How can the return picture change so dramatically in three months? – you ask yourself and suspect your fund of slipping down the returns chart.

Now, this is often a trigger for many of you to conclude that your fund is not doing okay and stop the SIPs. And there begins your woes.

Stopping SIPs, unless you know your fund is a definite underperformer, can harm your portfolio. That is to putting it mildly. If you were saving for a goal, then stopping SIPs can be short of being disastrous for the following reasons:

– One, you lose out on the best periods to average your costs, when the NAV is trending down

– Two, you would stop installments thereby upsetting the whole time frame over which you intended to save for the goal. In all likelihood, you would not have invested elsewhere immediately and hence effectively postpone your goal.

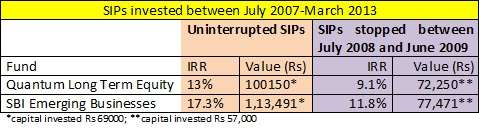

Here are couple of examples simply to illustrate how your portfolio suffers when you stop your SIPs for a while. In this example we take two scenarios – SIPs of Rs 1000 each started in July 2007 and continuing till date and another scenario when you stopped SIPs from July 2008 (when the market crash worried you to stop investing) and started again in July 2009 after you got a clear sign of revival. We chose a diversified fund and mid-cap fund merely to illustrate the level of impact.

Look at the difference in yield in the table below. In a diversified fund like Quantum Long Term Equity, you would have lost about 4 percentage points. In a mid-cap fund like SBI Emerging Businesses, where NAVs tend to fall more sharply, you would have lost as much as 6 percentage points.

In fact, between December and now, SBI Emerging Businesses has shed about 12% of its NAV. Don’t be shocked. The BSE Midcap index has lost 14.5%. Your fund would be quietly averaging at lower levels now. Disrupting it would mean losing out like we just illustrated. The stock market, with its currently weak earnings fundamentals and economic growth besides an upcoming election year, is likely to see enhanced volatility. That means markets and NAVs can see-saw. While we are not suggesting that you could have an opportunity like 2008-09, even a shorter period of volatility is bound to help your SIP process.

So, when should you be looking at stopping SIPs?

First of all, do not stop SIPs altogether unless you no longer wish to invest. If you stop in a fund, ensure you are starting SIPs in another immediately. Secondly, avoid looking merely at your standalone fund returns to conclude that your fund is under performing. Look at the benchmark index, then look at peer funds and category average. It is quite likely that the market is under performing.

But if you compare a mid-cap fund with a large-cap fund, it may not help, especially in a market like the present one. Large-cap index Sensex fell by 3.5% year to date but BSE S&P Midcap fell 14.5%. That means your mid-cap funds or even many dividend yield funds with higher exposure to midcaps would have fallen more.

Thirdly, 2-3 months is too short a period to conclude a fund is poor even if it underperforms its index or category average. Fund underperformance takes not less than 6-9 months to start showing up. Temporary blips are bound to happen if a call ot two goes wrong (and it is bound to, for any fund). That should not cause panic in a long-term wealth creating process. Keep track of fund ratings in such funds, for any steep slippage (say from 4 or 3 to 2).

If you are still confused, request your advisor to do a quick reality check on your portfolio.

What next?

Once you are convinced that nothing is wrong with your fund and the market is at fault, you may be tempted to actually buy more on dips. But how can you time this? It is, after all, in hindsight that we know a market low. Still, if you wish to, you can use some simple tools in your FundsIndia account to invest more on dips and benefit over and above your SIP averaging. Watch out for this in our next blog post.

Until then, ‘SIP’ equities well. It’s one of those years that affords a chance to buy on dips. Don’t lose it.

The only good part about the article is the analysis of the difference in returns between SIPs that continued between ’08-’09 and those that did not.

Is FI seeing a reduction in the number of SIPs in the market? Or inquiries from investors whether to stop? Because this article adds nothing new to the thought process – continue SIPs when markets are volatile is something we’ve heard time and again.

Vidya Bala has set very high benchmark and in this article under delivers, in my opinion.

I don’t think something is under delivered. It is only a cautionary note to new investors.

Good job done Vidya !!!

Rgds

Hari

The only good part about the article is the analysis of the difference in returns between SIPs that continued between ’08-’09 and those that did not.

Is FI seeing a reduction in the number of SIPs in the market? Or inquiries from investors whether to stop? Because this article adds nothing new to the thought process – continue SIPs when markets are volatile is something we’ve heard time and again.

Vidya Bala has set very high benchmark and in this article under delivers, in my opinion.

I don’t think something is under delivered. It is only a cautionary note to new investors.

Good job done Vidya !!!

Rgds

Hari

I have a different opinion on this topic

– If you’re long term investor and investing in MF in SIP way for longer term, say 5 to 10 years, yes, it makes sense not to stop the SIP.

– But, if you’re investing for 1 to 4/5 years, it does NOT make sense to continue SIP in trending down market, it’s like Catching falling knife!!, when you know its going down, you better pay attention on weekly basis(once in a week) and then add to your SIP in the form of additional purchase instead of leaving it to do its magic.

In my experience, the Equity market volatility has increased quite significantly from past few years (i.e first in 2009 & in 2011), so be watchful and stop SIP whenever you see news about Nifty & Sensex on first page of your popular news paper, it means its at its top, and wait for it to come down and re-start SIP once you think its bottomed out & starts moving higher, you can even buy as additional purchase along with SIP.

In the above table, the amount invested in less in later case, hence the difference in amount, considering the additional purchase was done for same amount during period Nov-2008 to March-2009, you can re-calculate yourself, Obviously later one beats the earlier one with good margin!!!

Thanks,

-Srinivas

Hello sir, Thank you for sharing your views.

1. Yes, it is crucial for a long-term portfolio to continue SIPs.

2.But for the short-term of 1-3 years, one should not be venturing too much into equities in the first place. For instance for a one year period, it can be highly risky to enter equities, leave alone continue SIPs. For a 1 year tiem frame we do not even recommend equities. For a 2-3 year time frame, we normally advocate a good proportion of debt in a portfolio to avoid getting hurt by equities. In such a time frame, limiting exposures and stopping SIPs, well before the goal, irrespective of market movements is the best option one has.

For a 4-5 year tiem frame, very very rarely in the history of mutual funds do funds deliver negative returns. In fact if you take very established funds such as HDFC Top 200 and do a rolling 4-year return (that is 4-year returns irrespective of when you invest), you will find that they have not gone negative.

3. In the table illustrated by us, the amount invested is less in the scenario where you stop SIPs, no doubt. But pl. look at the IRR. the IRR is with respect to the amount you invest. That clearly shows that you lose out on returns (not just absolute quantum of money) by stopping SIPs in between. The idea is to show you lose potential to make higher returns. Your suggestion fo adding back the money, means that an investor never stopped SIPs. That is the firt scenario.

This article is for new investors to simply know the repercussions of stopping SIPs in a down market, when they have a long-term goal to achieve. And for most people, child education or retirement is often a long-term goal. a year such as 2013, is going to be helpful to average costs, although on the face of it, it will seem like a bad year for equities. So the message is for investors to learn from the past. Tks, Vidya

Good One !! Well written!!

I have a different opinion on this topic

– If you’re long term investor and investing in MF in SIP way for longer term, say 5 to 10 years, yes, it makes sense not to stop the SIP.

– But, if you’re investing for 1 to 4/5 years, it does NOT make sense to continue SIP in trending down market, it’s like Catching falling knife!!, when you know its going down, you better pay attention on weekly basis(once in a week) and then add to your SIP in the form of additional purchase instead of leaving it to do its magic.

In my experience, the Equity market volatility has increased quite significantly from past few years (i.e first in 2009 & in 2011), so be watchful and stop SIP whenever you see news about Nifty & Sensex on first page of your popular news paper, it means its at its top, and wait for it to come down and re-start SIP once you think its bottomed out & starts moving higher, you can even buy as additional purchase along with SIP.

In the above table, the amount invested in less in later case, hence the difference in amount, considering the additional purchase was done for same amount during period Nov-2008 to March-2009, you can re-calculate yourself, Obviously later one beats the earlier one with good margin!!!

Thanks,

-Srinivas

Hello sir, Thank you for sharing your views.

1. Yes, it is crucial for a long-term portfolio to continue SIPs.

2.But for the short-term of 1-3 years, one should not be venturing too much into equities in the first place. For instance for a one year period, it can be highly risky to enter equities, leave alone continue SIPs. For a 1 year tiem frame we do not even recommend equities. For a 2-3 year time frame, we normally advocate a good proportion of debt in a portfolio to avoid getting hurt by equities. In such a time frame, limiting exposures and stopping SIPs, well before the goal, irrespective of market movements is the best option one has.

For a 4-5 year tiem frame, very very rarely in the history of mutual funds do funds deliver negative returns. In fact if you take very established funds such as HDFC Top 200 and do a rolling 4-year return (that is 4-year returns irrespective of when you invest), you will find that they have not gone negative.

3. In the table illustrated by us, the amount invested is less in the scenario where you stop SIPs, no doubt. But pl. look at the IRR. the IRR is with respect to the amount you invest. That clearly shows that you lose out on returns (not just absolute quantum of money) by stopping SIPs in between. The idea is to show you lose potential to make higher returns. Your suggestion fo adding back the money, means that an investor never stopped SIPs. That is the firt scenario.

This article is for new investors to simply know the repercussions of stopping SIPs in a down market, when they have a long-term goal to achieve. And for most people, child education or retirement is often a long-term goal. a year such as 2013, is going to be helpful to average costs, although on the face of it, it will seem like a bad year for equities. So the message is for investors to learn from the past. Tks, Vidya

Good One !! Well written!!

That’s a stellar article Vidya. The points you brought out are poignant and retail investors who often get spooked by market volatility should take note of that example you gave.

There is nothing worse than buying at the highs only.

That’s a stellar article Vidya. The points you brought out are poignant and retail investors who often get spooked by market volatility should take note of that example you gave.

There is nothing worse than buying at the highs only.

Hi vidya,

You are being pointing some useful tools in funds india for the trigger mechanism and invest more during correction. Can you through some more light on these ?

Thanks…

Hi Jinny, our next post will provide some tips on this. tks, Vidya

Hi vidya,

You are being pointing some useful tools in funds india for the trigger mechanism and invest more during correction. Can you through some more light on these ?

Thanks…

Hi Jinny, our next post will provide some tips on this. tks, Vidya

Hi Vidya,

A good article. Will wait for the next one about the tools on SIPs. I am planning to start some SIPS now !!!

Hi Vidya,

A good article. Will wait for the next one about the tools on SIPs. I am planning to start some SIPS now !!!

The article clearly explains to stay invested for long-term through SIP’s. One should think while investing how long he wants to be in market to reap the benefits of long term wealth creation for the required goals.

This artlcle is the clear example for investing in the long-term in the volatile market like we have now through SIP’s to create the wealth in the long run

Its a good article on understanding the benefits of long term wealth creation through SIP’s

Regards

Satish

The article clearly explains to stay invested for long-term through SIP’s. One should think while investing how long he wants to be in market to reap the benefits of long term wealth creation for the required goals.

This artlcle is the clear example for investing in the long-term in the volatile market like we have now through SIP’s to create the wealth in the long run

Its a good article on understanding the benefits of long term wealth creation through SIP’s

Regards

Satish

i had SIPs in hdfc top200,reliance regular savings fund and reliance gold fund which have been stopped by me,since june 2013.i want to know ,whether continuing SIPs in the above funds (say for another 5 years) is wise.pl advice me if any other fund is suitable for me.

thanks,

malini

Hello Malini,

If you have a 5-year view, you should definitely continue your SIps in equities. With god, as long as your exposure is restricted to say 10-15% of your total investments, you should not worry continuing SIPs. This year will offer good opportunity to average gold prices as they are on a dip. For fund advice, it is important to know your goal/time frame/investment amount. Also we request you to use the ‘Ask Advisor’ feature in your FundsIndia account (click help tab and you will see this), so that we have a mechanism f tracking your queries and our own responses. Thanks, Vidya

i had SIPs in hdfc top200,reliance regular savings fund and reliance gold fund which have been stopped by me,since june 2013.i want to know ,whether continuing SIPs in the above funds (say for another 5 years) is wise.pl advice me if any other fund is suitable for me.

thanks,

malini

Hello Malini,

If you have a 5-year view, you should definitely continue your SIps in equities. With god, as long as your exposure is restricted to say 10-15% of your total investments, you should not worry continuing SIPs. This year will offer good opportunity to average gold prices as they are on a dip. For fund advice, it is important to know your goal/time frame/investment amount. Also we request you to use the ‘Ask Advisor’ feature in your FundsIndia account (click help tab and you will see this), so that we have a mechanism f tracking your queries and our own responses. Thanks, Vidya

I want to stop SIP , what is the process for that because I have already send a mail regarding for that.

Plz help me

All you need to do is send an email to our support team and they’ll stop it. If they haven’t responded to you yet, please let us know your ticket number and we’ll follow up on this. Thanks!

I want to stop SIP , what is the process for that because I have already send a mail regarding for that.

Plz help me

All you need to do is send an email to our support team and they’ll stop it. If they haven’t responded to you yet, please let us know your ticket number and we’ll follow up on this. Thanks!