As the story of the Tata conglomerate unceremoniously firing its Chairman unfolded, some of the key listed Tata group stocks took a hit post Monday’s news. The event added further tension as the ousted Chairman Cyrus Mistry, in a letter to the Board of Tata & Sons, placed serious allegations against his most recent employer.

As a large conglomerate with over 100 companies several Tata-group companies are listed. Needless to say, a good number of these stocks is owned by the mutual fund industry. That means the schemes you hold will likely have some Tata stock or other. How did those stocks react to this news and should this unfolding event scare you?

How Tata stocks performed

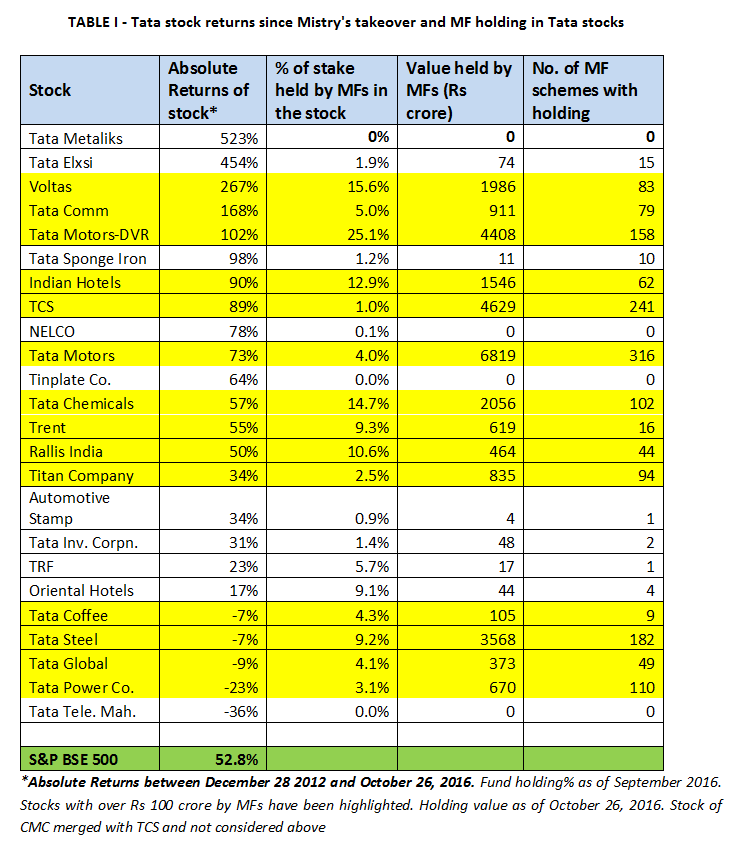

Before we move on to answering the above questions, let’s look at the performance of the listed Tata stocks and how they delivered since the takeover of Mistry in end-December 2012.

Barring the stocks of Tata Power and Tata Steel that lost wealth for its investors, most of the stocks that mutual funds presently hold were ones that have been deriving value over the years.

How mutual funds built positions

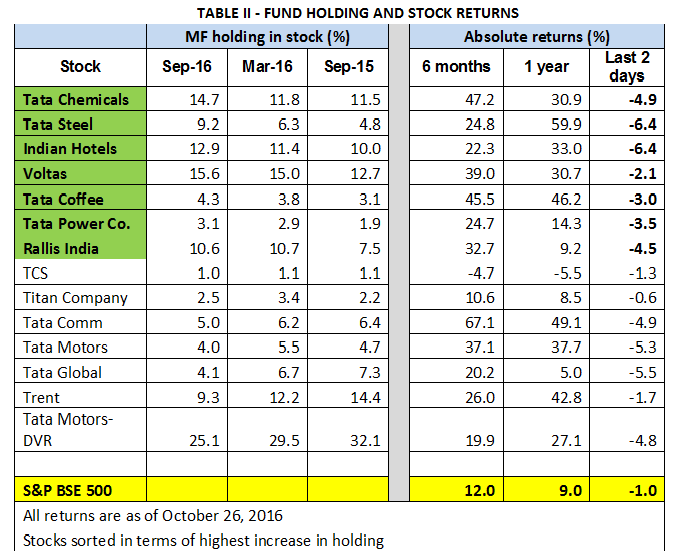

But what exactly did mutual funds do with these stocks in the recent past? Did they increase their stakes or reduce them and what did these stocks return in the last 6 months and 1 year? For this, we took some key stocks, where the MF industry, as a whole, held exposure of Rs 100 crore or above in each stock.

Table II has a good story to tell on how funds increase or decrease stakes. If you see stocks such as Tata Coffee or Tata Steel that saw a commodity upturn, mutual funds have been quick to spot it and increase stakes.

The returns in the last year, in these stocks, have also been sound. Then there are also companies such as Tata Chemicals, Tata Power or Indian Hotels or Tata Steel (commodity upturn aside) that were streamlining businesses or selling non-core businesses; with markets rewarding the stocks for cleaning up and getting leaner. Other stories such as Voltas were cases of turnaround in sector fortunes. In other words, much of these returns were driven by better fundamentals or perception of improving fundamentals.

Even as the markets rewarded many of these impending turnaround stories, the allegations thrown by Mistry has equally dented them. A letter by Mistry stating that a write down of Rs 1,18,000 crore may be warranted, over time, in some of the market favourite companies such as Tata Motors, Tata Steel Tata Power Indian Hotels and Tata Tele, citing practices that include aggressive accounting that deferred losses and inflated assets in books, is no small allegation. However, much of these are subjective based on perception of ‘fair valuation’ and none of these are yet validated or proved.

Fund holding

Contrary to your fears, there are several aspects of this shake up (as far as MF holding is concerned) that could provide some cheer to you and at the same time also remind you how prudent diversification strategies by funds pay off.

First, while mutual funds hold several Tata stocks, as can be seen from the first table, their holding is not high except in a couple of stocks, the highest among them being Tata Motors DVR. This stock, particularly, delivered handsome gains for funds and have seen funds reducing stakes in it (see table II). In fact, in a good number of stocks (barring Tata Power), fund houses have already generated returns (Trent, Tata Communications) and booked profits by reducing stakes.

Second, the exposure in the Tata Stocks is so widely dispersed across many schemes that the impact of the recent fall has not been significant in individual schemes thus far. For example: as seen from the first table about 316 schemes hold Tata Motors while 182 schemes hold Tata Steel. The holding by the fund industry in fundamentally weak companies such as Tata Steel is only 9.2%

If funds held any of these stocks, it is natural that they took a hit as markets reacted; how much depends on their holding. For example, a fund like Reliance Tax Saver, that held 5.8% in Tata Steel as well as a 1.6% holding in Trent fell by 1.6% in the last 2 days (October 24-26). While Franklin India High Growth companies, with a 5.2% stake in Tata Motors DVR fell by 0.8%. Even the concentrated logistics fund, UTI Transportation and Logistics with a 9.3% stake in Tata Motors fell by just 0.5% in these 2 days. The Nifty, itself fell 1.1% from close of Monday.

What should you do?

Should you panic about all this? Not really. Most of the stocks that mutual funds hold is backed by fundamentals and fund managers would likely take a call on whether to buy into dips in certain stocks, based on the fall as well as analysing the impact of the allegations. These companies have their own boards and full time directors and are not run on a day-to-day basis by the Chairman of the group.

As such, if you are a mutual fund investor, you should take comfort from the fact that there are fund managers to do the job of adding or weeding stocks for you. Hence, we’d say – stay tuned to the unravelling mystery (as a popular newspaper put it) and tune off from watching your fund’s day-to-day gyrations. The onus is on your fund managers.

We’ll keep you posted periodically if the events have further impact on your funds.