Irrespective of whether you’re a person who lives by a clockwork schedule or someone who likes to plan things on the go, there are some things that run on a fixed schedule. Namely: your salary, your rent, and your utility bills.

The predictability of this fixed routine helps add some stability and certainty to life. If you know when you’re getting your money and when you must spend it, you can easily plan out the budget for the rest of the month (check out the 50-20-10-10-10 plan if you need help with this). So, following the same logic, you should add stability to your savings and investments by scheduling them on a particular date.

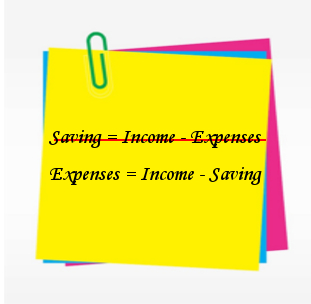

The reason for this is simple: To make sure you stick to your budget, it’s important that you get your savings out of the way first. This way you make sure you’re putting away sufficient money for your short and long-term goals, and that you don’t overspend. As all ‘money-wise’ people know, the real formula for planning your budget is: Expenses = Income – Savings.

The reason for this is simple: To make sure you stick to your budget, it’s important that you get your savings out of the way first. This way you make sure you’re putting away sufficient money for your short and long-term goals, and that you don’t overspend. As all ‘money-wise’ people know, the real formula for planning your budget is: Expenses = Income – Savings.

Of course, what applies to savings applies to investments as well, as your investments are a subset of savings. So, make sure you plan all your investments for a fixed date. This date should preferably be early in the month – that way you can be assured that you’ll have sufficient money in your account. By scheduling your investments for the end of the month, you run the risk of spending too much and not having enough money to fulfil your monthly investment requirement.

Having a fixed date for investments also helps inculcate the habit of saving. If you’re having trouble putting away money for other savings, try starting a long-term SIP in mutual funds. SIPs normally use a mandate to deduct money from your account and invest it in mutual fund schemes of your choice. This automatic debit makes sure that you can’t forget to make this little ‘saving.’ After a few months of running a SIP, you may find yourself able to deal with expenses better and maybe even put away something in your savings.

However, if you’re still not able to save money apart from the amount that gets invested through your SIP, you could look at investing some amount in liquid mutual funds too (you’ll have to do this manually as liquid funds do not allow SIPs). These (liquid) funds are the least risky among all mutual fund categories and are good for keeping away money for short-term savings or emergency needs. Though they carry lower risks as compared to other mutual funds, these funds have historically delivered higher returns than bank savings accounts. Also, money invested in these funds can be redeemed within one business day (some liquid funds also offer a 24×7 instant redemption facility, subject to some limits). This makes them a good option for storing excess cash for short-term needs.

This way, not only will you be saving money, you’ll also potentially be earning more than what you would if your money was simply sitting in a bank account.

To summarize: you should think of your savings and investments as bills that you must pay, and plan your budget accordingly. This will help you manage your expenses better, and save up for your short and long-term goals/ needs. Also, if you find it hard to start saving, remember: SIPs in mutual funds could offer an easy, and rewarding solution.