At FundsIndia we constantly strive to cater to your investing needs without compromising on the basic tenets of mutual fund investing. As part of such an effort, we have recently added SmartSIP, the first of its kind dynamically managed portfolio SIP. Here’s a quick summary of what SmartSIP is and what it does:

- An asset-allocated 2 fund SIP – consisting of an equity fund and a debt fund

- Invests dynamically every month between the equity fund and the debt fund while keeping your monthly SIP outgo fixed

- Uses market fundamentals and momentum factors to decide the allocation to equity and debt

- Past data shows SmartSIP beating a static 70:30 equity: debt SIP, by an average 1.5 percentage points, over 5-year SIP return periods

About SmartSIP

SmartSIP is a simple way to invest every month in an asset allocated manner for any of your long-term goals. SmartSIP consists of a multicap equity fund – Franklin India Equity and a short-term debt fund – Franklin India Ultra Short Bond.

Choice of funds: The reason for the choice of the 2 funds is to keep a multicap equity fund that is more responsive to broad stock market signals. In the debt fund, we did not want to time the debt market. We simply needed to park money to earn FD-beating returns and hedge the equity exposure. When equity market looks steep, higher allocation in debt will reduce volatility. This is the thought behind the choice of the 2 funds apart from these funds having a good track record of performance and showing high consistency.

Choice of fund house: The reason behind the choice of 2 funds from the Franklin Templeton house is as follows: Franklin Templeton India is among the oldest fund houses in the country. With an array of funds with long track record, Franklin has experience in understanding Indian market signals. SmartSIP has been built with the inputs of Franklin Templeton India’s research team, on the signals to dynamically allocate between equity and debt. In other words, this is a product exclusive to FundsIndia, using Franklin Templeton’s research acumen and FundsIndia’s technology skills.

Scheme allocation: The steady state allocation to these funds is 70% in the equity fund and 30% in the debt fund. However, based on various market signals (fundamentals such as valuations as well as momentum such as market direction), this allocation can undergo a change every month. For example: if you have a Rs 10,000 SIP running through SmartSIP, the investment will automatically be allocated as say Rs 7000 in equity and Rs 3000 in debt in one month or Rs 8000 in equity and Rs 2000 in debt in another month – based on the signals.

In essence, it automatically invests more in equity when markets correct or look more reasonable and invests less when equity markets seem stretched or valuations are expensive.

You will be informed about your allocation for the next SIP a few days in advance and you will also know the reasons why the allocation is what it is.

Retains the wisdom of a simple SIP

SmartSIP will do what all SIPs will do, that is – invest a fixed sum regularly and help cost average over the long term. Unlike some variants of SIP, it does not disturb monthly investment amounts. That is, you will not see a sudden increase in your SIP in one month and reduction in the next. There will also be no stopping or starting again. Such fluctuations and changes in SIP amounts make it hard to track investments and can lead to lower amounts being invested, hurting wealth creation. SmartSIP will follow the traditional SIP investing wisdom.

But SmartSIP does more than a regular SIP. Here’s a table explaining how SmartSIP varies from a regular SIP.

| Regular SIP | SmartSIP | |

|---|---|---|

| What it is | Regular systematic investment in individual funds. | A 2-fund portfolio with a fixed SIP amount but decides how much should go into equity and debt every month. |

| What it does | Help rupee cost average. | Apart from rupee cost averaging, helps deploy higher or lower amount in equity based on market conditions. It ensures investing scientifically based on market valuations and other factors. |

| How many funds | SIP can be done in any number of individual funds. | A 2-fund portfolio with funds chosen by FundsIndia research using its comprehensive quantitative and qualitative metrics. |

| Fixed or varying investment | Amount remain fixed every month. | Total SIP amount remains fixed every month. Only the amount invested in the 2 funds varies. |

| Asset allocation | No asset allocation. Portfolios must be built to asset allocate. | Asset allocated and dynamically managed. The portfolio invests in an equity and debt fund tending towards a 70:30 portfolio but deviating from this based on equity market conditions. |

| Equity market valuations and other fundamental metrics | Not considered. Monthly investment made on a fixed date without considering market conditions. | Market fundamentals considered in a scientific way to arrive at the equity allocation every month. |

| Regular savings/disciplined investment | Disciplined monthly savings. | Savings is not only disciplined but also optimised by making the best of market movements |

SmartSIP is also simpler and more scientific than SIP variants such as VIP. VIP requires you to state a a return expectation – this return number may be arbitrary, entirely based on your own expectation, and is not quantitative or based on actual market trends and metrics. It can either lead to constantly higher investment amounts or constantly low investment amounts. Monthly investment amounts can also keep changing. SmartSIP will avoid this limitation.

What it seeks to do

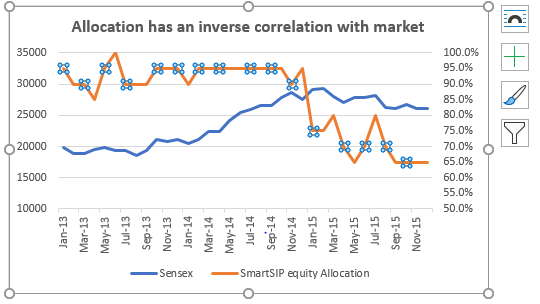

SmartSIP seeks to vary the allocation to equity and debt. Back-tested data for the past 10 years clearly show a negative correlation of SmartSIP allocation with the Sensex. In other words, SmartSIP ups exposure to equities when markets fall and vice versa.

Here is an example: The chart below will tell you that in 2013 (a pre-election year), when market was volatile, SmartSIP had an average equity allocation of 92% and it maintained it around this level until 2014. It then dropped this allocation to 70% in 2015.

This allocation came on the back of a good fundamental signal at distressed valuations, especially in 2013 when markets remained volatile. In 2014, while the rally had begun, it still participated in equity heavily (by keeping equity allocation steady) as it picked momentum signals well. In other words, it takes signals both from fundamentals (2013) and momentum (2014) and ensures equity participation is not missed out when opportunities are available.

As a result, 5-year SIPs between 2013-18 on an average delivered 1.24 percentage points higher than a static 70:30 SIP. It was as high as 1.92 percentage points.

The above asset allocation is an example of how dynamically the asset allocation is managed in SmartSIP.

Performance

The results of such allocation are two-fold: one, you automatically reduce exposure to equity and rebalance your asset exposure at the time of investing. Two, and importantly, historical data suggests that this strategy outperformed a static SIP. The table below shows that any 5-year SmartSIP in the past 10 years outperformed a static SIP by a good 1.5 percentage points.

Also, note that SmartSIP comfortably beats dynamic asset allocation funds offered by fund houses as it is built using a robust model of multiple fundamental factors and momentum factors and not just a single factor. For example: In the last 5 years ending December 2018, SmartSIP beat this category of funds by 1.2-2.8 percentage points. In the example given earlier for SmartSIP(2013-15), these funds either did not increase equity early on or exited equity too early after the election result rally. Both of these did not work in their favour. An added advantage in SmartSIP is that it houses an equity fund and a debt fund separately – there is absolute clarity on taxation. With dynamic asset allocation funds, taxation depends on your redemption date and the fund’s holding before it.

| Average 5-year SIP returns (IRR) between 2008-2018 | |

|---|---|

| Regular 70:30 SIP | 14.80% |

| SmartSIP | 16.40% |

| Average outperformance | 1.54% |

| Maximum outperformance | 2.60% |

Based on back-tested data for 5-year SIP periods had you invested anytime between 2008-2018.

Who should invest

SmartSIP is primarily an equity-biased portfolio and hence suitable only for long-term investors with a time frame of 5 years or more. It is inappropriate to compare SmartSIP with a pure equity fund. It is an asset allocated portfolio and seeks to do a better job than a regular static asset allocated SIP portfolio. The idea of SmartSIP is to capture and capitalize on market opportunities on top of rupee cost averaging.

SmartSIP is a strategy. Hence, in a portfolio of mutual funds, SmartSIP can be your dynamic market allocation strategy. The rest of the strategies may be themed around value or growth or midcap and so on. In other words, this can supplement your existing portfolio strategy.