IL&FS (Infrastructure Leasing and Financial Services) finances and develops infrastructure across the country, on its own and through a range of group companies. The group is among the largest in the infrastructure space, both on lending and on development. This company has been in the news in the past week, and not for positive reasons.

On 8th September, rating agency ICRA downgraded debt papers of IL&FS by several notches, across maturities. Other rating agencies such as CARE have also downgraded papers of IL&FS and its group companies. What happened and what’s the fallout for debt funds?

Sharp downgrade

Commercial papers (CP) are short-term instruments of less than a year’s maturity. According to news reports, IL&FS and its subsidiary IL&FS Financial Services delayed on inter-corporate deposits and commercial papers last week. Owing to this and an increase in liquidity pressure on IL&FS, its ratings were downgraded. Further, because IL&FS is a major source of funding and expertise support for its group companies, the parent’s liquidity pressures caused a downgrade in group companies as well.

Commercial papers (CP) are short-term instruments of less than a year’s maturity. According to news reports, IL&FS and its subsidiary IL&FS Financial Services delayed on inter-corporate deposits and commercial papers last week. Owing to this and an increase in liquidity pressure on IL&FS, its ratings were downgraded. Further, because IL&FS is a major source of funding and expertise support for its group companies, the parent’s liquidity pressures caused a downgrade in group companies as well.

Debt downgrades are not rare, especially when companies find it hard to meet obligations. However, what’s different about the IL&FS downgrade was its steepness and swiftness. Consider this: long-term debt facilities of IL&FS dropped from AA+ (investment grade) to BB (below investment grade). Please note that the SEBI’s new categorization consider AA+ and above as superior quality credit. Short-term debt was marked to A4, down from A1+ which is the highest credit quality.

For IL&FS Financial Services too, short-term ratings sank to A4 from A1+ on September 8th/9th by ICRA and CARE Ratings. CARE also revised the long-term debt down to BB. CARE had on September 3rd noted the delay in CP repayment but refrained from making a long-term debt downgrade. In its August 16 update, the ratings stood at AA+ on credit watch (ratings had been revised on that day from AAA).

IL&FS Transportation Networks also saw a similar steep downgrade over the past couple of weeks from the top-level AAA. Other group companies such as IL&FS Tamil Nadu Power Company and IL&FS Energy Development also saw downgrades by rating agencies in the past few days, but these papers already were low-rated. IL&FS and its group companies saw a downgrade in August before the latest one, but that was just by a notch.

Hit on prices and NAV

A downgrade in credit rating sends the bond’s price down – this either reflects in market price in traded bonds or rating agencies revalue the bonds. This basically means there is a mark-to-market loss that debt funds take, much like equity shares. The extent of the fall depends on the nature of the downgrade. In this case, because the downgrade was steep – from a top rating into below investment grade, the mark-to-market hit on prices was pronounced.

According to AMC reports, funds with exposure to IL&FS and IL&FS Financial Services had to take a 25% mark down in the price of their holding in these instruments. Please note that the mark down in on the individual instruments’ prices and not on the NAV entirely. So, the impact of the mark down will be high or low based on what proportion a fund holds in these downgraded instruments.

What is important to note is that this is a mark-to-market loss. It is not yet a default. Until the company defaults on repayment, this loss is notional. If the company returns the dues in full, the loss will reverse. Based on July portfolios, several funds, including liquid funds, held IL&FS group CPs and debentures with varying maturity dates. Troubles in meeting CP dues surfaced over the past two weeks. Going by the daily NAV movement for the liquid funds that held these CPs that matured end-August, there does not appear to be a default here.

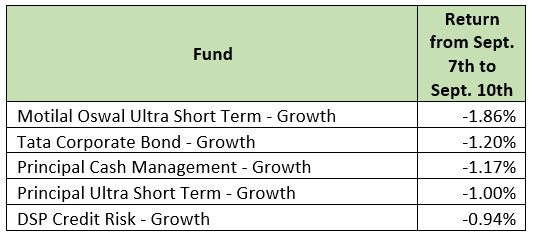

The hit to bond prices and NAVs comes for CPs and debentures with maturity dates of 10th September and later as the downgrade took place on the evening of 8th September. Principal Cash Management, a liquid fund with an approximate 9.8% (July portfolio) to IL&FS Financial Services saw its 1-day returns fall 2.3% on September 9th. Other funds with a higher exposure, such as Motilal Oswal Ultra Short Term and Tata Corporate Bond also saw slides in 1-day returns.

What’s the outlook?

IL&FS has been cognizant of its liquidity issues, going by news reports and press releases. The company had approval to conduct a rights issue of up to Rs 4,500 crore; reports peg a larger issue being considered by the company’s board. IL&FS counts LIC, SBI, Abu Dhabi Investment Authority and HDFC among its shareholders.

The company also has processes in place to monetise its assets over the next 12-18 months. According to release by IL&FS, it has identified firm offers for 14 of 25 projects it has put on the block. It also has dues of up to Rs 16,000 crore pending from the government. In light of its enormous scale in the infrastructure lending and development space, the liquidity pressure may make it more aggressive in resolving these dues. An improvement in its financial health can lead to better prospects for its group companies as well.

Again, going by daily NAV movement especially in the liquid funds, it appears as though CPs that were maturing on September 10th have been paid.

What should you do?

IL&FS is reported to be assessing funding and capital raising sources over the next few days and weeks. More clarity on liquidity issues will come in over the next several weeks. A knee-jerk exit now will not be prudent.

In liquid and ultra-short funds, unless you require the proceeds immediately in the next few weeks, it is best to continue to hold. If you are running any STPs from these, let them continue. Recouping the dues from the company and the coupon accrual from the existing papers in the portfolio should reverse the loss. The short maturity periods of these funds will aid faster recovery. In longer-term funds, again, wait it out since time is on your side.

In our Select funds, DSP Credit Risk holds IL&FS Energy and Development Company and IL&FS Transportation Networks. The total exposure here is 6.4% (July portfolios). These papers are due only in 2019, which gives the fund time to allow the company’s fund-raising process and asset monetisation to play out. In credit funds, hits due to downgrades are a risk taken. The impact of the downgrade on the NAV for DSP Credit Risk appears insignificant, given the low exposure of the fund. We do not recommend any exit at this stage. It will only convert a notional loss into an actual one.

Barring this, at FundsIndia, we have been cognizant of taking any risks for the short term and have preferred to stay with high quality funds even if it cost a few percentage points of lower return.

That said, when a highest rated A1+ instrument or a high rated AA+ instrument is sharply reduced to below investment grade, they can at best be termed as outlier cases that perhaps questions the way of the credit rating agencies in assessing risks.