing just like how we did with our daily office travel.

How do we do this?

To our rescue comes – The PAST!

While the future will always remain uncertain, the past can help us build reasonable expectations about the future.

When it comes to setting expectations, most of us are ok as long as the markets move up. But it is only the temporary declines which cause a lot of uncertainty and emotional pain.

So let us set the correct expectations on temporary market falls –

- What should be considered a normal fall and how frequently do they occur?

- What should be considered a market crash and how frequently do they occur?

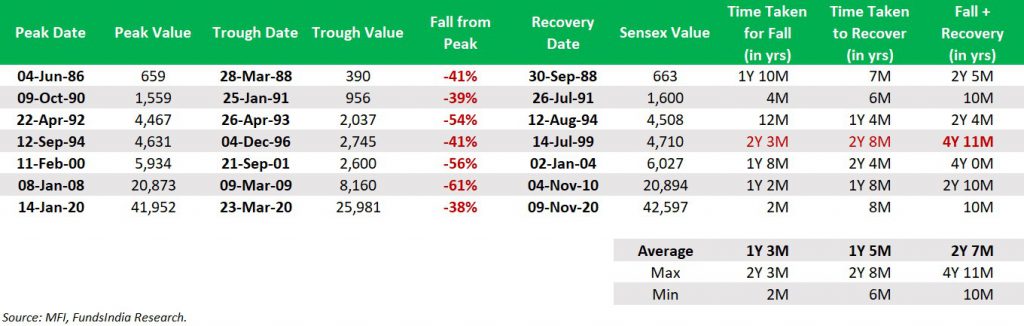

Here is an interesting chart. We went back as long as 40 years and decided to check for the maximum decline recorded each and every year i.e the fall from the highest index value to the lowest index value during the year.

What did you notice?

- Equity markets (represented via Sensex) had a temporary fall each and every year! You read it right – EACH & EVERY YEAR

- 10-20% temporary fall is almost a given every year. There were only 4 out of 42 years (represented by the yellow bars) where the intra-year fall was less than 10%.

Wow!

While the equity markets go up over the long run driven by the underlying earnings growth, the near term is filled with several temporary declines.

As seen above, a 10-20% decline in equities is as common as your birthday!

Let us make this a little more concrete…

The Sensex touched a peak of 50,000 a few days back.

Since a 10-20% intra-year decline in equities is common, Sensex falling to 45,000-40,000 levels should be a normal part of expectations.

While the media will be out there trying to scare the daylights out of you, as seen from the 40 year history, you now know that this is perfectly normal behavior from equities.

Now translate this expectation into your portfolio value. For eg assume you have a Rs 50 lakh portfolio and 50% is in equity (i.e Rs 25 lakhs) and 50% in debt (i.e Rs 25 lakhs).

Since a 10-20% temporary fall in equity portion is a part of normal expectation, your portfolio value can anytime see a temporary fall of 2.5 to 5 lakhs (i.e 10-20% of Rs 25 lakhs in equities) during the year. This should be considered as ‘normal’.

Now that we are done with setting our normal expectations, there are also times when the market falls much more than the normal range.

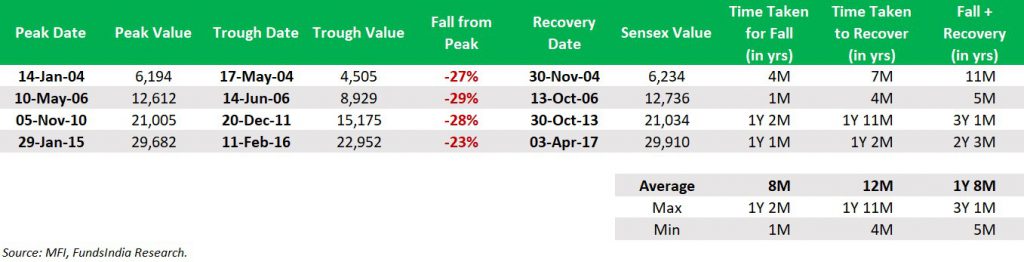

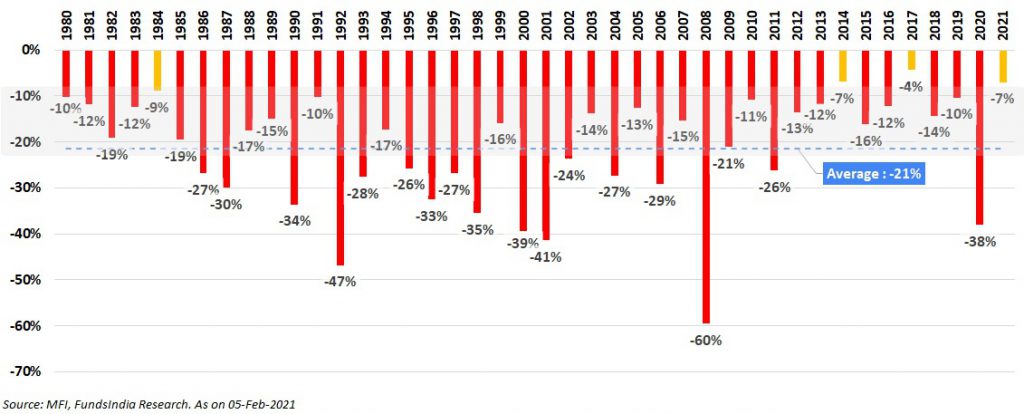

Occasionally, once every 3-5 years, equity markets can be expected to temporarily fall further upto 30% as seen below.

Once every 7-10 years, equity markets also witness a sharp temporary fall of 30-60%. Historically, during such deep temporary falls, it has taken around 1-3 years for the markets to recover and get back to original levels. In the worst case scenario, it has taken upto 5 years for the recovery.

Now let us also plug in the bear market expectations –

While we have no clue when a bear market will arrive, going by history, a fall in the range of 30-60% can be expected once every 7-10 years.

Translating that to Sensex values,

History tells us that, in the worst case, a sharp bear market correction can also bring the Sensex levels between 35,000 to 20,000 (30-60% temporary decline).

This while is not normal regular behavior, must be a part of our expectations and we should be mentally prepared to live through these deep temporary corrections once every 7-10 years.

Now translate this expectation into your portfolio value. Let us take the same example, where you have a Rs 50 lakh portfolio and 50% is in equity (i.e Rs 25 lakhs) and 50% in debt (i.e Rs 25 lakhs).

Since a 30-60% fall in equity portion is a part of worst-case expectation, your portfolio value in the worst case, may see a temporary fall of 7.5 to 15 lakhs (i.e 30-60% of Rs 25 lakhs in equities). This should also be a part of your expectation.

Now let us sum up the expectations:

- Equities have a temporary fall each and every year – this uncertainty is the emotional cost to be paid for long term returns.

- 10-20% temporary fall is almost a given every year.

- 20-30% temporary fall should be expected once every 3-5 years

- A temporary fall in the range of 30-60% can be expected once every 7-10 years.

Translating that into Sensex values

- Sensex has a temporary fall each and every year.

- Since a 10-20% intra-year decline in equities is common, Sensex falling to 45,000-40,000 levels should be a normal part of expectations.

- History tells us that, in the worst case, a sharp bear market correction can also bring down Sensex down to 35,000 to 20,000.

Now that we have reasonable expectations set for our equity portion, this leads to the next question:

How do we build an investment plan?

Two approaches to building an investment plan

In our view, there are two approaches to building portfolios

1. The Forecast Approach:

This approach is based on the belief that equity returns can be made without any pain.

This approach basically says, “Hey, if there is a 30-60% sharp crash that happens once every 7-10 years, I will simply predict the crash, step out before the crash happens, enter back at the bottom and make tons of money. Simple! Why unnecessarily go through the pain of a bear market for 1-3 years. Silly folks :)”

If you really think about it, our interest or concern to track daily market news, budget, international events, elections, macro economy, market outlook etc, and predict markets is a derivative of this thought process.

While this approach will obviously be the best approach, there is only one problem.

No one seems to have cracked this approach. No one has been able to time the markets (get out before and market crash and get in before a recovery) consistently.

While there are several investors who have got it right once or twice and go on to write several books and are featured in talk shows, they eventually get the next one wrong.

Here is a humble reminder…

You don’t need to take my word for it. Let us hear what the legendary investor Jack Bogle has to say about this topic…

“The idea that a bell rings to signal when investors should get into or out of the market is simply not credible. After nearly 50 years in this business, I do not know of anybody who has done it successfully and consistently.”

– Jack Bogle

For someone following this approach, each and every normal 10-20% correction that happens almost every year becomes something to worry about. Every fall, is anxiously viewed with the “What if this turns out to be the big one?” lens.

Inevitably mistakes happen. Sometimes you end up mistaking a normal decline for the big one and you step out only to miss the subsequent rally. Sometimes you take the money out correctly during the earlier part of a large correction, but miss out on getting back in. If you are wondering why getting back in is so difficult read our earlier article here. The recent 38% covid led crash and the quick recovery is a good reminder on why the “I will move out before the crash and enter before the rally” strategy is extremely difficult to pull off in the real world.

So overall, while this approach seems great in theory, unfortunately it is very difficult to pull this off on a consistent basis as seen from the evidence of even the biggest investors failing in this endeavor (check more on this here if interested).

Oops. So what is the way out?

2. The Forecast Free – ‘Expectations Driven Approach’:

This leads to our approach in which we build portfolios with the humble acceptance that we won’t be able to predict the market crash but rather the portfolios will have to endure & survive the crash.

The key for this is to ensure that our portfolios always have ‘Room for Error’.

We build this using the time tested boring principles of asset allocation, rebalancing, diversification, discipline to stick to the plan, long time horizon and patience.

We do not spend our time as investors trying to forecast when any of these events might happen. All we know is that temporary market falls of 10-20% happen on a regular basis, 20-30% temporary falls happen once every 3-5 years, a 30-60% deep temporary fall happens once every 7-10 years.

While we know these temporary falls will definitely happen, we have no clue on ‘when’ they will happen.

As the popular personal finance writer Morgan Housel quips, we would like to spend our time doing three things-

- Helping you build an investment plan that is built to endure & survive the crash

- Helping you create an investor mindset that is prepared for – the market crashes whenever they come

- Helping you stick to your investment plan for the next 10, 20, 30, years or more – and let compounding work its magic

How to put the “Expectations Driven Approach” into practice?

- Assume you cannot predict a crash – Put in place an Asset Allocation mix which allows you to endure the declines and stick to the plan without the need to predict and step out of a crash

- A 100% equity exposure implies being ok with a 50-60% temporary decline once every 7-10 years. Most of us won’t be able to handle such a large fall and may panic out of our portfolios.

- So the idea is to add fixed income to soften the blow during market crashes.

- The percentage of fixed income in your portfolio has to be decided based on the extent of declines you can tolerate – the lesser the decline you can tolerate the higher the fixed income allocation.

- The overall split between equity and debt in your portfolio is by far the most important determinant of your long term returns.

- Rebalance

- Rebalancing the portfolio once a year back to original asset allocation when equity allocation deviates by +-5% keeps the portfolio declines under our expected levels.

- Rebalancing also tends to improve the return potential by 0.5% to 1.5% over a market cycle – as this is a simple mechanism to buy low-sell high!

- Build an “Equity Market Sale!” plan

- Demarcate a portion of your debt allocation as ‘Opportunity Bucket’ to be deployed into equities if the market corrects more than 20%.

- Preload the decisions on how you will deploy the money –

- If Sensex Falls by ~20% (i.e 40,000) – Move 20% from debt portion (intended for tactical allocation) to equities

- If Sensex Falls by ~30% (i.e 35,000) – Move 30% from debt portion (intended for tactical allocation) to equities

- If Sensex Falls by ~40% (i.e 30,000) – Move 40% from debt portion (intended for tactical allocation) to equities

- If Sensex Falls by ~50% (i.e 25,000) – Move 10% from debt portion (intended for tactical allocation) to equities

*This is a rough plan and can be adapted to based on individual’s risk profile

- Build a valuation driven framework to partially reduce equity exposure when markets become insanely expensive – You can read about our entire framework, in detail here.

- Diversify across investment styles, geographies, large/mid/small cap.

- Provide the portfolio enough time (preferably 10+ years) and patience.